Here, we expand on the two significant self-inflicted trading psychologies that can potentially destroy a trader’s account. We are familiar with FOMO, the Fear Of Missing Out, but there is also the Fear of Being Wrong. As we explore these two psychological pitfalls in trading, think about how you feel during your trading experience.

The Fear of Being Wrong: Over-confidence

More often than not, inexperienced traders often start to get an inflated sense of confidence especially if they’ve made profit on their first few trades. This euphoric feeling is great because you feel like you are invincible.

Obviously, confidence is required to be a successful trader but tread lightly if you are new to the trading scene. Over-confidence will likely put you in tricky spots where you’ll speculate more and take bigger risks.

The pitfall is when your over-confidence overrides the trends and market analysis and compels you to trade irrationally or emotionally, rather than being an objective investor.

With over-confidence often comes over-precision, over-estimation, and over-placement.

[rml_read_more]

For example, over-precision is considered an excessive sense of confidence where, despite knowing the facts, you irrationally rule out the possibility of being wrong.

When it comes to over-placement, you might tend to judge your performance in comparison to others.

It goes without saying that when we’re over-confident, we often over-estimate our level of skill, ignoring set or implied limitations which prevent us from going too far.

To combat over-confidence, take a step back and breathe. Be realistic. Let achievable goals. Be impartial to incoming information. This is true as much in life as it is in trading.

Fear of Being Wrong: Overriding Stops

Stop losses are pending orders that are set in order to effectively close out your trading position(s) when it seems that losses are hitting a predetermined price. This helps protect your portfolio in the long run, should the bear market prices drop deeper than you’re willing to lose.

If you’ve put some thoughts into analyzing a crypto asset and established your maximum risk exposure per trade, then you shouldn’t tinker with your stop loss level.

Having a clear picture of your equity curve can establish discipline and protect you from huge losses so, if the market has reached your stop, your reason for the trade is no longer valid. Don’t allow the fear of being wrong stop you from smart trading. Certainly you can widen your stops, but do so after observing the risks and market data.

Fear of Missing Out: Over-trading

Inexperienced traders often make the mistake of placing more trades after experiencing a few losses; turning a blind eye to any risk management protocols that might have been put into place.

Here’s a note of advice: Just because you can place more trades, doesn’t mean you should. Stick to your trade management rules and don’t come up with ideas on the fly, especially during a volatile market because doing so will just set you up for disaster.

Sure, you might catch a lucky break here and there, but Lady Luck is fickle and when something sounds too good to be true, it probably is. Don’t put yourself into a position of over extending your funds because something looks irresistible. Chances are, there are market manipulations in play and it’s dangling a carrot for victims to chase.

Revenge Trading

Whether in trading or in life, things happen that causes strong emotions and regretful reactions. Don’t let it happen to you! Trading and emotion are not good bedfellows.

We’re putting revenge trading under the FOMO banner because when emotions run amok, it is common to feel personally offended when you can’t seem to break a losing streak. Thoughts of flipping your losers into winners without regard to analysis is compelling but very dangerous. “Road raging” a market asset might cause your holdings to crash. Think about that.

How to avoid revenge trading?

- Strictly follow your developed mechanical trade strategy and plan.

- Reduce your entry-exit points into semi-automated chunks.

- Deploy dashboards that allow your computer to do the number crunching.

- Stay focused on your trading process not on profit and losses.

- Stay impartial. Don’t let fear or greed or panic do the trading.

Fear of Missing Out: Over-leveraging

Different trading instruments allow you to get access to a more substantial trading position with your little balance.

Your broker may give you access to opening a $100,000 position with a $1,000 account using a leverage of 100:1, which sounds like you’ve got a windfall of cash, but just remember that leveraging is a two-edged sword. A highly leveraged account can significantly magnifying your profits and your losses.

We view leverage as opting for the rate at which your capital is exposed to risk.

A low leveraged account often fits a strategy that relies on strategy with higher reward to risk ratio, however, to be successful with high leverage, your strategy’s maximal adverse excursion has to be very low.

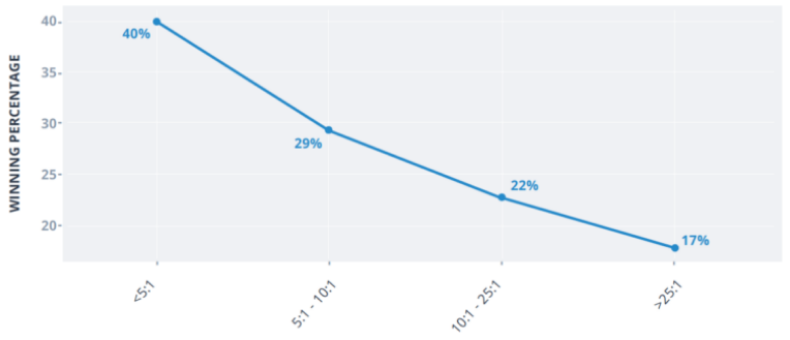

What this means is that in most cases, your trades will first go in the opposite direction before it heads towards your profit target. If you’re thinking about leveraging your account, we recommend that you trade with low leverage, a 5:1 to 30:1 ratio, this way you’ll stay longer in the game and increase the chance of your potential profits.

Fear of Missing Out: Over-exposure

By exposing your trading account to different positions in crypto, you stand a risk of a margin call. Most of the cryptocurrencies are highly correlated but they move at different volatility rates.

Carry out extensive analysis on uncorrelated cryptocurrencies and trade them. By taking a position in multiple correlated cryptos, you are increasing your risks.

If more than two correlated cryptocurrencies indicate a buy or sell signal, do yourself a favor and trade only one of the coins. This helps you stem the bleeding should the market turn unfavorably.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.