What Is Risk Management?

By definition, risk management is the identification, assessment, and rank, or priority, of risk, which is then followed by monitoring moving factors in order to coordinate economical decisions to control or lessen negative impacts, or increase the opportunities for potential profit.

Successful traders are those who research their options, watch the charts, and manage their risk in order to make a consistent return on their trading capital.

It would be a fool’s game if investors threw money at a cryptocurrency or project without doing their due diligence. No one likes to lose, so it’s critical to define the highest and lowest amount of risk you are willing to take in order to trade responsibly.

Strangely enough, traders often ignore the idea of risk management and “shoot from the hip” with precarious results. The trading industry has always been flooded with get-rich-quick schemes and buy-ins for projects that seem too good to be true. There are two sayings to remember: “If it’s too good to be true, it probably is,” and “Don’t invest if you can’t afford to lose it.” This is where risk management comes in prior to taking a position.

[rml_read_more]

Cryptocurrency broker and exchanges offering margined trading accounts can be compared to a casino. Many people go to Las Vegas to gamble and hope to win the jackpot, but only a handful win. This is because casinos know they have a statistical advantage. But how does one tip the scales to their favor?

Let’s examine a few examples that emphasizes the need for risk management while trading cryptocurrencies – or any asset.

Let’s say you started trading with a $100,000 trading account. Losing 50% of your account leaves you at a balance of $50,000.

For you to get back to your initial starting capital of $100,000, you would need to make a 100% of your current balance. So, what this means is that you are already mathematically disadvantaged if you trade a strategy that has a 50% win rate and a 1:1 risk to reward ratio — more on risk to reward ratios later.

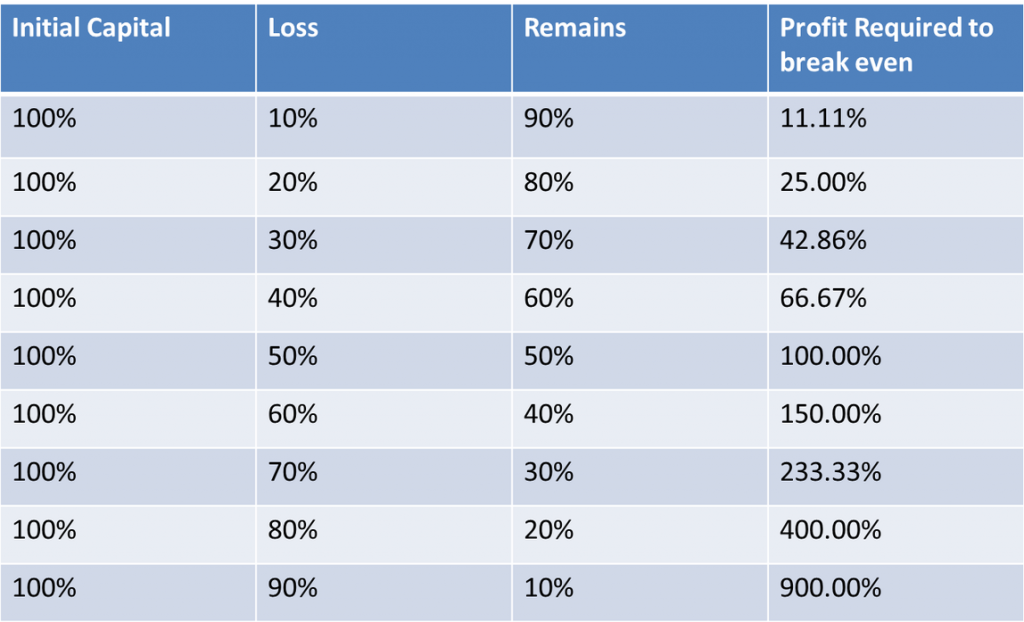

Below is a table that shows the percentage of your remaining capital required to restore your account to the initial amount after a series of losses.

From the above illustration, notice how difficult it is to get back to break even point even after a loss of 30%, it requires that you make 42.8% of your capital.

The simple formula for calculating your percentage recovery after a loss is:

y = x/ (1-(0.01*x))

Where “y” is the percentage gain required to break even, and “x” is the percentage lost.

At this point I guess you want to ask, so how much should I risk on every trade?

Our answer: you should never risk more than 2% of your capital on every trade. If your trading strategy overshoots frequent trade signals, then you may even want to risk 1% of your capital per trade and not more than five trades running simultaneously.

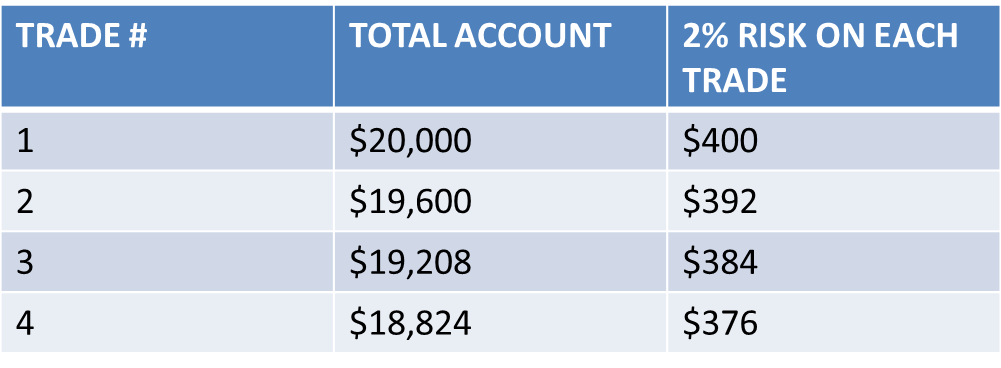

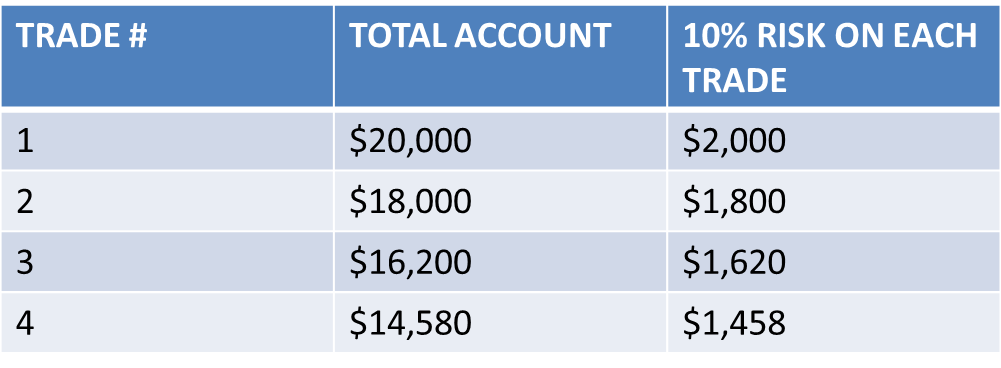

Below, we present to you a table that compares having a low-risk exposure on your capital per trade to having a high-risk exposure.

A 2% vs. 10% Risk Exposure on each trade.

It’s obvious there’s a vast difference between a 2% risk exposure and a 10% risk exposure on every trade.

If you lose 19 trades in a row, it’s pretty clear you’re on a losing streak. At a 10% risk exposure per trade you would be left with $3,002 and a loss more than 85%. On the other hand, risking 2% of the same $20,000 would leave you with $13,903 after 19 trades; 30% of your starting capital. If you risked only 2%, you would still have $13,903, which is only a 30% loss of your starting capital.

As you can see from the illustration showing the recovery formula after a loss, imagine how difficult it would be to recover after losing 85% of your capital!

Having the discipline to follow a low-risk exposure on every trade would keep you in the trading game until a success period kicks in. This might also help boost your confidence so you can live to trade another day.

From experience, we highly recommend delegating someone to hold you accountable for your risk management policy. So if you set to risk not more than 1% of your capital per trade and not more than 5% of your capital exposed in a position, your risk manager, either human, machine, or preferably a combination of both, will help ensure you keep to these rules and stay out of the red.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.