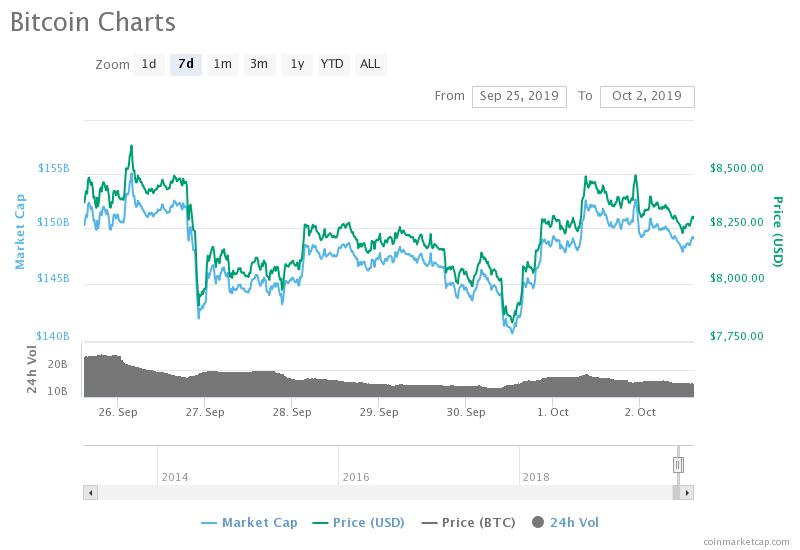

After the bearish bloodbath in the crypto markets last week, Bitcoin is still recovering with its price hovering around $8,270. There are some signals for the possibility of extended growth this month even as a move below SMA200 on the weekly chart makes investors carefully consider their long-term prospects.

[wlm_private “Crypto Trader Pro – Monthly|Crypto Trader Pro – Yearly|Crypto Trader Pro (Lite)”]

We have taken into consideration some bullish and bearish trends for the mid-term price predictions. As Bitcoin recovers above $8,000, there is some relief that this is a positive signal for long-term bitcoin bulls because many are regarded this as a buying opportunity.

This pullback is an opportunity to buy or add to existing positions at lower prices. Bitcoin prices tend to get better after a collapse of over 10% within a 24-hour frame. The average returns at 7 days, 14 days, and 30 days are better after a strong sell-off than on all other days. This is a great time to buy the dip.

BTC/USD slipped below SMA 200 for the first time since March 2018 and there is a potential for an extended downside momentum. There may be negative returns for the next 120 days. BTC is down by 1.12% in the last 24 hours. Bitcoin price started a strong recovery above $8,000, hitting the $8,200 resistance level. There are strong indicators of more resistance near the $8,500 level.

Yesterday highlighted a major bearish trend as the resistance line was breached near $8,080 on the hourly chart of the BTC/USD pair. The price may fall below $8,000 in the coming week. On the upside, BTC is facing two important hurdles near the $8,500 and $8,750 level.

After trading through a new monthly low, Bitcoin is still recovering but there was a close above the $8,000 level and the 100 hourly simple moving average. As a result, the price climbed above the $8,150 to reach the $8,200 resistance level.

After yesterday’s bearish trend, the BTC/USD pair gained strength above $8,000 and surpassed $8,200. At the moment, it seemed like the price is facing resistance near the $8,500 level but it’s likely to correct lower toward the $8,250 or $8,000 support. The 50% Fibonacci retracement level of the recent wave from the $7,670 low to $8,525 high indicates support near $8,100. One thing to keep an eye on is whether the price closes below $8,000 as the 100 hourly SMA might push the price back into bearish territory.

There are two important barriers for the Bitcoin bulls – $8,500 and $8,750. If the price crosses $8,750, expectations are that it will rise sharply towards $9,000 and $9,500. We’ll keep an eye on the charts for the latest market trends.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.

[/wlm_private]

Want to read the rest of the article? Join our pro-membership and receive all of the following:

✅Access to ALL content.

✅Access to the CTN editorial staff.

✅Access to our CTN trading dashboard.

✅Access to our exclusive telegram channel where all our pro-members and editorial staff are in.

✅Ability to request content/research material!