With the interest in cryptocurrencies growing in popularity, more crypto-friendly platforms and exchanges are springing up to catch the trend. While not a new exchange, Coinbase is one of the most popular crypto exchanges.

In this review, we will present you with a fresh take of the platform’s trade marketplace, revealing the basics about Coinbase, their fees, verification requirements, trading pairs, security, and much more.

General Information

Coinbase was launched in San Francisco June of 2012, by Brian Armstrong and Fred Ehrsam. The company, which operates under regulations of the American financial authorities, operates in 32 countries and has served over 12 million customers to exchange over $40 billion in digital currencies.

By 2013, the exchange emerged as the highest funded Bitcoin startup. It also emerged as the biggest crypto exchange company in the world.

[rml_read_more]

In 2018, the company rebranded its sub-platform formerly called GDAX to Coinbase Pro in order to separate the ‘trading’ element of the exchange from the more casual consumer platform.

Coinbase Pro is the major focus of this review.

Coinbase Pro Review

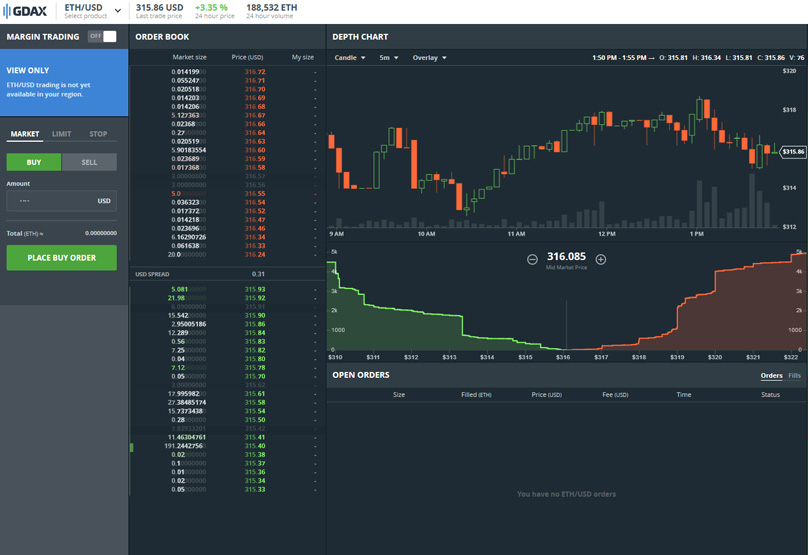

Coinbase Pro is a trading platform designed to appeal to more advanced traders and crypto enthusiasts who wish to know more than just the basics of market changes associated with currency pairs. Coinbase Pro features real-time order books, charting tools and trade histories.

Coinbase Pro is currently only available through a web browser. Though the original exchange is available to users through iOS and Andriod apps, it does not include the new trading marketplace.

All customers of Coinbase automatically have an account on the Coinbase Pro platform where they can login with the same credentials as the Coinbase platform.

Regions Served

When compared to other global crypto exchanges like Bitfinex, CoinEX, and EXMO, Coinbase Pro does appear to have a restricted customer base serving only 32 countries; 27 of which are European and the others being the US, Australia, Canada, Singapore, and the UK.

Payment Methods

Coinbase supports fiat deposits using direct bank transfers and credit cards as a funding option. There is a 3.99% fee for credit card deposits while bank transfers vary depending on the kind of bank transfer and the currency used. Fees may vary from 0 to 1.49%.

The exchange only accepts USD, GBP, and EUR for fiat deposits.

Cryptocurrencies Supported

Coinbase, unlike other crypto exchanges, focuses only on the most popular cryptocurrencies and currently offers 19 trading pairs. The US and some European countries have 9 trading pairs available while the other countries, namely Canada, Australia, and Singapore, only have four trading pairs, excluding fiat.

Coinbase users can deposit and withdraw Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

Fees & Limits

Coinbase, unlike some other trading platform, uses the “maker & taker” fee structure.

Presently, Coinbase traders depending on the traded monthly value pay within the region, currently between 0.3% to 0% if their order is a “taker” on the platform.

Makers do not incur extra fees; an incentive to increase traffic and liquidity of the marketplace.

Coinbase imposes no limitations on orders or for deposits/withdrawals.

Security

Coinbase has a secure marketplace as the company uses a number of security protocols to protect sensitive information.

They also maintain asset insurance, so customer funds are part of the insurance covered by the platform. This means that any loss suffered by users due to hacking attempts and security breaches are retrievable.

2FA (two-factor authentication) with Google or phone and an IP whitelist is also featured. Email notifications are offer security and confirmation for transactions and logins.

Trading Guide

Coinbase offers 19 popular trading pairs.

BTC/USD remains the biggest trading pair on the platform followed by fiat pairings, with ETH/USD second in popular trading pair.

Overall trading volume is presently $57 million for BTC/USD and $44 million for ETH/USD. The total trading value within our 24-hour assessment stands at approximately $150 million.

Regarding the user interface, unlike BitMEX that allows customization of its UI, the Coinbase UI does not allow for much customization, however, it is quite easy to navigate their site. Charts, indicators and several types of bars can be modified to a certain extent on the Coinbase interface.

Coinbase Pro allows users to open orders through Limit, Market and Stop tools, shown in the image below.

Other advanced tools offered by the platform include Immediate or Cancel (IOC), Fill or Kill (FOC), and Good ‘Til Canceled (GTC).

Stop functions include the regular stop-loss limiter and take-profit price limiter. Traders on the platform can set upper and lower price levels and include advanced instructions for when the market enters bear or bull stages.

Customer Support

The platform has a singular support page that includes an FAQ section and ticket system. Coinbase does not feature live chat but clients can reach customer support through email or by directly calling support.

Pros and Cons

Let’s examine some of the pros and cons of trading on Coinbase.

Pros

Security: Cryptocurrencies are secure and insured on the exchange.

Reputation: Coinbase is a large, reputable company with limitless potential to expand when we consider its client pool.

The exchange offers liquidity options.

Cons

Reach: Coinbase suffers limited geographical spread as it is only available in 32 countries; some of the participating countries not offered all trading pairs.

Conclusion

Coinbase, while not perfect, is one of the better crypto exchanges and trading platforms for newbies in the crypto space. The exchange might be considered one of the safest places to become indoctrinated into the world of crypto, allowing new customers to feel confident in their crypto trades, and the ability to easily buy in using fiat. The Coinbase user interface also has enough features for expert users to trade comfortably.

As we conclude our examination of Coinbase, we will end with this: Coinbase has huge growth potential and has earned its position as a leader in the crypto industry.