On Twitter, statistician and Bitcoin enthusiast, Willy Woo stated that he expects more volatility and a short term bearish outlook towards the Bitcoin price. He also advised that Bitcoin HODLers should not expect a similar cycle like those of previous Bitcoin halvings.

[wlm_private “Crypto Trader Pro – Monthly|Crypto Trader Pro – Yearly|Crypto Trader Pro (Lite)”]

Mr. Woo referred to the Bitcoin halving events of 2012 and 2016 that came after an upward price surge. He stressed that the bears are in control of the current state of the Bitcoin markets, and the bearish sentiment may persist. Perhaps, we should not expect similar rallies that came before previous halving events.

After BTC failed to close above the bearish accumulation resistance of $9,586.50 on the weekly time frame, November 04 ’19, the Bitcoin price entered a downward spiral from the $10,350.00 high of October 21 ’19.

A further increase in selling pressure forced BTC below significant support levels across the daily and 4-hour time frames for the world’s leading cryptocurrency.

The price plunge also drove a couple of leading altcoins into bearish sentiment as BTCUSD trades slightly above the $8K round-number support.

CHARTS

Below, we include the weekly, daily and 4-hour analysis of the Bitcoin/USD trade pair to show market sentiment and action.

BTCUSD: Weekly Time Frame

Looking from a weekly time frame perspective, the recent price drop was expected, due to a bearish accumulation pattern signaled on November 04, just after the previous week closed as a bearish inside bar candlestick pattern on October 28 ’19.

The subsequent price close below the bearish inside-bar support emphasized an increase in selling power along-side the earlier bearish accumulation pattern.

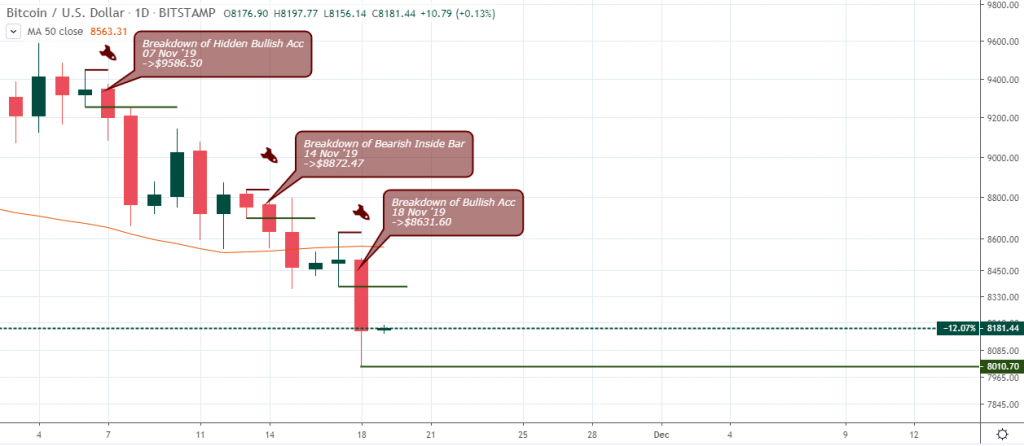

BTCUSD: Daily Time Frame

A view from the daily time frame reveals the significant support levels in green that had to be broken for the price to be at its current low.

The bears launched their selling campaign from November 07, for a dip below the 50-period Moving Average, before finally breaking the bullish accumulation support $8,631.60.

At the time of writing, the BTCUSD price moves about 4.74% and looks to flag a bear trap price pattern on the 4-hour time frame.

BTCUSD: 4-hour Time Frame

Yesterday’s bullish accumulation support at $8,375.00, on the Daily-TF, failed a buildup of selling pressure on the 4-hour time frame, as shown below.

The double bearish accumulation resistance at $8,496.59 and $8,493.20 on November 18, 04:00 & 08:00, sent the BTC price plunging toward $8K.

Conclusion

Now that the Bitcoin price trades within the September 30 channel, with resistance and support established at $8531.25 and $7714.70, we will look for a reversal breakout towards the upside on the daily or 4-hour time frame.

A critical support level on our watch list is the October 21 breakout support of $7,293.55, as it’s about the same level as the 50-period Moving Average, which was at the $7183.99 support level.

If the Bitcoin price close below the $7,293.55 support, we should expect a long-term change in polarity of the Bitcoin chart to a longer bearish pattern. On the other hand, a double bottom price pattern may be well on the way.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.

[/wlm_private]

Want to read the rest of the article? Join our pro-membership and receive all of the following:

✅Access to ALL content.

✅Access to the CTN editorial staff.

✅Access to our CTN trading dashboard.

✅Access to our exclusive telegram channel where all our pro-members and editorial staff are in.

✅Ability to request content/research material!