Houbi is one of the numerous exchanges that have emerged in the cryptocurrency market in recent years. Each presents a unique mix of user interface, fees, pairings, and geographical quirks, but Huobi seems to be one of the more promising options.

Huobi is a Singapore–based company founded 2013 with a focus on customer service and independent cryptocurrency analysis. Huobi is very much focused on the Asian market with offices in Hong Kong, Japan and its head office in Singapore.

In May 2018, Huobi notified an exclusion of prospective U.S based clients mainly due to U.S regulatory laws. However, the company said it intends to open service for U.S citizens shortly, based out of its San Francisco, California location.

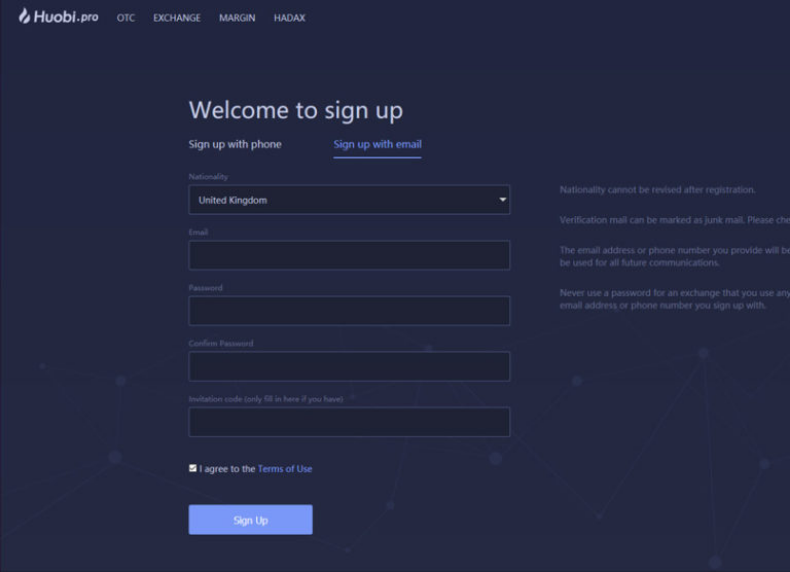

ACCOUNT SIGNUP ON HUOBI

[rml_read_more]

Creating an account on Huobi is quite easy. There is a link to create an account in the top-right corner of the home page. Upon clicking, you are prompted to select your country of origin by the sign-up screen, with a warning that it cannot be changed once entered. Huobi can successfully brag of operating in 130 countries. However, the most selected nationalities as of May 2018 are China, Hong Kong, Taiwan, Japan, Korea, Germany, the United Kingdom, and Canada.

You can sign up for an account by providing your email address or phone number. Once you’ve completed the account opening process, check your email spam folder, as verification email addresses can sometimes be marked as spam. Upon signing up for an account, and confirming your email, you’ll be shown a welcome screen on your first login showing you the different payment methods. The payment methods include cryptocurrencies, Chinese Yuan (CNY), US dollars and Singapore dollars (SGD). By using the exchanges’ OTC service, you can transfer funds to your trading account.

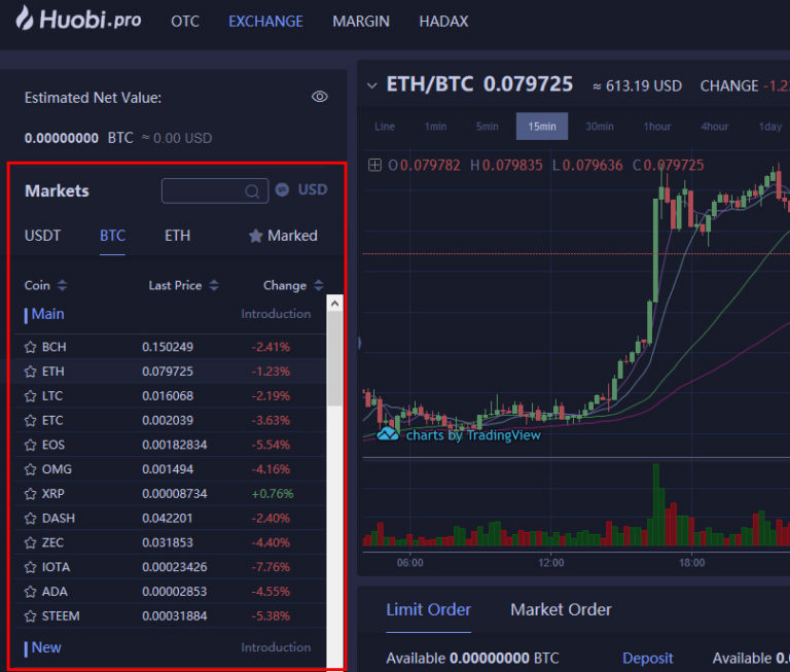

HOW TO TRADE ON HUOBI

Once you’ve created an account, you can visit the basic exchange. Huobi offers USDT, BTC, and ETH pairings. Huobi offers over 40 USDT pairs, and roughly 100BTC crypto pairs, as well as a handful of altcoins paired against ETH. The crypto pairs are split into categories according to how long they have been on Huobi and if they are a fork of an existing coin.

The main trading screen is fairly easily understood with all available trading pairs located on the left sidebar. Huobi has a Tradingview powered interactive candlestick chart on the right-hand side of its screen, with a whole range of tools for carrying out technical analysis. Such tools include Moving Averages, Bollinger Bands and much more.

The order forms are directly below the chart, letting you buy and sell with limit orders. On the right-hand side are the recent prices and orders of the selected coin.

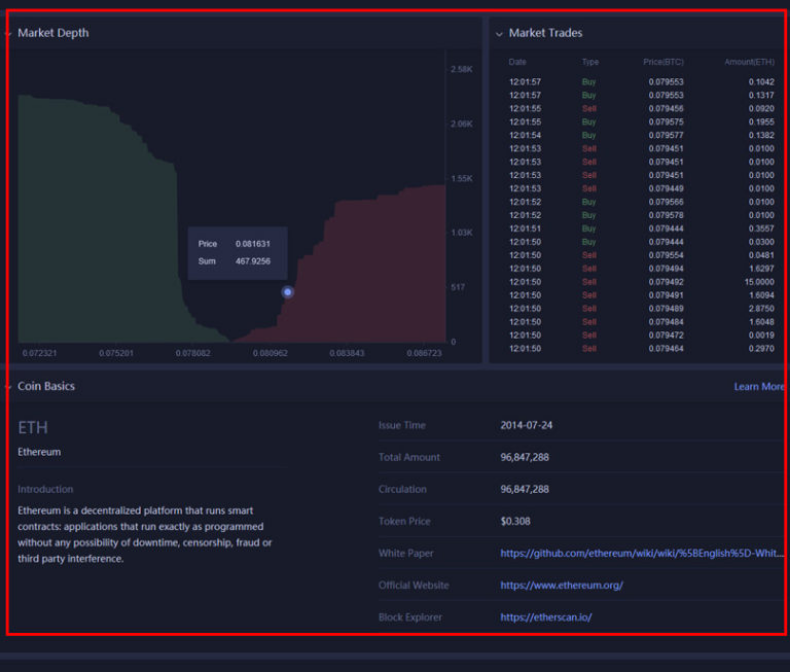

Below these tools is a market depth chart, a running score of market trades and a very useful section featuring each coins’ personal statistics. This makes Huobi’s exchange tool stand out in contrast to other exchanges, like Binance.

At a glance, a trader can get a look at any given coins’ total supply, circulating supply, website, white paper and more. This setup provides most of the related information in a toolbox directly on the exchange screen saving you the stress when doing your research on cryptocurrency trading options.

This information, which is further explained in Huobi’s asset introduction page, is made available by clicking the ” help” link at the bottom of the screen.

TIME TO TRADE

Having funded your wallet with the cryptocurrency you wish to trade with, Huobi lets you jump straight into the markets through their exchange screen. Support-limit and market are the two types of orders.

The trading for both is easy to assimilate. Prices are shown in the two potential pairing and U.S dollars and the amount can be manually done or selected with a slider. This is a very useful tool to see the share of your current pool of coins which you plan to stake in a trade. If you are going all-in, drag the slider to the right while dragging it halfway means you are taking half of your coins to market, etc.

Aside from the essential trading platform, Huobi also offers two complimentary trading platforms.

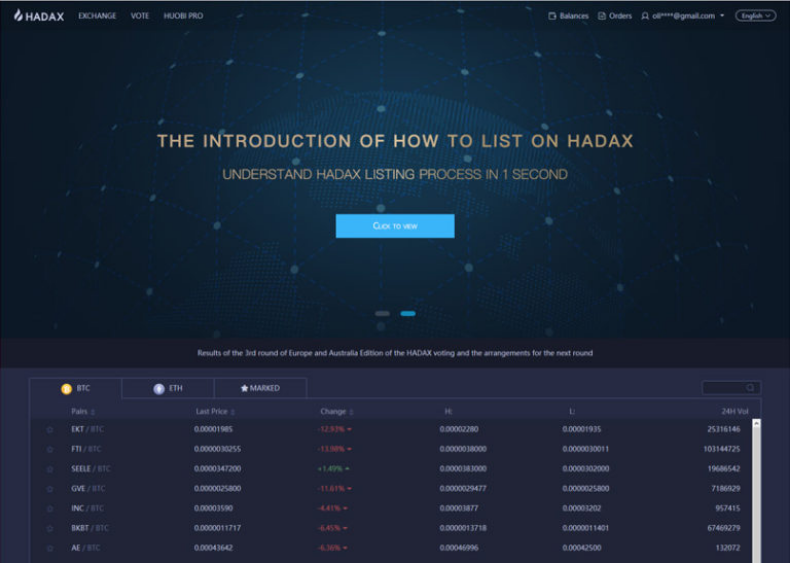

The HADAX

The HADAX which means Huobi Autonomous Digital Asset Exchange, a platform granting professional traders access to an even more adventurous version of the regular cryptocurrency market.

On the Hadax system, Huobi does not verify the value of the investments of coins and tokens registered to trade as it does on the primary Huobi platform. Hadax users on the other hand vote for token listings which HADAX confirms to be original and valid. To become a HADAX user, prospective investors will have to meet up with minimum investment criteria due to higher risks involved in trading these altcoins.

For a coin to be approved on the platform, it must be listed first as a new coin on the Huobi main trading site, as long as it satisfies Huobi’s investment criteria. Elimination of a coin from Huobi does not imply its removal from HADAX.

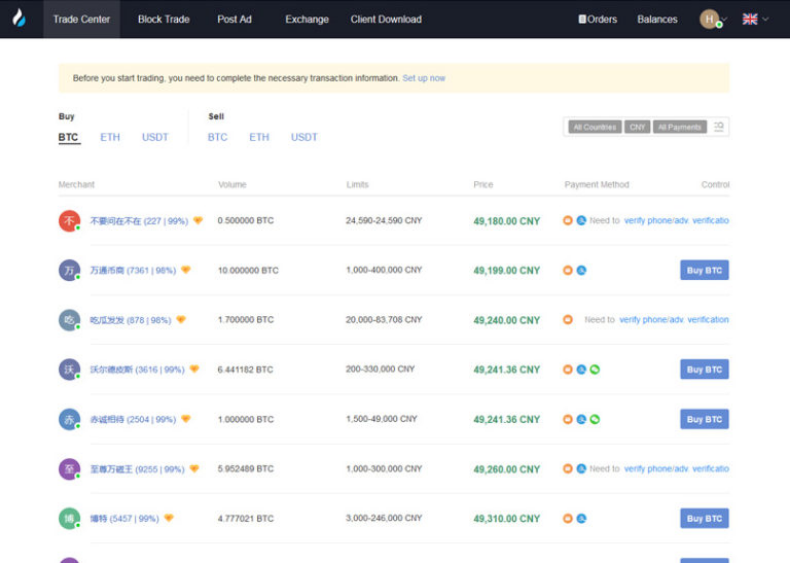

OTC

The over-the-counter or (OTC) section of Huobi offers prospective buyers and sellers a way to move huge quantities of coins without disclosure to the fickle exchange market. Certified merchants can register here, and slippage can be reduced by connecting buyers and sellers directly instead of relying on market orders.

OTC cryptocurrency trades are usually made when the size of the buy or the sale is likely too be big to move the market on its own.

MARGIN TRADING

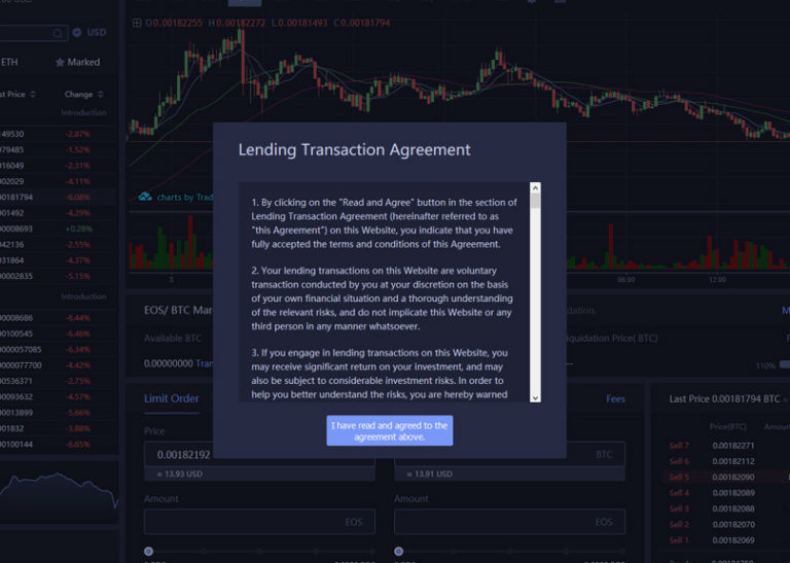

Margin Trading is a whole different ball game from the basic exchange. Huobi offers Margin Trading. In Margin Trading: funds lent from a broker are used to trade a given cryptocurrency. The cryptocurrency serves as a guarantee for the brokers’ loan.

The short and long position can take allowing the potential to magnify both gains and losses. Therefore, it is only recommended for experienced and seasoned professional traders.

Margin trading needs a level of market understanding that allows a trader to see several steps ahead into a coin or token’s future. Before using the Margin Trading part of Huobi, there is an extra Lending contract agreement that must be confirmed before proceeding.

Huobi’s trading options run the scope from simple to complex. There is a trading platform available for most users’ needs, be it reducing slippage on large buys or risky moon shots on unproven coins.

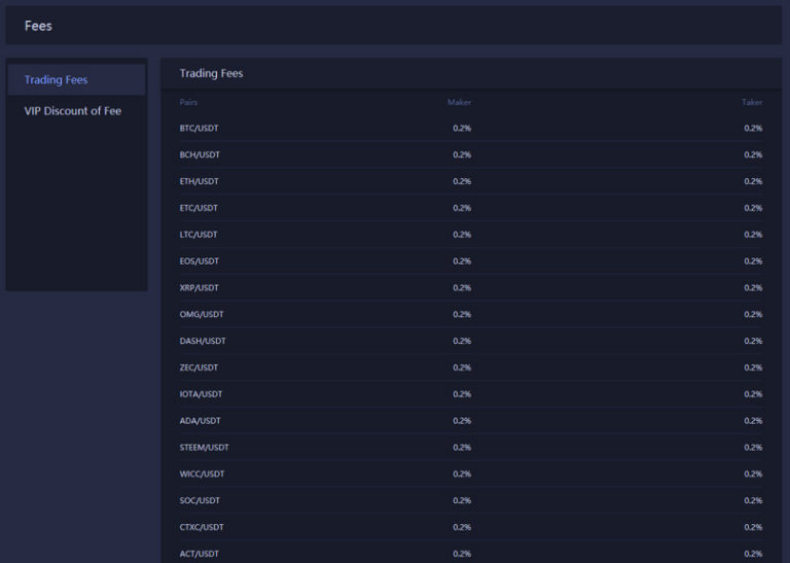

FEES ON HUOBI

Despite the surplus of trading options available, Huobi has a very simple fee method. Both the maker and taker fees are presently set for almost all trading pairs at 0.2%.

Maker fees are measured when adding liquidity to Huobi’ order book through a limit order under the last buy trade price and above the last sell trade price.

HUOBI TOKEN: The Native Cryptocurrency of Huobi

Like Binance’s BNB and Kucoins KCS, Huobi spots its own cryptocurrency. The HT can be bought through the exchange and is given out as part of loyalty and new user reward programs. The token has a total supply of 500 million.

HOW SAFE IS HUOBI?

Huobi has high professional cryptocurrency security backed by Global financial titan Goldman Sachs assisting in the security and risk control. The independent cryptocurrency scrutiny system is designed to keep potentially malicious coins from being traded on the exchange’s main site.

ID verification is available, as is two-factor authorization for trades and with withdrawals. In May 2018, Huobi was a victim of hackers but no customers’ funds were compromised.

Conclusion

Huobi strives to comply with U.S regulations in a bid to get U.S residents signed up on its platform. The exchange also relentlessly works on improving security to match up with traditional standards of traditional stock exchanges as well as sustain customer service.

At Crypto Trader News, we heartily recommend Huobi for traders of all styles.