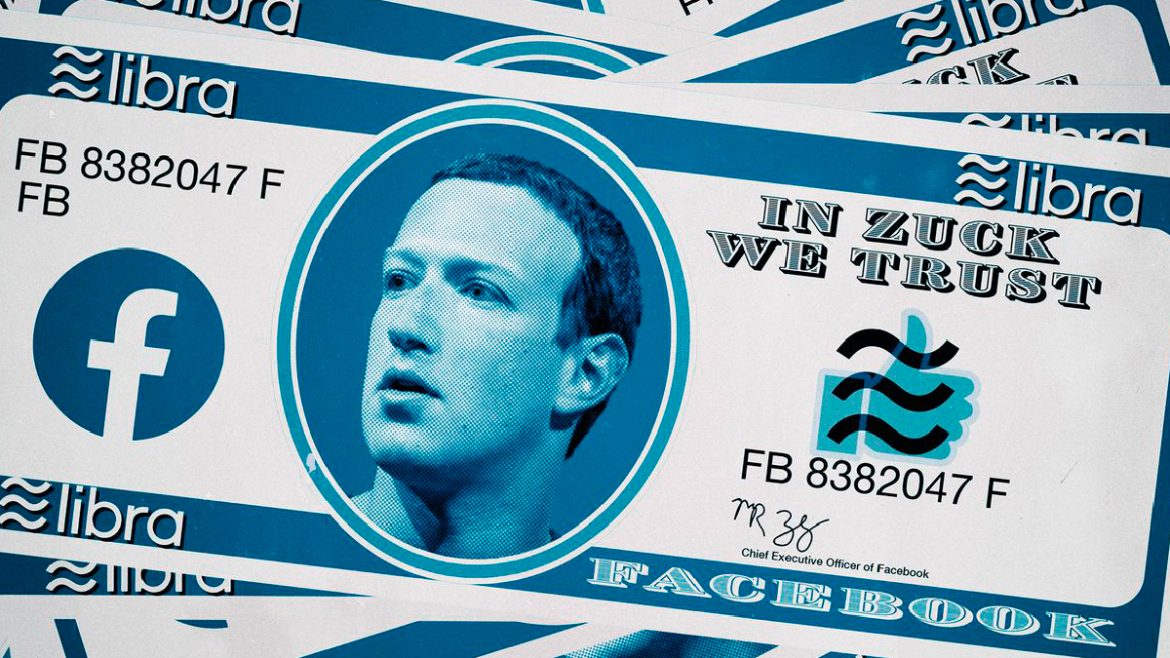

From the moment of Libra’s launch announcement, there has been major push back from crypto enthusiasts and government regulators all over the world, in large part because of their association with Facebook. Maybe it was this controversy that prompted Libra to be one of the most talked about crypto projects in 2019 but this hasn’t helped Libra at all.

The Libra project made many of the same promises most new digital currencies do: it would work more efficiently than existing payment technologies, and it would avoid the volatility by being developed as a stablecoin. By making it available to Facebook’s 2.2 Billion people through Messenger and other apps, Libra could revolutionize the global financial system. Why? Because over 50 percent of Facebook users have little or no access to banks and financial institutions.

While several stablecoin projects were announced across the globe, this one received much more attention as it came from Facebook, a firm with seemingly endless series of data privacy scandals. The scandalous social media giant was appearing as the lead partner in a plan to create a new global currency, alongside a coalition of other major tech, finance and commerce companies, and was promising to roll the whole thing out in early 2020.

Within weeks of the announcement, Libra was attacked seemingly from all sides. Cryptocurrency fans said Libra wasn’t a real cryptocurrency, as it breaks some of the fundamental principles promoted by the community’s often techno-anarchic fan base – including the important distinction that Libra transactions still rely on trust rather than mathematical proof.

Others criticized Libra as a corporate power grab. Economists warned it could challenge countries’ control over their own monetary policy and so undermine democracy. And lawmakers and regulators around the world lined up to say they’d be launching investigations or taking action against the fledgling currency before it had even launched.

In early October 2019, PayPal, one of 28 founding members of the Libra Association, who was set up to manage the cryptocurrency, withdrew from the project. A week later, e-commerce platform eBay and payments companies Visa, Mastercard, Stripe and Mercado Pago also backed out, leaving only one payments partner, fintech company, PayU.

Why Libra would have had a chance, without Facebook

The Cambridge Analytica Scandal and Facebook’s involvement in this data scam, set the stage for Libra from day 1. On October 23, Facebook CEO Mark Zuckerberg was brought in front of a congressional panel to answer questions about Libra from a largely frosty House Financial Services Committee. In an opening statement, committee chair Maxine Waters threw down the gauntlet by restating her call for a moratorium on Facebook’s development of Libra until Congress could properly consider the issues it raised, and suggesting that Facebook focus on existing problems.

Facebook is faced with several existing deficiencies and failures and it was repeatedly asked to address those, before proceeding any further on the Libra project.

Apart from the data scandal, Facebook has a bad record for diversity and political advertising. Facebook’s name has given Libra a biased view from its launch announcement and the project will never be able to have a fresh start.

While Libra insists that it is more than just “Facebook’s currency”, many of the project’s key architects are Facebook employees – all of the authors on the white paper introducing Libra’s blockchain are listed as working for Calibra – and the cryptocurrency’s early days began within Facebook, which built an in-house unit to work on blockchain before forming the coalition that became the Libra Association. Facebook began quietly staffing its blockchain division under David Marcus, its Vice President overseeing Facebook Messenger, who now runs Calibra and is one of the Libra Association’s five board members.

Furthermore, Libra’s ambitions to become a global currency rely largely on Facebook’s reach. Across Facebook, WhatsApp and Instagram, the company has close to 2.5 billion active users, many of whom – thanks to its Free Basics and Facebook Zero projects to spread internet access in the developing world, which together have an estimated 100 million or more users – are outside the banking system. As a result, the social network is integral to the project, even if it is also the biggest driver of its backlash. Will the fledgling currency be able to overcome the reputation of its corporate parent?

One may ask, why might Facebook, a social media company, be so interested in developing a global currency? The Libra Association insists that access to payment data will be tightly controlled, and that Libra users’ data will not be shared with Facebook or other third parties without consent. That said, Facebook clearly has a lot to gain from integrating payments into its platforms in terms of keeping users inside its ecosystem.

Beyond the usual regulatory concerns on issues such as anti-money laundering and fraud prevention, Libra could present a threat to local economies. It’s no surprise that banking regulators across the world have taken a strong interest in the development of Libra, with representatives from 26 central banks across the world questioning Libra executives, back in September 2019. The departure of its main payments partners, however, means Libra no longer has their experience of the extensive regulatory requirements of moving money – a significant challenge that makes Libra’s 2020 launch date seem increasingly unlikely.

Many are terrified of Libra’s success, more so because of its association with Facebook.

What are your thoughts? Leave a comment!

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.