As we near Christmastime 2019 and close out the year, it seems that the stock markets are still breaking records and precious metals like silver and gold are holding their own. Silver bugs have been seizing their opportunity to accumulate in time for the holidays. Naturally, with everything that’s happening between the political upheaval associated with the House impeachment of President Donald Trump, to the unknowns of the U.S. – China trade war, investors are wary of the geopolitical situation.

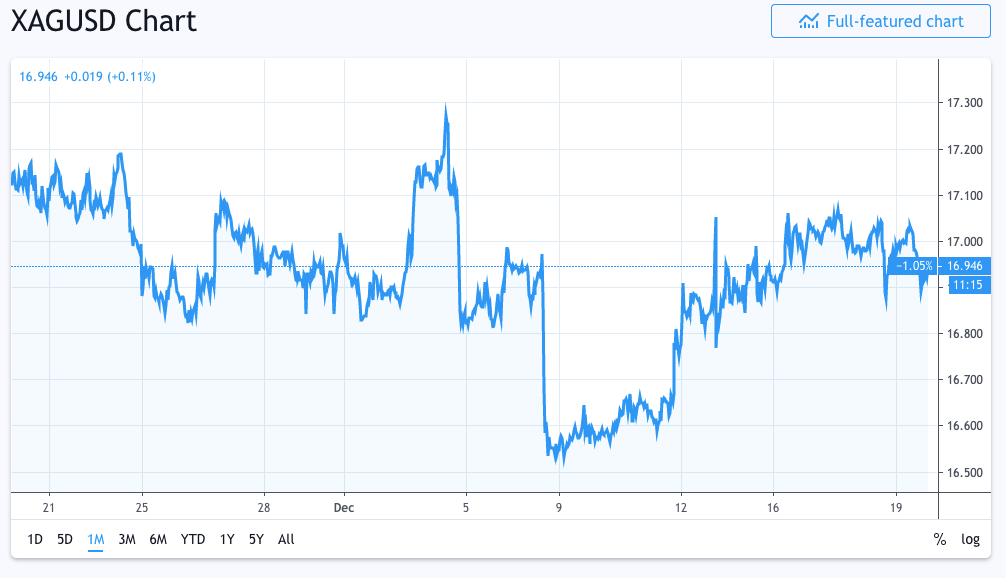

For this reason, it seems the price of gold and silver may rise, especially since precious metals are considered a hedge in times when investment in stock markets are bound to suffer from the impact of global and political unrest. Silver markets initially rallied during the trading session earlier this week at the 50-day EMA. At this point, experts have predicted that with U.S. – China trade crisis, the silver market may continue to be pushed around. When the markets rallied on Tuesday, silver hit the $17 level and the market has just started gaining momentum however, with the current updates, we may see some initial selling and loss of investor interest. While we are on top of our precious metal investments, it is possible that the metal slips back to the 100-day SMA level.

The silver market is more volatile than ever and it would be best to wait for the volatility to settle before selling. Silver markets have been volatile right from the onset and as an investor, you should be well aware of the risks of entering/exiting trades right now. With the U.S. President being impeached, there may be lack of trust brewing up in investors and there will be some signs of positivity once this settles. The price may move sideways over the holidays and we expect there to be some back and forth before discerning whether investors should buy the metal.

Experts have predicted that there may be a major move as we enter 2020 and the price may hit the $16.25 level in the next two weeks.

With this market situation, there is probably little opportunity and silver may make a comeback after the impeachment hearings are done with and the U.S. – China trade war settles. In anticipation, we are inching closer to the holidays with the thought that this may not be the best time to buy silver.

When looking over the technical chart, we are simply anticipating minor price movements over the weekend through New Year’s Eve. The trade volume may increase in the second or third week of January but, until then, the price may not change much, if at all.

Low-volume trading may cause erratic movements and traders should open trades with a set target in mind. However, if you are planning to buy silver over the holidays, I’d suggest waiting for the selling to begin and buy during the dips. As the situation unravels and geopolitical crisis settles, you may be able to sell between the $18 to $20 level. Until then, we’ll keep an eye on the market as you plan your trades.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.