Bitcoin has become mainstream and gained popularity in the past decade by offering decentralization of digital money to peers across the globe. It has increased in popularity thanks to low transaction fees, ease of use, speed of transaction and through the use of a trustless system.

Bitcoin’s inherent independence of government and centralized organizations makes it more appealing to users for protecting their privacy and transacting between peers, but contrary to popular belief, Bitcoin is not as trustless and decentralized as one may have believed. In this article we’ll explore the question as to whether or not Bitcoin is really decentralized.

Bitcoin’s big question

Recent events have revealed the true limits of Bitcoin’s “decentralization” due to public scrutiny surrounding certain decisions involved in the operations of the Bitcoin network, which begs the question: is it really decentralized?

Because of the sheer size of the chain and mining difficulty, the number of miners is limited to big enterprise and conglomerates who operate nodes on the network. It is the operators who ultimately control the decision making process.

For example, following the aftermath of the major security breach on Binance, where funds worth $41 million were stolen from the exchange, CZ and the associated team considered rolling back the transactions on the Bitcoin Network.

This should be a terrifying thought and it has, in fact, raised questions on the trust that we place on the blockchain. It made us realize that entities controlling the transactions on Bitcoin Network are organized and unanimously make decisions. This introduces us to the possibility of orchestrated “devaluation” of Bitcoin at their discretion.

How it works

In the Bitcoin Network, a “vote” is used to solve the problem of double spending. Users in the network cast votes with their computing power and this effectively limits the power of individuals and mitigates the risk of Sybil attacks. Bitcoin is also popular for the computing power it consumes and it is impossible for a single individual to acquire the computing power needed to control the network.

Though impossible for an individual, there is a loophole in the network’s security which can open the possibility of an orchestrated attack.

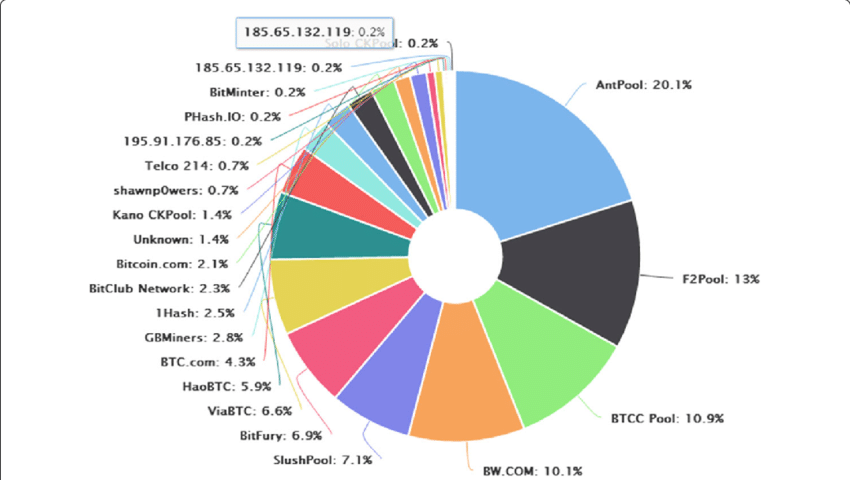

Let’s review the computing power distribution for the network.

A quick look at this distribution reveals that the power of miners dedicated to the network is much more than the smaller, let’s call them the less-than-five percenters, entities involved. So, for a decentralized operation, with only a handful of parties controlling well over 50% of the network, by and large, it is difficult to call this decentralized. It certainly looks more like a conglomerate.

Beyond just mining, other operations like protocol updates and responding to incidents on the blockchain are not decentralized and are limited to a small pool of administrators, irrespective of their computing power. Bitcoin administrators are appointed by function and users have no voice in these actions. This is the kind of control that is exercised on fiat currencies by centralized government institutions.

An attempt to increase transparency?

One could argue that Bitcoin introduces a certain level of transparency in mining; the transactions on the network are on a ledger that is public. The community of developers also attempt to increase transparency and share their thoughts on public forums. Despite this, it is unclear how Bitcoin handles dispute resolution and hacks – such as the one on Binance and Mt.Gox.

The network lacks, or holds at its discretion, any dispute resolution policy or framework in the event of such incidents. Rolling back transactions and disavowing already accepted blocks could dissolve trust and shred the foundation of what Bitcoin was created for.

The lack of regulatory framework gives Bitcoin certain freedoms, but let’s not fool ourselves into thinking it is 100% decentralized. The network only needs consensus, which can open wide any loopholes for controlling parties to devise their own framework to their benefit. This question is to provoke your thoughts on the network and help find improvements in security and question how dispute resolution is handled in the network.

Perhaps this is over-simplified, and we expect to hear from both sides of the argument, but based on what we’ve offered, we can conclude that Bitcoin is not truly decentralized as it is touted to be. What are your thoughts?

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.

1 comment

[…] Bitcoin […]

Comments are closed.