Traditionally cryptocurrencies have raised funds through the ICO model, but thanks to a lot of scams and lost confidence in that form of crowdfunding, ICOs have become virtually obsolete. In fact, there have been several ICO scams; over 80% of the projects that never even built an MVP. The invested wealth was wiped from the market capitalization as projects failed to deliver anything beyond their whitepaper. Because of these scams and high-risk ventures, legitimate projects have had to adjust from an ICO model and replace it with STOs and eventually IEOs. Which leads us to DAICO.

Join our Pro-Community.

✅Access to ALL content.

✅Affordable ($10.00/month).

✅Access to the CTN editorial staff.

✅Access to our CTN trading dashboard.

✅Access to our exclusive telegram channel where all our pro-members and editorial staff are in.

✅Ability to request content/research material!

What is a DAICO?

Projects are now turning to DAO for raising investment. DAO was designed to be automated and decentralized. The organization acts like a VC fund based on open-source code and without human management. DAO was designed to allow investors to send money from anywhere in the world anonymously and then the organisation would provide owners with tokens, allowing them voting rights in the project.

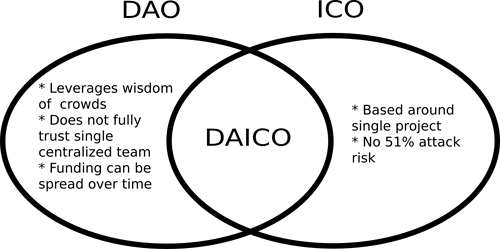

The DAO does have its benefits but not without some risk. The ICO model, though riddled with scams, was an effective one. DAICO leverages the ICO machine with the benefits of a DAO. This minimizes complexity and risk.

Source: Internet

The snazzy acronym combines DAO and ICO to be referenced as DAICO. It is published by a single development team that wishes to raise funds for projects. It begins in “contribution mode”, specifying a mechanism by which participants can contribute ETH to the contract. The participant then receives tokens in exchange. Based on the team’s needs, the sale of tokens can be capped or uncapped. Once the investment period has ended, the initial token balances are set and the tokens can be traded.

Why do we need DAICO?

- ICOs carry several risks and they typically have a soft cap. If the project doesn’t hit the soft cap, it is deemed a failure and the funds are returned to the investors. However, once the team raises funds they are free to use it as they deem fit.

- 51% attack maliciously raises the tap; developers can just lower the tap again, or not claim excess funds

- Voters can prevent wasteful spending by not raising the tap by too much too quickly. If it happens anyway they can vote to self-destruct

- 51% attacks maliciously self-destructs

Who introduced DAICO?

When it comes to new initiatives, it’s important to know who the developers and think tank are. In DAICO, Vitalik Buterin, the founder of Ethereum, is the first to come up with the concept of DAICO back in January 2018. He proposed combining features of DAO and ICO in order to improve accountability in the ICO model of fundraising.

Disclaimer

Content provided by Crypto,Trader,News. is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold Crypto,Trader,News. Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.