Trading cryptocurrencies or any asset class is like trying to catch a moving target. The main goal for us as traders is to follow the money in order to make money. One way of doing this is to remember the importance of trading multiple time frames.

The money could flow from one time horizon to another or from altcoins to Bitcoin (BTC), as seen on the Bitcoin dominance chart. Stay with us as we further explain trading in multiple time frames.

[wlm_private “Crypto Trader Pro – Monthly|Crypto Trader Pro – Yearly|Crypto Trader Pro (Lite)”]

From experience, trading multiple time frames from experience involves looking at anyone’s markets from the perspective of a daily, weekly, and monthly chart. Having at least the monthly and weekly time frame in the same direction builds a trader’s confidence to enter into the long or short trade.

A common mistake many traders go through is looking at multiple time frames then wait until all the lights are green, but then they don’t have an exit strategy when things start turning downward into red again. Timing one’s entry into the leading trend direction takes practice and a lot of chart analyses, especially studying the monthly time frame.

Here are a few reasons you must consider analyzing multiple time frames before entering a trade.

Follow The Money

As mentioned earlier, trading multiple time frames serves as a guide to follow the money. How is that done? A trader can follow the money by marking the three time frames and identifying established support and resistance levels. Don’t forget the technical chart patterns.

Recommended is observing a combination of three time frames like the 4-hour, daily and weekly charts, or the daily, weekly, and monthly charts, especially when trading cryptocurrencies.

Different Risk Exposure Using Different Time Frames:

In many instances, traders are faced with contrary signals dependent on which time frames they’re analyzing. For instance, a daily or weekly trader would probably go long on a particular crypto asset even though their intraday trading counterparts would trade short – or vice versa.

The shorter intraday trader often trades with less risk per trade than the long-term time frame trader. This is because an intraday trader is looking at the immediate market trend with smaller percentage stops than the daily or weekly trader who are looking at broader time frame analysis.

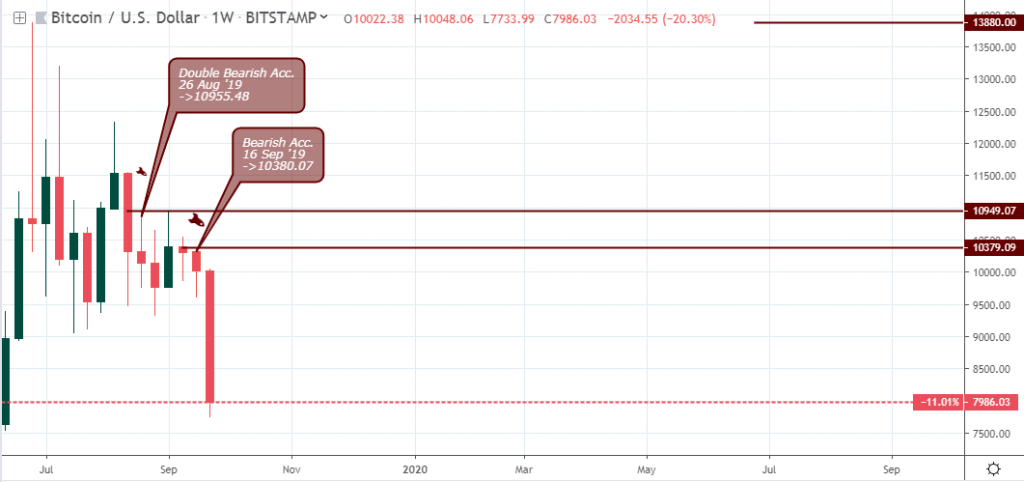

BTCUSD Weekly Time Frame

BTCUSD Daily Time Frame

BTCUSD 4-Hour Time Frame

Variation in number of trades:

Trading multiple time frames on a cryptocurrency, for example, BTCUSD, broadens the trader’s perspective and increases their chances of success. Often by default, intraday and short time frames help traders make more trades than daily or weekly time frames.

This allows traders with low capital an opportunity to trade digital currencies at low risk through day trading or swing trading strategies. But a word of caution: be certain the quality of the trade offsets the costs associated with the increased volume of trades.

In Conclusion

Analyze the multiple time frames or risk trading blind to events taking place in the cryptosphere, especially through the lens of a longer time perspective. Yes, there are short-term gains that can be made but without looking at the whole field, it’s easy to fall into a trading trap. Be in the habit of employing a multiple time frame analysis. It may reap better rewards in the short and long term.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.

[/wlm_private]

Want to read the rest of the article? Join our pro-membership and receive all of the following:

✅Access to ALL content.

✅Access to the CTN editorial staff.

✅Access to our CTN trading dashboard.

✅Access to our exclusive telegram channel where all our pro-members and editorial staff are in.

✅Ability to request content/research material!