Introduction

Ripple in the Second Quarter of 2019, recorded new heights as the company saw the highest number of customer transactions on RippleNet. Q2 saw the amount of xRapid transactions from Quarter 1 to Quater 2 go up by 170%. Also, in the last quarter, the company recorded a 30% rise in the amount of live xRapid partners.

[wlm_private “Crypto Trader Pro – Monthly|Crypto Trader Pro – Yearly|Crypto Trader Pro (Lite)”]

However, CoinGecko’s Quarterly Report for Q2 2019 reveals that XRP lost nearly 50% of its market dominance, with the company falling to 5.7% a 4.1% drop from its 9.8% figure in Q1.

Below we shall consider the significant fundamental issues and technical price patterns in XRP’s Q2.

NEW CRYPTO EXCHANGES

A total of a dozen new exchanges listed XRP in Q2, bringing the total number of exchanges listing the cryptocurrency to over 130 worldwide.

XPRING

In Q2, Ripple’s initiative Xpring saw more additions of companies that seek to leverage and build on its protocols (XRP Ledger, ILP, and XRP).

The initiative lends support to a team of open-source developers developing on the decentralized XRP Ledger through partnership and investment and by building crypto infrastructure.

Some of these companies include:

Bolt Labs, a privacy-focused payment channel network that off-chain transactions and support multiple digital currencies, and Agoric, a company which facilitates developers to build protected smart contracts and unique digital assets that can connect to public and individual blockchains.

PARTNERSHIPS

In Q2, Ripple agreed to a partnership with international funds transfer provider MoneyGram (NASDAQ: MGI).

This collaboration will make Ripple become its key associate for cross-border payment and forex settlement utilizing digital assets. The company agreed to an initial 2-year partnership with Ripple that will see Ripple provide a capital commitment to them. This collaboration will enable MoneyGram to draw up to $50 million in exchange for equity for over two years.

MoneyGram serves millions of customers in more than 200 countries in the global remittance market, supporting multiple currencies.

NOTABLE REGULATORY ACTIVITY

Q2 saw an increase in regulation throughout the crypto space which did not exclude Ripple.

In the quarter under review, the SEC announced that it would establish nodes on specific open-source, permissionless ledgers, such as the XRP Ledger. This move, they submit, is to inform its policy-making.

Also, the UK’s Financial Conduct Authority recognized XRP as a hybrid utility/exchange token and not a security token. It also analogized XRP to ETH.

OTHER ANNOUNCEMENTS AND EVENTS

- Spanish bank, Santander, reported the expansion of One Pay FX, its payments medium to non-customers via its One Pay app that is powered by Ripple.

- In June, Ripple opened more offices in Brazil and Switzerland.

- In March, Weiss Ratings ranked Ripple as the second-best cryptocurrency ahead of third-placed Bitcoin.

Technical Analysis

Here, we carry out a top-down analysis of the Ripple XRP in the second quarter, starting from the monthly time frame.

XRPUSD: Monthly

Ripple (XRP), the cross border remittance cryptocurrency, experienced an upward price swing starting with a bullish engulfing bar at the close of April.

The shooting star candlestick pattern at the closing price in June dashed all hope of a complete recovery from the crypto winter.

The bulls did not breach the double bearish accumulation resistance level on December 01 ’18 after the price set the all-time high of Q2 at 0.5100 as the XRP price heads towards the April 01 support at 0.28332, erasing all the gains in Q2.

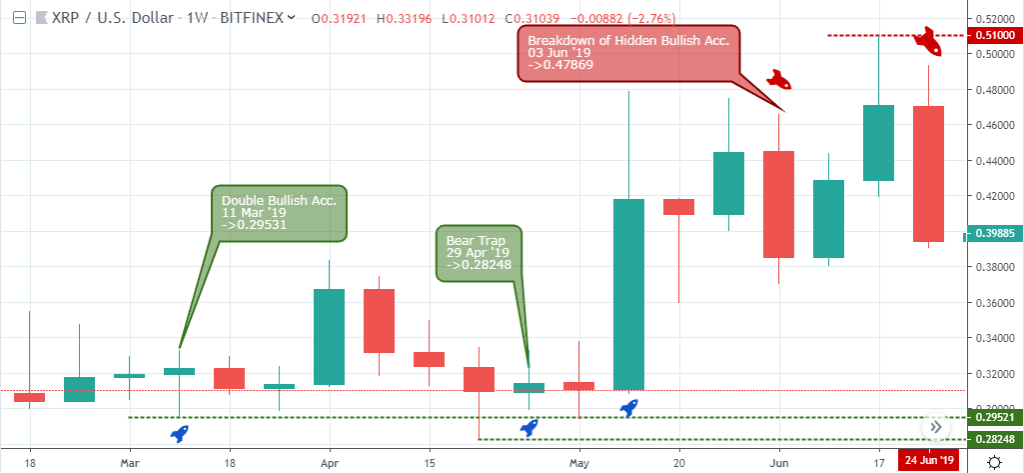

XRPUSD: Weekly

A formation of double bearish accumulation on March 11 ’19 towards the end of Q1 established a support level that later became a sound reference point for the bulls to use as a springboard in Q2.

Following a bear trap and bullish inside-bar candlestick pattern on April 29 ’19, the XRP price increased by about 61.70% before starting a bearish descent on June 24 ’19.

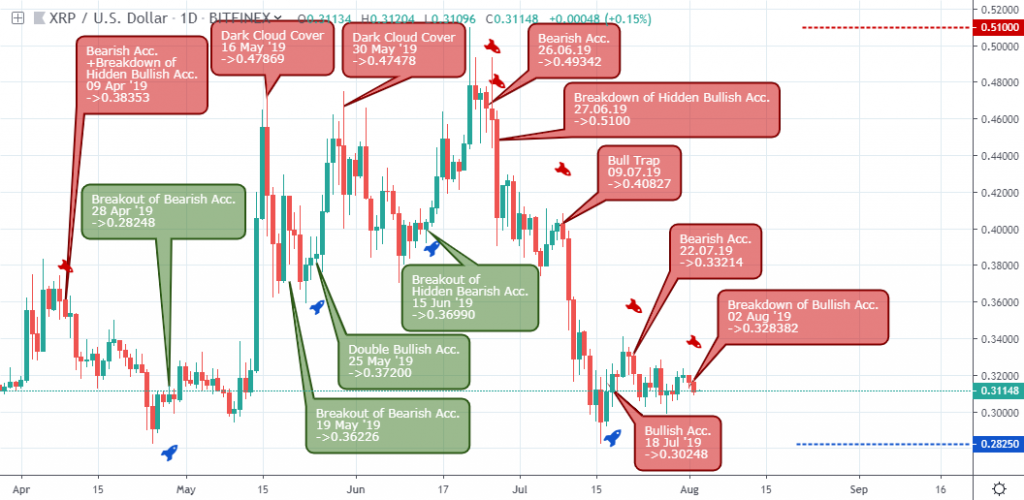

XRPUSD: Daily

Above is a daily time frame view of the XRPUSD pair, where we get better timing into the market swings.

A breakdown of hidden bullish accumulation in combination with a bearish accumulation pattern signaled the first bearish swing in Q2 for a short entry.

An opposite breakout of bearish accumulation resistance truncated the bearish swing on April 28 ’19, as the XRP price skyrocket by roughly 53.5%.

From the first bullish price surge in May ’19, the XRPUSD entered an upward winding rollercoaster that eventually failed to a breakdown of hidden bullish accumulation on June 26 ’19.

All attempts by the bulls could not stand the selling pressure as the XRP dominance grew weaker into July and August ’19.

XRPUSD: 4-hour

June 2019, the last month in the second quarter showed both bearish and bullish swings.

After the increase in selling pressure on June 03 and 07, an increase in demand continued, starting with a breakout of bearish accumulation on June 11, ’19 11:00.

The higher highs of the XRP price, compared to the lower low of the RSI oscillator force the XRP price into the overbought area on June 18 ’19 23:00 setting support at 0.41874.

Demand for Ripple XRP withered upon exiting the overbought area on June 23 ’19 03:00, as all attempts to restore the price to previous highs, gave in to heighten selling pressure.

Conclusion and Projection

Despite an increased adoption rate of the cross border solution, the Ripple XRP price experienced a sharp decline by the end of Q2 ’19, a general decline in market cap of major alternative coins.

The previous weekly time frame support on March 11 ’19 (Q1) may again present an opportunity to go long the XRPUSD, perhaps serve as a level for taking a profit in a short sell position.

[/wlm_private]

Want to read the rest of the article? Join our pro-membership and receive all of the following:

✅Access to ALL content.

✅Access to the CTN editorial staff.

✅Access to our CTN trading dashboard.

✅Access to our exclusive telegram channel where all our pro-members and editorial staff are in.

✅Ability to request content/research material!