The title is a little misleading for long-term Bitcoin holders, but I’m really speaking to the short-term, day traders who are using Bitcoin as their token of choice. You might be wondering why you’re not making fast money with Bitcoin and I want to make five points to help clear the air about that.

[wlm_private “Crypto Trader Pro – Monthly|Crypto Trader Pro – Yearly|Crypto Trader Pro (Lite)”]

First of all, crypto trading is a job for some and a hobby for others. How you feel about cryptocurrencies in general will ultimately determine your trading strategy or lack of one. But let’s say that you’ve been thinking about joining the ranks of cryptocurrency traders and your sights on trading Bitcoin. Now take a moment right now to write down WHY. Why do you want to trade Bitcoin? Don’t worry. No one can see your answer but you so it’s okay to be perfectly honest.

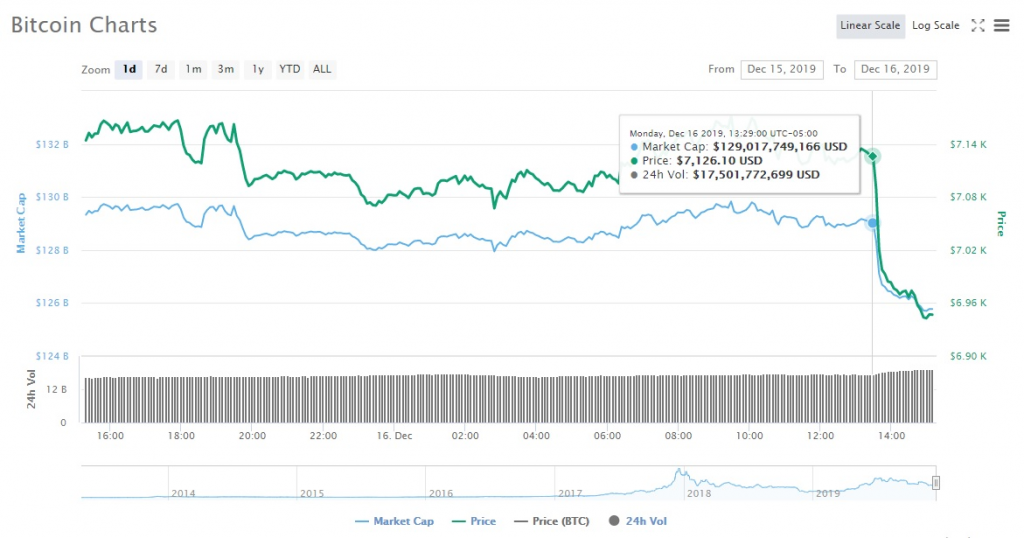

Now that you’ve done that, let’s dive in. The name of the game is prediction in trading. When looking at the crypto market, you might see hourly, daily, weekly trends; maybe you’ve even done some research or found cool projects that are launching on the Bitcoin network that could help boost its value. But the markets are volatile and fickle. December 16, 2019 is a perfect example where the market was hovering around $7126.10 one minute and then the trap door opened and the price plummeted to $6942.85 in just over an hour.

Anyone who was hoping that the support level at $7100 would hold and rebound to bullish sentiment probably bought in with a fair amount of confidence. And like a tsunami pummeling sandy shores, it wiped out a good portion of your investment capital.

Short-Sighted

Herein lies the first reason why you won’t make money trading Bitcoin in the short term. Fallout happens and if you’re looking at the 1-hour or 4-hour market trends, you might be trading yourself off a cliff.

All’s not lost – if you’re a HODLer – but if you’re a day trader, you’ve probably lost your daily limit if you were hedging on Bitcoin today. This is not to say you’re a bad trader; in fact, you’re probably a very decent trader but you might have a little remorse for not looking at altcoins more carefully. Prediction can be a real bitch.

The point of this lesson is not to fool yourself into thinking you are good or bad at trading. Bad days happen. It’s what you do afterwards that will rescue your portfolio or convince you to quit.

Don’t Be a Stubborn Fool

It’s one thing to have conviction and a path moving forward, but if people say, “Hey buddy, the bridge is out up ahead,” a smart man may proceed with caution and think about an alternate route, whereas a dummy is going to gallop ahead and ignore sound advice.

Let’s be clear. There is a huge difference between shillers and trusted friends sending out advisories. If you’ve done your research and watched the markets, then you probably have a set of resources to know who is helping the trading community and who is our to scam you.

For your personal trading style, it’s important to find a good balance between listening to your intuition, trusting your own judgment, and also listening to a counter-argument to what you believe to be true. There is merit to knowing all sides before making a final decision on which asset to trade, how much, and a good entry and exit point.

Be open to diverse opinions, especially if they are from voices you trust, who also have a history of good trades and predictions. Great traders take information from people even after taking a stand.

Swing and a Miss

Take a look at your portfolio and give your Bitcoin trading history a hard look. Unless you are making some significant gains on those swing trades, you’re probably making less than you anticipated because on many exchanges, transaction fees cost more with Bitcoin trades than most altcoins.

Did you really make a profit from a quick trade or did you break even, or even lose, because of the fees? If you’re not keeping track of the expenses involved with trading Bitcoin then it’s time to accept that it was a bad call.

Lucky Trades

Of course lucky trades help traders become successful. There are plenty who say they’d rather be lucky than good, but that’s not a strategy. In fact, if your highest winning trades are admittedly lucky then, I hate to say this, you may never be better than an average trader.

Luck only gets you so far and then it runs out. And if you look at your trading history based on luck, chances are, you’re calling them lucky because they’re the ONLY winning trades. Isn’t that a red flag? Are you trading or gambling? Believe it or not, there is a distinction.

To succeed as a trader, you must be calculating and approach trading systematically, with due diligence, avid research, and discipline.

Cut the Noise

If you’re on Crypto Twitter than you will see the spin about Bitcoin both for and against it. On one side, there are people who think Bitcoin will eventually reach $1 million; on the other side are people who think it’s dead.

Taking the December 16, 2019 drop off as an example, one party says, “BUY,” the other says, “Told you so!”

What if I told you both were right. The real question is: Is it right for you?

December 16, 2018, a year ago, the price of Bitcoin was $3278.86. Even with the drop in 2019, the 24-hour low was $6942.85, more than twice BTC’s value a year ago. How about December 16, 2016 when Bitcoin was $782.13. If you bought and held, you would be sitting in a nice profit despite the rise and fall of 2017’s crypto bubble.

And that’s the whole point we’re getting to: If you’re trying to day trade with Bitcoin, you probably won’t make any money. Maybe it’s time to change your mindset and think of BTC as a long-term asset, like precious metals. Don’t consider this financial advice. I’m just stating it like I see it, based on my personal experience and due diligence.

Take from it what you will and trade wisely.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.

[/wlm_private]

Want to read the rest of the article? Join our pro-membership and receive all of the following:

✅Access to ALL content.

✅Access to the CTN editorial staff.

✅Access to our CTN trading dashboard.

✅Access to our exclusive telegram channel where all our pro-members and editorial staff are in.

✅Ability to request content/research material!