₿itcoin

What comes to your mind when you think of getting financially lucky before the end of the decade? If you ask this question to crypto traders, they’d have a single answer - A Bitcoin Bull Run. So what is the hype surrounding this cryptocurrency and why is it taking the world by storm? Let’s discuss Bitcoin.

What is Bitcoin?

- Concentration of power in one body/ institution

- Printing money led to inflation (if the supply was increased to cover deficits

The most relevant news delivered right to your inbox.

Bitcoin's Strengths

Below you will find our most recent posts about Bitcoin and other cryptocurrencies we cover.

Bitcoin (BTC)

Below you will find our most recent posts about Bitcoin (BTC). Bitcoin is considered the founding father of all cryptocurrencies. It came about in 2009 when Satoshi published his Bitcoin and Blockchain whitepaper. Bitcoin is considered the digital version of gold.

How Crypto is Changing the Game of Poker

As the popularity of cryptocurrency continues to rise, more and more industries are taking interest in it — and the world of poker is

Chamath Palihapitiya Explains How Bitcoin May Emerge as a Flight to Safety Amid the Economic Crisis

Anthony Pompliano 0:00This leads to Bitcoin, right? You’re famous for calling it the schmuck insurance. I’m not gonna say that we’re in the situation

Why Everyone Should Have Bitcoin in Their Retirement Account – CEO of Kingdom Trust Explains

Anthony Pompliano 0:00Other things that you guys are doing is obviously working with folks like fidelity obviously, is a very big kind of stamp

Altcoins

Whether you're interested in Litecoin (LTC), Bitcoin Cash (BCH) or in the recently announced Facebook Libra... Here you will find the most relevant cryptocurrency news for all sorts of different altcoins.

How Do You Earn BNB Interest Through a Savings Account?

If you want to earn from your Binance coin holdings, you can decide to trade with it to make some capital gains, or you

Anchorage Acquires Merkle Data

No, we’re not talking about Alaska. Anchorage is a San-Francisco based firm providing its institutional custody services since 2017. Anchorage’s rivals are BitGo, Fidelity

Novogratz is Skeptical About Altcoin Rally

Novogratz is popular in the crypto community as a Bitcoin bull and recently on Crypto Twitter, he tweeted that he is struggling to understand

What came before Bitcoin?

The dot com crash of 2000 didn’t bring about an economic crisis? Why not. Until 1976, which was very recently, when we consider the year 2000, the United States Dollar was backed by gold. The paper currency in circulation could be exchanged for its value in gold and that created an intrinsic value and backing for money. However, in 1976, the decision was made to move away from gold backing, due to lack of gold reserves and need for more money to cover deficits, and since then the USD is backed by the full faith of the United States and its people.

In layman terms, this means the current Fiat Currency, over 60% of it, has no intrinsic value. The paper currency that is the foundation of the economy is as baseless as the economy in itself. This has led to a financial and economic dilemma.

In 2009, Satoshi set out to resolve this dilemma and his answer was to give power to the people. The salient features of Bitcoin were - Decentralization and Trustlessness. Additionally, the digital currency transactions were P2P in what was called decentralized digital electronic cash.

If you had a chance to check out Bitcoin’s white paper, you’d know exactly what Satoshi intended to do. He intended to replace the crippled economic hierarchy and dependency on the government for monetary transactions and give power to the people, taking trust away from governments and putting it in technology. This ingenious solution however wasn’t recognized instantly. For the first few years it remained in circulation among closed circles of tech developers and you must have definitely heard the story of the guy who bought 2 pizzas for 10000 Bitcoin.

Bitcoin didn’t gain much popularity until its first halving in November, 2012 and the first subsidy occurred when block 210,000 was solved. Until block 420,000, the block reward would be 25 BTC instead of the original 50 BTC. This means that every 10 minutes a Bitcoin miner had 50 BTC sent to their wallet for confirming a transaction. These were the glory days of Bitcoin Miners, when they amassed wealth in Bitcoin.

The current block reward is 12.5 BTC, and the block reward has been cut in half two times with the next halving set to happen in 2020. This will reduce the block rewards to 6.25 BTC every 10 minutes. At this point, many miners are debating whether they should continue mining or to quit because mining profitability will drastically go down for individual miners and cloud miners. The mining difficulty is set to go up and the reward is getting slashed in half. Could this spell disaster for Bitcoin?

The miners who are brave enough to weather the unknown will possibly see a spike in demand for the currency, as the supply would fall by over 50% due to reduced mining activity. This may pump up the leading cryptocurrency to new heights altogether.

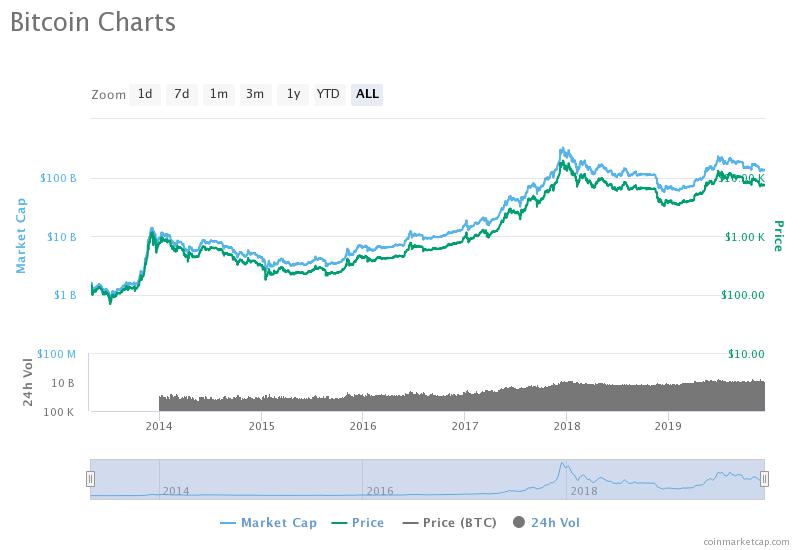

Speaking of Bitcoin’s price, let’s analyse its performance since 2013, the chart is a courtesy of coinmarketcap.com.

Bitcoin’s market cap in 2013 was a little over a billion dollars, compare this to the market cap towards the end of 2017. In December 2017 during the historic bull run, the market cap increased 100x within four years. Currently the market cap is around the same level as December 2017, however the price is less than half of that time. Market cap had decreased for the winter of 2018 and bulls managed to pull it back to its original level. We are now expecting the market cap to increase further by 10x in 2020. This means that Bitcoin’s reduced supply and reduced mining activity will trigger an increase in the price.

During the crypto winter that spans 2018 and the first half of 2019, most bulls amassed Bitcoins and less than 10% of it is in circulation. The HODLing may be their way of preparing for the upcoming bull run. We have discussed this theory in more detail here.

There have been predictions of $50,000 in 2020 and $1,000,000 in 2021 for Bitcoin, by experts and influencers in the field; people like John McAfee and Anthony Pompliano. On the flip side, there has been ample criticisms by gold buffs and traditional investors like Peter Schiff. However, an increased maturity in the cryptocurrency market and the participation of institutions has made it easier for the cryptocurrency to hit new heights.

While governments have not been entirely excited or interested in adoption Bitcoin for transactions and taxation in their economy, it cannot be denied that a parallel Bitcoin economy has been created in most countries. Bitcoin has reached third world and remote countries where people have no access to banks, forget having access to transactions and money transfer services. Most Asian and African countries have seen a flourishing and active Bitcoin economy with business investors, traders and retail investors involved in it. Bitcoin is preferred over traditional means of settling payments as it is faster, convenient and simply new age. While this has encouraged anonymous transactions and settlements to occur outside the brackets of taxation, the government in most countries is yet to ascertain a framework for accommodating these transactions.

Bitcoin’s decentralized nature has been its biggest advantage and driver for adoption on the one hand, and it has hindered its acceptance by centralized institutions on the other. Central governments of countries like France, China, Russia and India are discussing and debating the possibility of a centrally issued stablecoin backed by their existing fiat currency.

The fundamental flaw in their idea is that Bitcoin is backed by technology and it has intrinsic value due to the Blockchain Technology that powers the network and its other salient features. However, they have set out to issue centrally created digital currencies backed by fiat that doesn’t have intrinsic value in itself. This is simply a means of rescuing a failing economy and delaying the downfall by a few years.

This delay in downfall has also offered them a window to crush and dissuade the adopters of the revolutionary cryptocurrency - Bitcoin. Bitcoin’s haters may hate it all they want, the cryptocurrency has made its presence felt, from being called digital gold to being included in the list for issuing futures and derivatives trading, there is very little that it hasn’t covered.

In third world countries businesses are accepting Bitcoin for settlements and transactions, and even some jurisdictions have started taxing Bitcoin transactions while working on an inclusive economy. The fiat economy has left out a large percentage of the billions of people who have access to an active internet connection but maybe not a local bank or financial institution.

Bitcoin is not dependent on tax payers money and has no organization running its day to day operations. This has given it the freedom to be available for all, charge minimal transaction fees, and include every segment of society irrespective of where they live or whether they have a bank account or not. Refugees have used Bitcoin extensively and there are heartwarming stories of immigrants who fled from North Korea, Venezuela, Syria and other oppressive and corrupt regimes; starting a new life thanks to Bitcoin. No fiat currency would ever be able to be as global and as inclusive as Bitcoin. In the opinions of a growing crypto community, Bitcoin cannot be stopped and it’s here to stay for the long haul.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.