This week in cryptocurrencies Bitcoin mining profitability went up despite an increase in hash rate and mining difficulty. The People’s Bank of China (PBoC) made strides in developing Digital RMB as Facebook may possibly delay the launch of Libra. While volume and number of transactions has increased in the Bitcoin network, retail and institutional investors’ interest in Bitcoin has spiked. This is a positive development because a strong demand from institutional players might help to expedite approval for a full-fledged Bitcoin ETF for retail investors.

The increasing tension from the trade war between U.S. and China and deep negative interest rates are driving investors across the world towards the newly emerging safe haven – Bitcoin. This could be a leading reason for the continuous increase in Bitcoin’s dominance. It is currently at 71% and expected to rise further in the following weeks of September 2019.

Let’s analyze the top 5 cryptocurrencies this week.

BTC/USD

Bitcoin has steadily bounced back from $9,000 level and is currently trading at $10,550, up 5.95% in the past week. However, bulls are facing resistance just below the $11K mark. Both moving averages are flattening out and the RSI is just above the midpoint. This points to another week before we cross the $11K level.

If the price doesn’t cross $11K level, and starts plummeting it may fall below the psychological $10K level. If the bulls are successful in pushing the price up, a breakout and a rally would possibly lead to the yearly high of $13K.

ETH/USD

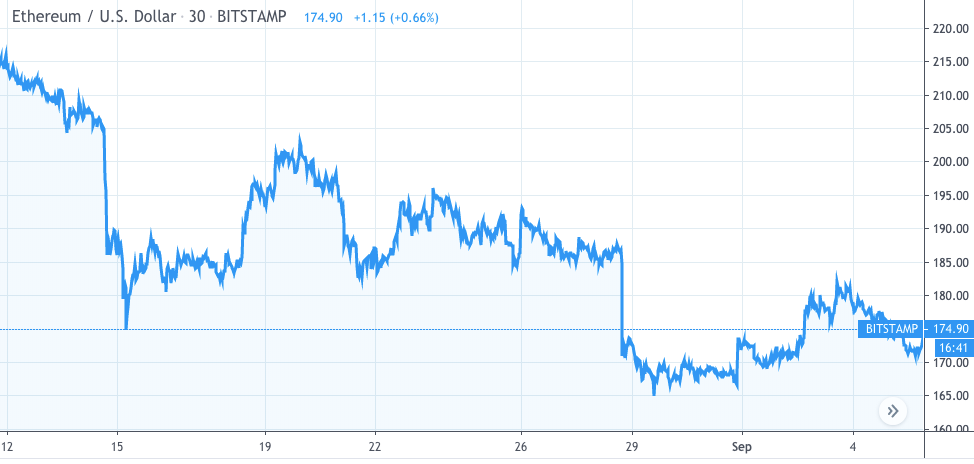

Ethereum has gained 2.3% in the past week. Ethereum has been facing a resistance at the down slide 20-day EMA. This indicates that the downtrend is on. Bears are now competing to get the price below $165 and if successful, the downtrend may hit the $155 level. Ethereum is currently trading at $174.57.

The next resistance is at $190 level and if bulls take up from here, a rally to $235.70 is likely. A long position is not recommended this week.

XRP/USD

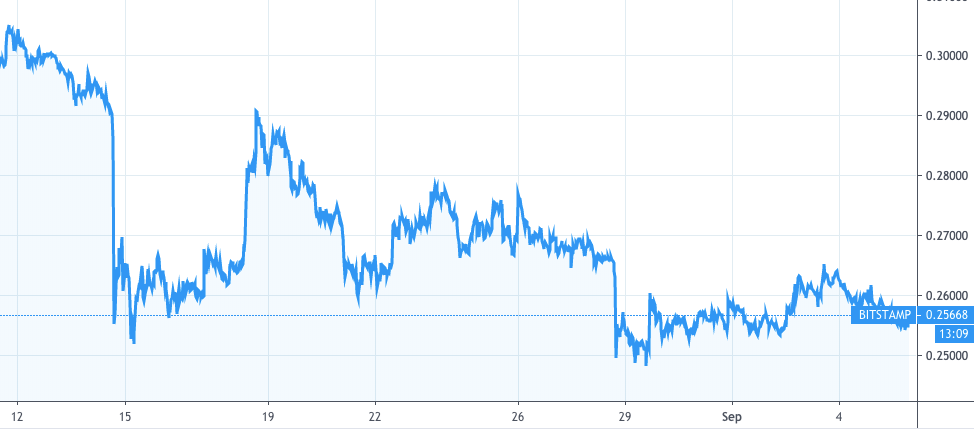

Ripple has been stuck on $0.25 level for the past week. It is facing a resistance at the 20-day EMA. Ripple is on a downward trend. If bears take over, the $0.25 may turn into a downtrend and plunge to $0.19.

However, if bears lose their grip, bulls may take the price up to $0.30 level. It is recommended that we wait for the trend to change before assuming a position here.

BCH/USD

Bitcoin cash is currently trading at $292.55 and has reached the 20-day EMA. It was trading at $280 and is now trading at $292.58 at the time of writing.

The price may rise further and cross the psychological level of $300. However, if the pair falls below current levels, it can slump to $165 and below $100. We can’t find any reliable buying level and suggest holding position.

LTC/USD

Litecoin has been losing considerable market capitalization and price action indicates a downward slope. Bears are taking over Litecoin since the halving and slashed block rewards. Litecoin currently ranks 5th on market capitalization and it lost 2.53% in the past 24 hours.

Bulls are trying hard to push the price above the 20-day EMA. If this is successful, the pair will gain momentum after it sustains above the downtrend line. Once there is a trend reversal, it may indicate the buying level.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.

1 comment

[…] top 5 cryptocurrencies recovered from the slump of the past week and gained momentum over the weekend. That being stated, […]

Comments are closed.