In the second quarter of 2019, Litecoin, like many other digital coins, witnessed a flurry of activities. In Q2, LTC opened with the price at $77; staying at that price for most of the opening months of the quarter.

[wlm_private “Crypto Trader Pro – Monthly|Crypto Trader Pro – Yearly|Crypto Trader Pro (Lite)”]

Litecoin reached its highest price for the quarter in late June, hitting the $141.6 mark— a record price not witnessed 2007. The market cap for the quarter closed at about $7.4 Billion in the quarter and trading volume hit around $4.9 Billion.

We shall state some other activities and major happenings of Q2 below.

RANKING AND RATING

In the quarter under review, an American provider of investment data Weiss Ratings ranked Litecoin (LTC) as “excellent” regarding investment rewards, attractiveness, and adoption by the public.

However, in terms of the investment risk factor, the digital currency rating agency rated the Exchange as “fair” resulting in a B- rating in the risk to reward ratio.

PARTNERSHIP

In a blog post in June, Litecoin Foundation announced a partnership with Bibox Exchange and blockchain firm, Ternio. The partnership is foreseen to be a joint venture to release a physical cryptocurrency debit card.

The debit card, which will be dubbed “BlockCard” will allow users to spend their cryptocurrency funds both online and in physical store locations around the world. In their press release they stated that: “Customers will have the ability to make deposits in various cryptocurrencies and then keep their spendable value in Litecoin (LTC), Bibox Token (BIX), or Ternio (TERN).”

LAUNCH OF EURO AND GBP TRADING PAIRS ON VERTBASE

On April 24, Vertbase announced that starting from May 1, 2019, customers in Europe could buy digital currencies with the Euro (EUR) and British Pound (GBP).

The aim for Vertbase is to provide a fiat gateway to digital money and assets not supported by major industry players. They’ve announced enabling direct purchases for all digital currencies including Litecoin.

Technical Analysis

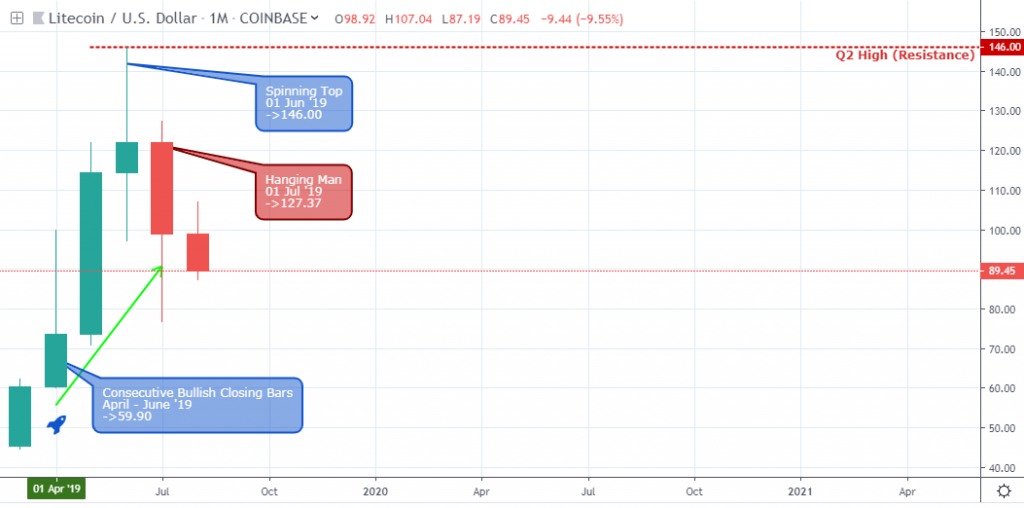

Let’s go into a detailed analysis of the technical chart and price pattern in the second quarter of Q2 2019.

LTCUSD: Monthly

The second quarter 2019 was a highly bullish one for Litecoin as the number five cryptocurrency by a market cap like many others fully exited the crypto winter.

As shown in the above monthly time frame of the LTCUSD, the pair closed bullish (141.8%) for three months in a row in Q2, with the last month signaling a spinning top reversal candlestick pattern.

LTCUSD: Weekly

Following a sudden increase in bullish volatility on April 01 ’19, the Litecoin (LTC) price entered the overbought area and exited the next week.

A bear trap candlestick pattern signaled after the bullish closing bar on April 29 ’19 again pushed the LTC price into the overbought area, while signaling double bullish accumulation pattern on June 03 ’19.

The LTCUSD resumed a bearish price decline after exiting the overbought area and signaling an evening star/ bearish inside bar candlestick pattern.

LTCUSD: Daily

A view from the daily time frame presents a broader picture of the technical chart and price patterns in Q2 2019.

Similar to the weekly time frame, the daily exits the overbought area, only addition here is that we get to see a buildup of the double bearish accumulation pattern.

The initial bullish trend retraced by roughly 22.5% before a hidden bullish divergence pattern resumed the upbeat campaign.

As the trend continued higher, the Litecoin price got enclosed within an equidistant channel established by a combination of alternating bearish and bullish divergence patterns on May 30 ’19, and June 06 ’19.

A regular bearish divergence pattern eventually flagged an end to the bearish trend on June 23 ’19 for about 42.7% price decline.

Conclusion and Projection

The hanging man candlestick formation on the monthly chart and the regular bearish divergence on the daily time frame confirmed the spinning top reversal pattern for the current decline in LTC price at press time.

The general Bitcoin dominance over every altcoin in the space emphasizes the bearish outlook on Litecoin.

Although the market exits the oversold area on the daily time frame at press time, a price close above the $106.04 resistance level will confirm a bullish comeback against the greenback. However, the LTC price may decline further if the $76.63 support fails.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.

[/wlm_private]

Want to read the rest of the article? Join our pro-membership and receive all of the following:

✅Access to ALL content.

✅Access to the CTN editorial staff.

✅Access to our CTN trading dashboard.

✅Access to our exclusive telegram channel where all our pro-members and editorial staff are in.

✅Ability to request content/research material!