Crypto, cryptocurrency, digital assets, investing in crypto… These seem to be trending key terms that are garnering attention, especially with traders. But what is cryptocurrency, how different is it from trading in stock market and commodities, and can you really earn money from this digital currency? If so, where to start and how does a person get their hands on some?

[wlm_private “Crypto Trader Pro – Monthly|Crypto Trader Pro – Yearly|Crypto Trader Pro (Lite)”]

Cryptocurrencies have come a long way since Bitcoin launched their white paper and mined the very first cryptocurrency in 2009. One of the problems that crypto is supposed to solve is removing the middle man problem so that buyers and sellers can have a vehicle of exchange without a third party – and whatever fees might be associated with that.

Central banks control the traditional fiat currencies of most nations, but cryptocurrencies are virtual currencies that programmed using the trustless blockchain technology, and anyone can buy or sell them.

With nearly 2,500 cryptocurrencies available on the market, the question might now turn to which one to buy? Research is critical to investors but we’ve got a short list of cryptocurrencies that you might profit from if you’re willing to invest.

Bitcoin (BTC)

Dominant in the market is Bitcoin. Some people consider BTC to be the gold standard and others argue that Bitcoin is only dominant because it’s been around for a decade. That being said, Bitcoin, just like all other cryptocurrencies, is very volatile with devastating lows and moonshot highs that can happen in a New York minute.

If you are planning to accumulate and hold, BTC is a great choice to invest in long term. All you have to do is keep yourself updated about the current market trends and wait for the price to spike.

Above is a weekly chart illustration, where the BTCUSD exited the oversold area, signaling an exit of the crypto-winter.

The recent increase in selling pressure on August 26 and September 16 offers new lows to buy into the bullish trend. However, if the $7432.84 support is breached, then you might want to look into opportunities to short-sell the BTCUSD.

Binance (BNB)

Binance (BNB) is the cryptocurrency offered by the worlds leading cryptocurrency exchange, Binance. It is a decent cryptocurrency to invest in and our second choice after Bitcoin, especially considering that it was able to sustain an early bullish trend against the BTC and USD Tether in the face of increasing Bitcoin dominance.

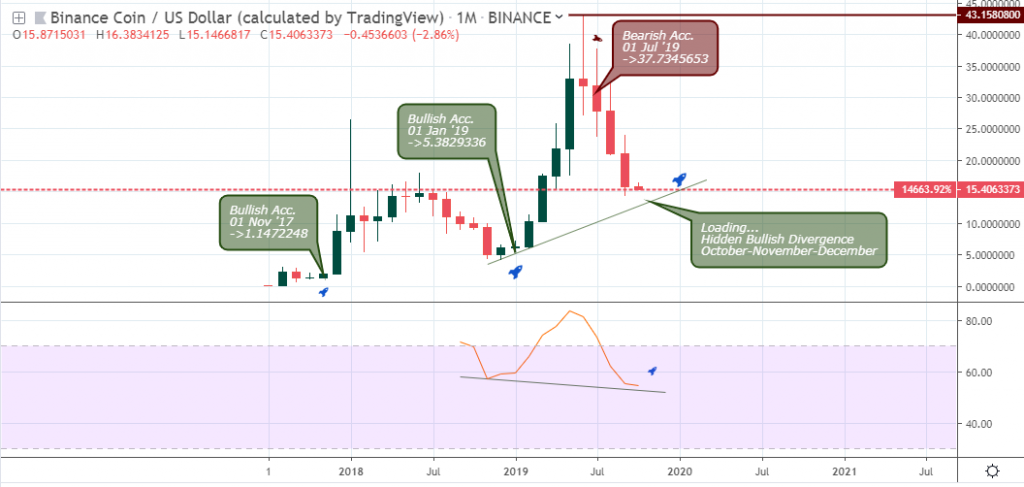

A bearish accumulation pattern signaled after the all-time high of 43.158080 initiates a correction of the bullish trend.

We anticipate a hidden bullish divergence pattern as long as the price stays above the May ’19 low price even as the RSI oscillator maintains a lower low level compared to the May ’19 low.

Litecoin (LTC)

Released in 2011, Litecoin is another excellent alternative cryptocurrency, or altcoin, for investors to make a profit. Yes, markets have a tendency to rollercoaster and deep dives below support lines are a nightmare. Litecoin has a total supply of 84 million and also boasts much faster transactions than Bitcoin.

Remember: Buy Low, Sell High. There are advantages to watching the crypto markets and scooping up digital assets that others didn’t have the stomach to HODL.

The LTCUSD has been in a bearish trend for about three months now, forming a series of bearish closing bars on the monthly time frame. An exit of the oversold area, in combination with a breakout of bearish accumulation on September 30 from a daily chart perspective, offers an opportunity to enter a long position.

Ethereum (ETH)

The market cap of Ethereum has increased a lot in recent years with its maximum high in 2017. So, this currency holds the potential to offer much more substantial benefits to investors in the future. After Bitcoin, Ethereum has the potential to become the next king of cryptocurrency.

Remember the soda wars between Coke and Pepsi? Ethereum and Bitcoin are kind of in a war for dominance. While Bitcoin might be the granddaddy of crypto, ETH is a lot faster with their transactions.

Altcoins are generally in a bearish trend, following an increase in Bitcoin dominance and a crashing ICO market. Notwithstanding, the above daily chart of the ETHUSD shows a breakout of bearish accumulation on September 29, an opportunity to start a bullish campaign.

Ripple (XRP)

Many people consider Ripple, a safe and secure currency to invest in, probably because Ripple holds connections with many central banks. We all know that banks don’t connect with non-reliable investment entities and there are many investors seeking a more stable crypto to invest in. Ripple has the potential to offer a sense of confidence because of those banking partnerships that they’re building.

Ripple (XRP) has been in a prolonged bearish trend on the monthly time frame offering an opportunity for traders to stack up buy-stop orders above significant resistant levels. A price close above the triple bearish accumulation candlestick resistance on September 29 from a daily chart perspective offers short term opportunity to enter a long position.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.

[/wlm_private]

Want to read the rest of the article? Join our pro-membership and receive all of the following:

✅Access to ALL content.

✅Access to the CTN editorial staff.

✅Access to our CTN trading dashboard.

✅Access to our exclusive telegram channel where all our pro-members and editorial staff are in.

✅Ability to request content/research material!