The Private Market

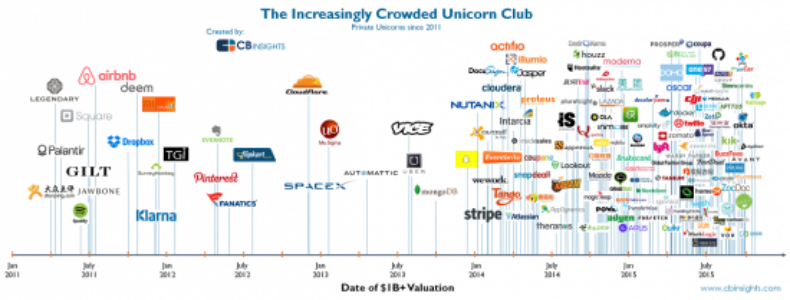

There’s a significant rise in the so-called unicorn markets and its something important to watch. Unicorns were supposed to be rare but there’s over 200 unicorns in existence today.

Courtesy:CB Insights

When we look at the growth of unicorns – these are startups valued at more than $1 billion – do we see signs of excess or, to use Alan Greenspan speak, “irrational exuberance”?

If not excess, are we seeing a new age of companies where growth is prized over profits? Are we in a land where paper markups are coveted? What happens when everyone plays hot potato with valuations, take on more risk and always bet on the next buyer?

Thanks to firms such as Softbank, Wework, Uber, and many others, startups capture funding and see their valuations soar. Everyone, from employees to management, and prior investors, is happy until some parties in the picture see the terms of late stage investors like Softbank asking for 2x or 3x liquidation preferences. Where, if a value markdown were to occur, the late stage investor recoups money while early stage investors often wind up with nothing.

That’s pretty scary for mutual funds, pension funds, and other limited partners that allocate money to venture capital firms.

Meanwhile a portion of Softbank’s portfolio has gone public , with some being home-runs (Alibaba) and others (Uber) being less spectacular investments.

But back to the private unicorns.

An increase in members of the Unicorn club doesn’t seem like a great deal for limited partners, operators, venture capitalists or for the general public. It is even more worrisome in a time period that looks like a top and when public markets may not be too willing to absorb losses of unicorn companies on their way to elusive potential profits.

A host of unicorns looks great on paper but what happens when no one is willing to buy at those prices? Even more pressing is when highly valued startups need more money to run operations and grow. Startups must make tough choices. Conduct down rounds (devalue), sell, or eventually die…when the cash runs out.

We’ve already seen this happen over the past couple of years. Unicorns like the Gilt Groupe were valued at over $1 billion, it eventually sold for $200 million to another company. Jawbone is one that is under liquidation. Evernote, has downsized several times over the past couple of years and has changed leadership to focus on being cash flow positive.

This trend is even more intriguing when compared to an ever growing concentration to tech stocks in the public markets.

Public Markets Beyond Profits

Meanwhile in the public markets, recent unprofitable consumer facing IPO’s like Uber and Lyft have not fared so well, while others like Beyond Meat with no profits trade at large multiples.

Concerns over risk and a global slowdown continue to rise amidst trade-wars and personal and national debt burdens.

Liquidity is another risk factor in the current period.

Are underlying assets in ETFs and other financial instruments liquid? If not, then in a potential decline, when a catalyst occurs and everyone sells, not everyone captures what’s left of their principal.

This spills over into cryptocurrency markets as well.

The Volatile Cryptocurrency Sector

Investors are still reeling from the 2018 bust but are slowly recovering. Everything was re-priced. Bitcoin has bounced back and trades at around $10,000 while alt-coins are still down in a major way. Volumes and commits go to Bitcoin, Ethereum and maybe a couple of other cryptocurrencies across large exchanges. If a global recession were to happen and this causes sales of assets in the cryptocurrency market, you’d want to be in assets that are more liquid (Bitcoin and Ethereum) and have broader strength.

Generally, private and public markets are flying high. The signs of excess are there with Dalio predicting a 40% chance of a recession in the next few years.