While cryptocurrency mass adoption may still take some time, there are several countries in the world that truly see the benefits of crypto and are willing to take the ‘risk’ by adopting cryptocurrency earlier than the others. The word “mass adoption” has been a popular topic probably since cryptocurrency was created. Sadly though, the term doesn’t seem to catch up with the growing popularity of the cryptocurrency itself. In this article, we’re going to summarize the countries who have the strongest economies and see what their stance is with regard to cryptocurrency.

[wlm_private “Crypto Trader Pro – Monthly|Crypto Trader Pro – Yearly|Crypto Trader Pro (Lite)”]

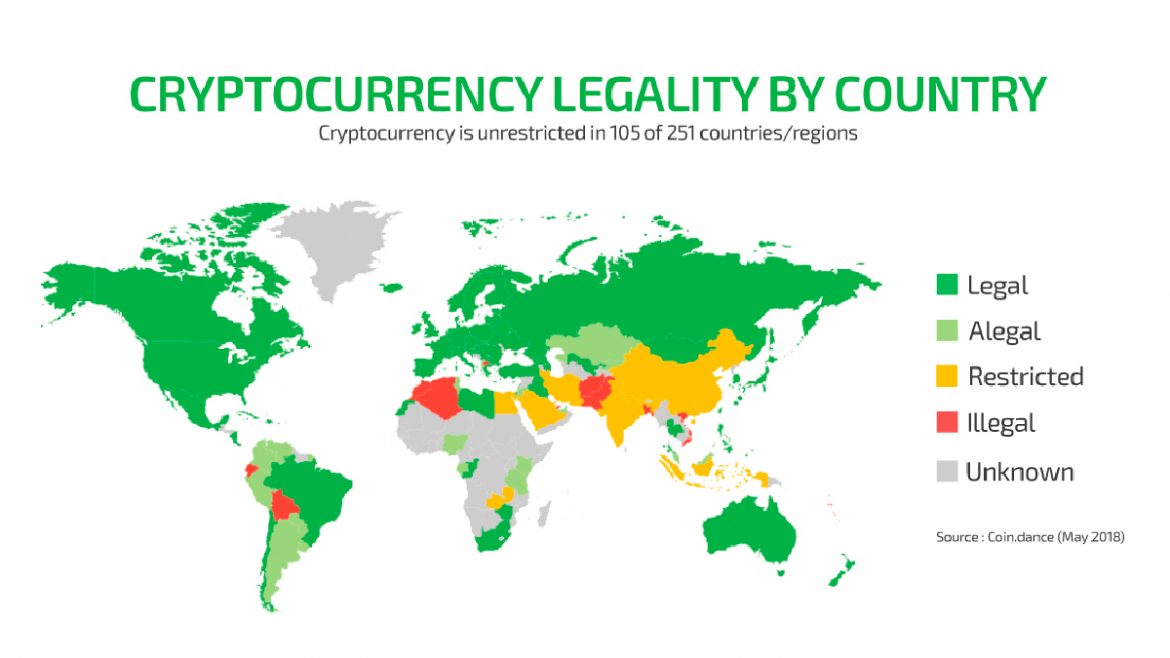

Leading economies like China and India, decided to crack down on anything involving cryptocurrency even going as far as to subdue the underlying technology of cryptocurrencies and exchanges, and even blockchain, in an effort to suppress the growth of crypto within the country. But as more tech was being developed and more enterprises seemingly adopting it, more countries have opened up to the idea of blockchain, eased their restrictions, and began creating better regulation for cryptocurrencies and their functions as both an asset and utility. A few countries have even decided to go above and beyond regulation, creating an environment where cryptocurrency can truly grow.

Despite facing challenges at the domestic level along with a rapidly transforming global landscape, the U.S. economy is still the largest in the world with a nominal GDP forecast to exceed USD 21 trillion in 2019 and it seems that the country is split on adopting cryptocurrency. Certainly, there is push back on projects like Facebook’s Libra by Congress, as many states are crypto friendly, while others like New York, are not.

Is the United States making a mistake by not taking a more assertive stance on adopting crypto and its underlying technology? Are we falling behind where other countries that have strong economies and a strong stance on digital assets, crypto exchanges, and blockchain technology are moving ahead?

China

Beijing’s interest in cryptocurrencies is longstanding. Though China has for years restricted the use of Bitcoin and other cryptocurrencies within the country. The People’s Bank of China started a cryptocurrency research group in 2014, and as early as 2016, the central bank’s governor at the time, Zhou Xiaochuan, had mused about issuing a digital coin.

But in 2017, as Bitcoin’s value soared and speculative frenzy raged, China shut down cryptocurrency exchanges and cracked down on fund-raising through virtual coins. Officials continued to discuss a government-controlled digital currency in speeches and articles, and after Libra was announced, China declared that it was accelerating its efforts.

Beijing has long wanted China’s currency, the Renminbi, to be used more in international trade and finance. If Libra proves convenient for moving money across borders, then it could become the currency of choice in many countries, particularly those with unstable economies.

Japan

Bank of Japan (BoJ), the country’s central bank is conducting research on digital currencies, according to an official. The governor of the central bank, added that the BoJ currently has no plans to issue a digital currency but can do so in the future if need be. The official is also not keen on stablecoins and believes that these should not be issued unless there is a sufficient framework in place to ensure governance and risk management.

The BoJ has previously also raised financial stability concerns related to digital currencies and stablecoins. In April 2018, the BoJ’s deputy governor Masayoshi Amamiya said issuing a digital currency may have a “large impact” on the country’s “two-tiered currency system and private banks’ financial intermediation.” Most recently, Amamiya said the central bank has no plans to issue digital currencies for now partly due to its impact on commercial banking.

Germany

Germany is one of the world’s leading economic powers and it isn’t quite one of the world’s leading cryptocurrency nations. Countries such as Switzerland, Malta, Japan, Singapore, Luxembourg and Liechtenstein have introduced more progressive legislation related to crypto and blockchain technology.

Still, Germany has witnessed relatively encouraging cryptocurrency adoption until now, while the government has just begun pushing through legislation and strategy documents that should create more propitious conditions for crypto. In other words, the foundation is already in place for Germany to become a leading crypto-nation. And as experts in Germany tell Cryptonews.com, the country is likely to cement its place as the most crypto-friendly state in the EU, while adoption among the general German public is also set to grow over the next few years.

Cryptocurrencies are hardly ubiquitous in Germany, but fortunately there’s already a significant base of early users from which further adoption could be driven. Larger companies and institutions remain somewhat skeptical of crypto and beside such landmark projects from a few companies, the topic of crypto assets is largely not understood and traditional financial organizations are very reluctant approaching this new field.

United Kingdom

The United Kingdom’s approach to cryptocurrency regulations has been measured: although the UK has no specific cryptocurrency laws, cryptocurrencies are not considered legal tender and exchanges have registration requirements.

HMRC has issued a brief on the tax treatment of cryptocurrencies, stating that their “unique identity” means they can’t be compared to conventional investments or payments, and their “taxability” depends on the activities and parties involved. Gains or losses on cryptocurrencies are, however, subject to capital gains tax. Cryptocurrency exchanges in the UK generally need to register with the Financial Conduct Authority (FCA) and although some crypto businesses may be able to obtain an e-license, instead.

India

While India is looking to create a concrete policy on cryptocurrency amid the current ban on trading and possession, finance minister Nirmala Sitharaman said the Indian government has already received several red flags from other nations, which vindicate its stance on virtual currencies.

Sitharaman, who is currently at the 40th meeting of the International Monetary and Financial Committee (IMFC) in the US, said that many global leaders and policy makers agreed with India’s contention that even though using cryptocurrencies might have their benefits, but there needs to be “extreme” caution before doing something to legalise the same. Reserve Bank of India (RBI) governor Shantikanta Das spoke about India’s concerns regarding cryptocurrencies at one of the interventions at the meet.

The finance minister also added that Facebook’s controversial cryptocurrency project Libra was one of the hot topics at the annual meeting.

There are actually quite a lot more crypto-friendly countries in the world but the ones listed above are really making aggressive moves to incorporate crypto into their country’s economy.

Future of Cryptocurrency Regulations

Lately, the impact of Bitcoin has prompted changes in different businesses. Online companies have started to acknowledge crypto as a means of payment. Further, it opened more possibilities for small organizations to establish themselves in the marketplace.

Earlier, the news around blockchain used to concentrate exclusively on its applications in cryptocurrency. Today, the blockchain domain has diversified into previously unexplored sectors like finance, energy, real estate, agriculture, logistics, healthcare, law, governments, etc. This has led organizations to gain access to progressively powerful blockchain strategies.

Though the number of dealers who acknowledge cryptocurrencies has gradually increased, they are still particularly less in number. Besides, if the cryptocurrencies are to be widely adopted, they need to gain widespread acknowledgment among users. Moreover, their relative complex nature compared with regular traditional currencies will probably stop people from using it, except those who are technically proficient.

If a cryptocurrency desires to become a part of a recognized financial framework, it will need to fulfill some fundamental criteria— it should be mathematically complicated to avoid hacks and frauds. Moreover, it should be simple for customers to understand. Cryptocurrencies should preserve user anonymity without being a channel for money laundering, tax avoidance, and different immoral activities.

Several discussions are going on concerning Bitcoin and other cryptocurrencies’ future. Regardless of Bitcoin’s continuous issues, we can note that it is thriving since its inception in 2009 and this has persuaded the creation of other cryptocurrencies like Ripple, Litecoin, and a few more.

A cryptocurrency that attempts to end up becoming a part of the standard financial system would need to satisfy different criteria and this possibility looks very remote. Bitcoin’s high-end success or failure in dealing with the current difficulties will decide the future and fortunes of various cryptocurrencies in the forthcoming years.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.

[/wlm_private]

Want to read the rest of the article? Join our pro-membership and receive all of the following:

✅Access to ALL content.

✅Access to the CTN editorial staff.

✅Access to our CTN trading dashboard.

✅Access to our exclusive telegram channel where all our pro-members and editorial staff are in.

✅Ability to request content/research material!