Binance, the world’s largest crypto exchange by trading volume, launched a little over two years ago, experienced a robust performance in Q2 of 2019. The exchange closed the quarter nearly doubling its Q1 closing price.

[wlm_private “Crypto Trader Pro – Monthly|Crypto Trader Pro – Yearly|Crypto Trader Pro (Lite)”]

Opening the quarter on April 01, BNB price was pegged at $18 and remained in that region throughout the first couple weeks of the quarter. By mid-April, things began to turn for the better for traders as the price of BNB increased to $24.58, a 25% increase.

Although the inevitable market correction caused a decrease in price as some point in the quarter, the price of BNB grew by 85% over Q2. At $33.30, the coin set an all-time quarterly price record not seen since the ICO boom of 2017.

The exchange reported $60 billion trade volume in June, with expectations that its Q2 net profit will surpass $100 million.

Some events and factors contributed to the overall health of Binance over the last quarter.

ANNOUNCEMENTS

Hack on Binance

In Q2, Binance was subject to a hack that saw the exchange lose over $40 million worth of cryptocurrency. The security breach that took place in May was subject to hackers stealing API keys, two-factor codes, and other user information in the attack.

After the hack, Binance revealed that they would return all user funds using the company’s SAFU (Secure Asset Fund for Users) to mitigate the damage. The news of the hack had little to no bearing on the exchange’s trading volume as its overall strong performance reduced any potential fallout from the hack.

Delisted

On April 18, IDEX, a decentralized exchange for trading Ethereum, announced that on April 23 BNB would be delisted as they transition to their native blockchain.

On June 13, Binance made a community announcement that they released Binance Chain Mainnet and Testnet dubbed version 0.5.10 of the Binance chain full node.

Throughout the Q2 window, Binance embarked and organized a series of meetups around the world. The exchange hosted over seven meetups in places like Lagos Nigeria, Jakarta, Italy, Manila, and St. Petersburg.

Technical Analysis

Let’s move on to analyzing the primary technical price and chart patterns that drive the Bitcoin BTC price, beginning with the monthly chart.

BTCUSD: Monthly

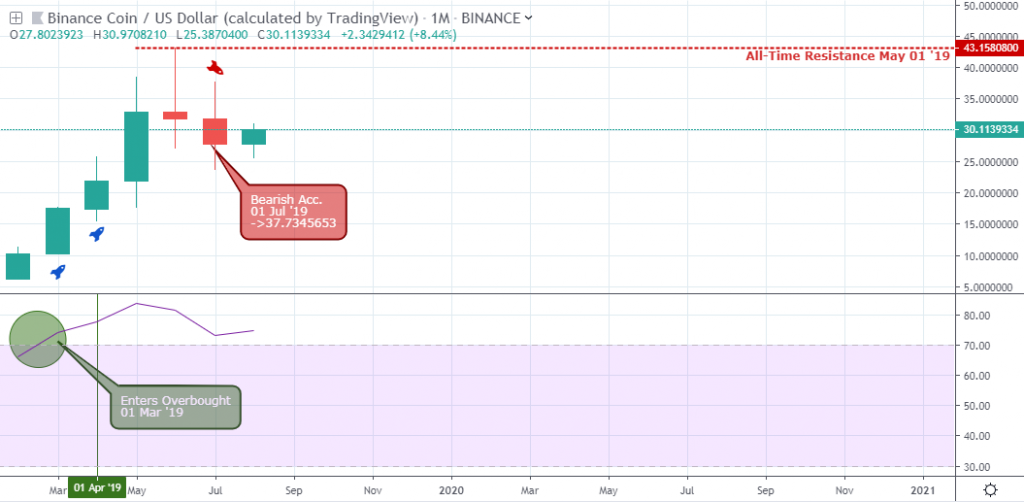

Binance Coin (BNB), from a monthly time frame overview, increased by approximately 146%, closing at 82.1% in June. The price rally started from an earlier entry of the overbought area on March 01 ’19. Faced with a bearish accumulation pattern, the pair continues to trade above the RSI level-70, maintaining a generally bullish outlook.

BTCUSD: Weekly

A view from the weekly time frame reveals a buildup of significant levels in Q2, first with a bullish accumulation price pattern on April 08 ’19, and then an exhausting price rally shown by regular bearish divergence on May 27 ’19 and June 24 ’19.

The price level at 26.5942532 served as resistance on May 27, and the BNB price could not close above that level.

Upon exiting the overbought territory in June, the BNBUSD show signs of a hidden bullish divergence which may likely take effect at the early part of Q3.

BTCUSD: Daily

The above daily time frame, like the weekly chart, presents a more transparent view of the general technical events in the second quarter.

Midway into Q2, the BNBUSD signaled a breakout of bearish accumulation resistance on April 14 for an earlier 32.4% price increase.

The BNBUSD signaled a hidden bullish divergence pattern on May 11 ’19 (17.606820) for a continuation of the bullish trend, following an opposite breakdown of bullish accumulation (April 23 ’19).

Formation of opposite regular bearish divergence on May 26 ’19 and June 27 ’19 served as take profit signals and short selling opportunity into the third quarter 2019.

Conclusion and Projection

Although the second quarter Q2 2019 closed bullish in the face of bearish price patterns and the hack, at the end of the quarter, the price correction is necessary for a continuation of the bullish trend in Q3.

The recent breakout of bearish accumulation resistance at press time shows a highly probable continuation of the dominant bullish trend in Q2.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.

[/wlm_private]

Want to read the rest of the article? Join our pro-membership and receive all of the following:

✅Access to ALL content.

✅Access to the CTN editorial staff.

✅Access to our CTN trading dashboard.

✅Access to our exclusive telegram channel where all our pro-members and editorial staff are in.

✅Ability to request content/research material!

1 comment

[…] Binance Q2 at a glance: Technical Analysis and Important News/Events […]

Comments are closed.