Among other recent changes, the Coinbase rate-hike announcement has many investors and cryptotraders looking at the various exchange offerings in a new light. For some, centralized exchanges are almost an antithesis of a huge portion of what Bitcoin and subsequent altcoins were initially conceived for — decentralization.

[wlm_private “Crypto Trader Pro – Monthly|Crypto Trader Pro – Yearly|Crypto Trader Pro (Lite)”]

Binance, Coinbase, Bittrex, Kraken and oh-so-many others are all considered “centralized” exchange markets for cryptocurrencies. And of course, that means that transactions are processed via a third-party middleman and that third-party, the exchange, requires KYC verification. Completely eliminating anonymity.

Traders have to entrust the exchange to safely complete their transactions as well as protect their personal data and funds from compromise as everything is housed on the market’s hardware. One benefit of these centralized platforms is that they do provide protection against accidentally losing the key to your digital wallet, a feature that you might miss if you move to a dEX platform.

A Peek Inside a dEX

dEX is simply geek-speak for decentralized exchange just in case you were wondering. As opposed to a centralized server, these type of exchanges use peer-to-peer networks where the exchange’s users support the network by running the specific platform on their personal computers.

Cutting out the middleman altogether, trading takes place on a global peer-to-pee network and the dEX platforms don’t store user funds nor their data on the exchange. Most don’t even require registration, are instantly accessible, and provide transactions that are completed by smart contracts and atomic swaps. This provides a private, truly trustless environment for traders and investors alike.

Furthermore, dEX options are resistant to many of the security issues that can, do, have, and will affect other exchanges.

So naturally, I wanted to take a closer look.

However, instead of picking one like HADAX or IDEX that other articles seem to cover quite extensively, I wanted to look at one that caught my eye the other day — Bisq.

Bisq is a decentralized, open-source, peer-to-peer desktop application that is one of the few dEX options that supports fiat-to-crypto pairings. Secure trading is completed via security deposits and multi-signature wallets and only trading partners exchange any sort of personally identifying data.

There’s NO identity verification! No registration and no waiting for some central authority to approve your account. Bisq is built on a pure peer-to-peer infrastructure: desktop software, Tor, local wallets, and no central accounts.

This enables you to privately sell and purchase Bitcoin in exchange for the traditional fiat currency of your country, or altcoins (seller’s choice).

They claim that Bisq is “so easy to use, you can be trading in under 10 minutes.” So, I wanted to put that to the test.

Getting Into Bisq

One of the things that drew me to Bisq in the first place is their stance on transferring national currency. I’m a true believer that decentralization has its place in helping people around the world move legally obtained money to whomever they want, anytime they want, without oversight and exorbitant fees.

And Bisq seems determined to deliver on that aspect.

Bisq is not a company. It’s a free software with a network that was built by individuals all over the world that work together because “they choose to.”

And it’s kind of easy to see why.

No censoring, confiscating, monitoring, or controlling financial transactions. Just a secure, private, peer-to-peer, decentralized option to trade our Bitcoin. Bisq says they’re built for traders that don’t want to trust a centralized exchange to hold their funds, yet have the ability to exchange a wide range of altcoins and national currencies for Bitcoin.

Okay, color me intrigued.

For many of us, forfeiting privacy and a good portion of our control to a central “authority” in order to complete trades with others in the industry is simply unacceptable. Our money is OUR money and NO one, not banks nor governments or anyone else, has any right or reason to monitor our transactions.

So let’s see how easy it is to actually get going on Bisq.

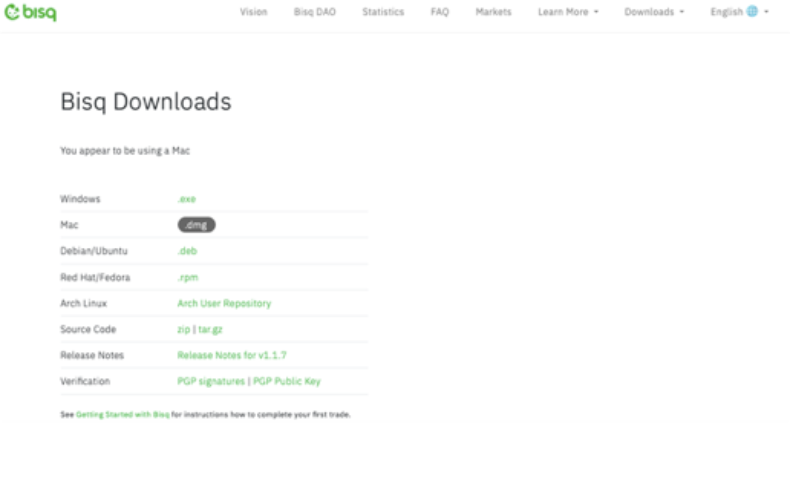

Of course as with any dEX option, the first thing that is required is to download Bisq’s software. You’ll need to select your appropriate operating system as shown in the image below, and once the download is complete, install the file.

This portion took under a minute, probably closer to 30-seconds, and was as simple as could be.

Next, open the file and you’ll need to read and agree to the short and sweet User Agreement before moving on. Bisq provides a short informative tutorial at this point and I do recommend giving it a view, it doesn’t add much time to the process at all.

You can click around at this point and check out the application, but before you can get to any buying or selling, there’s a few more steps you have to complete.

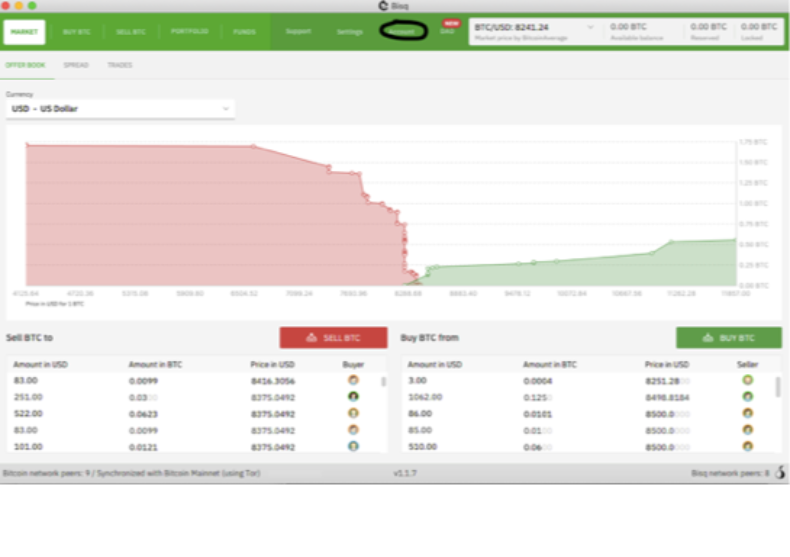

First, at the top of the platform you need to click the Account tab as shown in this image.

On the next screen, click Add New Account and select your preferred payment method. Click the Save New Account button and then click the Market tab in the upper left.

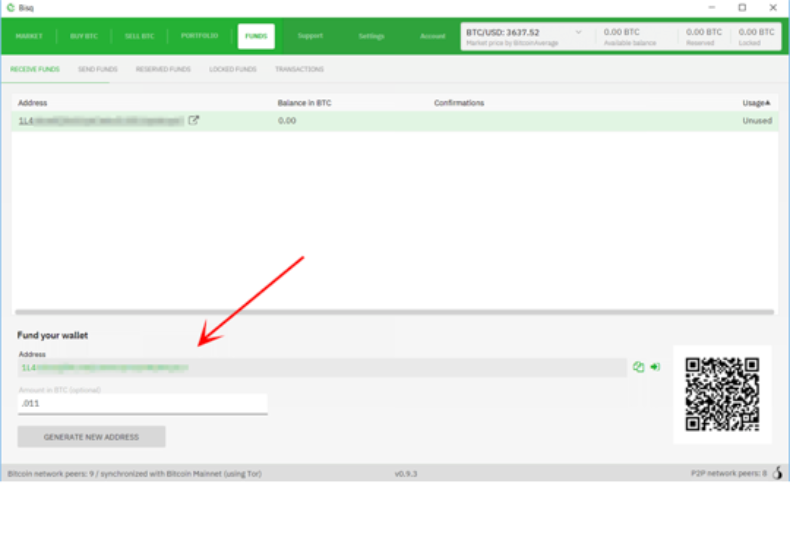

Now, you can either go ahead and fund your Bisq wallet with enough Bitcoin to cover the “security deposit” and fees, or you can simply transfer them manually when you take an offer. To add it now, simply:

- Click the Funds tab.

- Click the Receive Funds link.

- Use one of the addresses listed as shown in the image below, or generate a new one.

Once again, that process was really quick and painless and probably took me 2-minutes total to get to this point. Funding the account itself took a few minutes simply because of the inherent wait on the Bitcoin network, but all-in-all I was indeed set up and ready go in under 10-minutes.

So now, let’s take a look at completing an offer to buy some Bitcoin.

And guess what, it’s fast too.

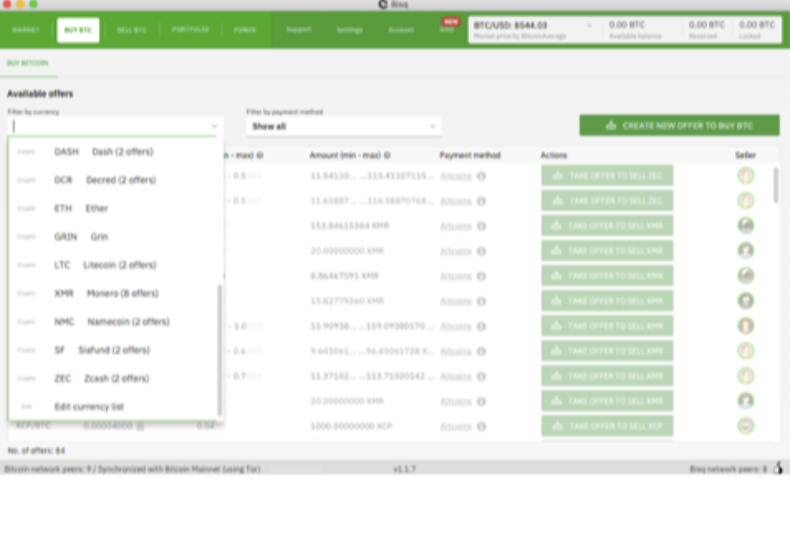

Click on the Buy BTC tab and then filter the results by currency as shown in this image:

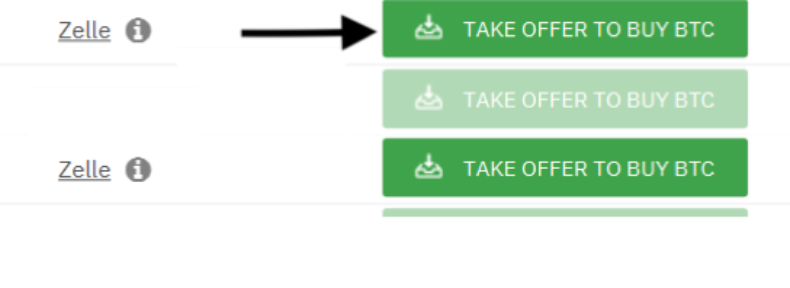

Next, you have to find the offer you want and then simply click the green Take Offer to Buy button next to it.

This is where you will need to fund your trade. Bisq creates a special trade wallet to hold your security deposit and fees. It’s used to pay the small Taker Fee for the transaction and will be utilized to transfer both your’s and the seller’s security deposit as well as the Bitcoin being traded, into a “multi-sig escrow transaction.”

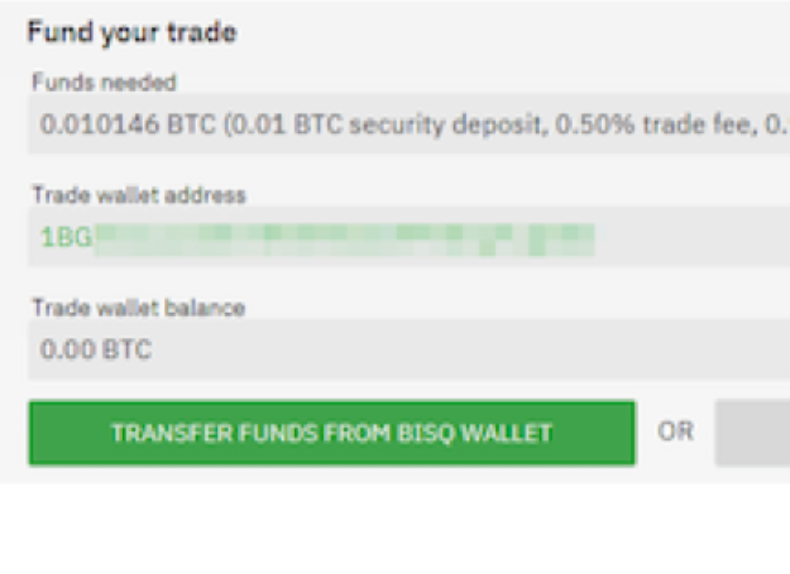

To fund the trade, Bisq will provide you the exact amount of Bitcoin to send and the correct address of the trade wallet. If you already funded your wallet, simply click the green Transfer Funds from Bisq Wallet button as shown below and the funds will automatically transfer to the trade wallet.

Once that’s complete, click the Review: Take Offer to Buy Bitcoin green button and take the time to completely review the offer details and ensure they are correct before clicking the green button for Confirm: Take Offer to Buy Bitcoin button.

Guess what? That took all of 15-minutes tops and the trade is underway. This is another unavoidable slowdown as you have to wait for the Bitcoin network to confirm the transaction, but once it’s confirmed, there’s only a few short, yet critical, steps to complete.

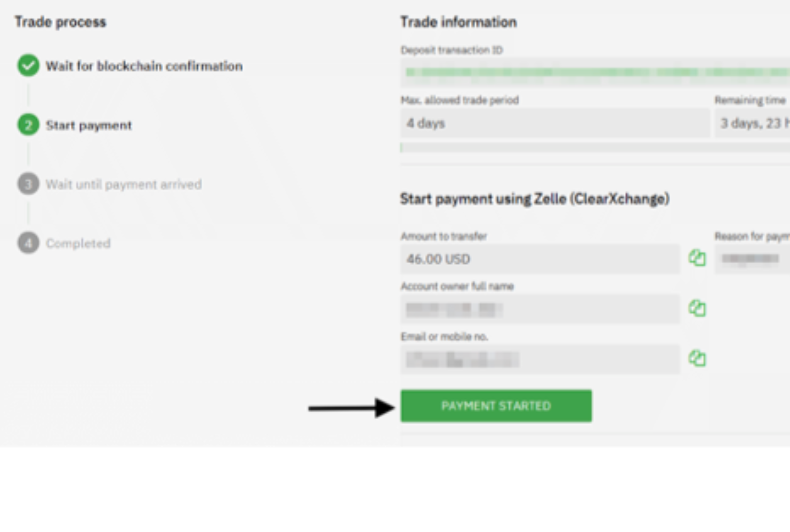

When you get a popup with the seller’s details like in the image below, you have to click the green Payment Started button.

Again, this is a critical step as it’s the only way that Bisq and the seller will know that you’ve sent payment. Remember, this is a decentralized network and as such, there’s no middleman sending emails saying payment has been sent.

Click that button and when the seller receives the payment, they’ll mark it as Received on their end and Bisq will release your security deposit and the purchased Bitcoin from the trade wallet and the transaction is complete.

A Little More About Bisq

All-in-all, Bisq is really user-friendly and quick and easy to get setup and trading. The quick little tutorial mentioned earlier does reveal a lot, so again I recommend giving it a view, but you’ll learn a lot just from clicking around too.

Under the Settings tab you can set your preferred language and currency, as well remove any altcoins you don’t want displayed or add any that you don’t see on the list. You can also set up multiple accounts under the Accounts tab and manage notifications, wallet passwords, backups, and more.

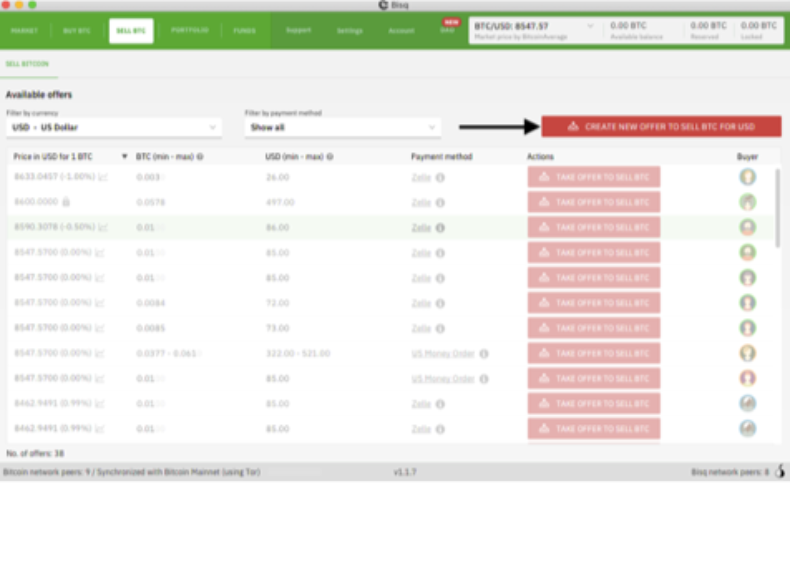

Of course one of the more interesting areas is the Sell BTC tab.

The arrow in the image above shows one of the options for selling, just click the Create New Offer to Sell BTC for USD button and set it up. You can also take one of the posted offers below that button, but of course you’ll want to pay close attention in order to find the best deal for yourself.

All four of the columns to the left of any Take Offer to Sell BTC button are extremely important. Price and Payment method can both be filtered via the dropdown boxes above the offers, but you should take the time to review Price, the posted BTC min/max, the Currency min/max, and the payment method.

Make sure you want the offer before proceeding!

Why We Need dEX Options Like Bisq

Bisq pretty much says it all in their mission statement: “to provide a secure, private, and censorship-resistant” option to exchange Bitcoin for altcoins and national currencies via the Internet.

That’s exactly why we need Bisq and other dEX options.

Security, privacy, and censorship-resistant platforms.

Centralized exchanges can attract thousands of users at any given time, meaning they are “holding” or at least temporally storing the cryptocurrency of numerous traders. Unfortunately, this inherent trait of these types of exchanges can paint a huge target on their servers.

Hackers are known to work almost relentlessly, day and night, attempting to break into various servers. Those housing centralized exchanges are almost always being scanned for possible vulnerabilities that can be exploited and unfortunately, there have been multiple cases in the past couple of years where they were successful.

Untold fortunes have been lost due to exchange hacks and unfortunately, the perpetrators are rarely caught. Recouping stolen loot is even more rare because the thieves generally launder the Bitcoin by sending it to multiple addresses and exchanges in a short amount of time.

Some centralized exchanges are working together now and getting better overall at tracking these transactions down and stopping them before the hackers can hide the funds or cash out. However, there’s a lot more to our crypto-world than just security.

Privacy is a huge concern for many traders and central exchanges just don’t provide that. Before you can even setup an account most of them require you to divulge personally identifying information, and they link all of your trading activity to it. This means that a compromise of a centralized exchange can not only cost us our Bitcoin, but our personal details are now in the hands of people that we damn sure don’t want involved in our lives.

Finally, when third-party middlemen are involved, such as Coinbase or Binance, they are required to operate within one legal jurisdiction or another. These laws and rules can include restrictions on what can be traded on the platform and even who can actually buy and sell based on their location in the world. Of course failure to comply with these jurisdictional laws can result in the exchange being fined or even shut down.

That sort of censorship just can’t happen on a dEX platform.

If you’re tired of your investments being subject to censorship and the compromise to your financial privacy, you may want to check out dEX options even more.

And if you’re interested, Bisq looks like a definite viable option.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.

[/wlm_private]

Want to read the rest of the article? Join our pro-membership and receive all of the following:

✅Access to ALL content.

✅Access to the CTN editorial staff.

✅Access to our CTN trading dashboard.

✅Access to our exclusive telegram channel where all our pro-members and editorial staff are in.

✅Ability to request content/research material!