You’re finally coming around to cryptocurrency and you’re looking for ways to jump in and accumulate, earn, or mine to fatten up your digital wallets, but you’re not exactly sure where to go or how to start. Well, we’ve got you covered in this short guide to staking and mining cryptocurrency.

Trading is not the only way to get your hands on crypto; far from it. Today, we’re going to cover staking and mining, but believe it or not, there are some cryptocurrencies that allow you to earn just because you’re HODLing or lending your crypto, in fact, we’ve touched on 10 Ways to Generate Passive Income With Cryptocurrencies, but today, we’re going to focus on staking, mining, and how to generate steady crypto income from it.

What is Staking?

When you hold funds in a crypto wallet to support the operations of a project, your staked cryptocurrency is locked and, depending on the blockchain or associated project, you will receive token. It is often based on how much of your resources you are willing to stake and how much the project has allocated for distribution.

Staking is not a new concept and is closely related to PoS (a consensus mechanism) in crypto. In several cases, projects want their users to hold tokens in a specific crypto wallet.

How do I Stake?

First things first, you need to find a project that rewards its users on staking its cryptocurrency. There are several projects that do this. Here’s a short list

- NEO

- ATOM

- NPXS

- KMD, among others.

Let’s discuss staking for these four projects in further detail.

NEO (NEO)

NEO ranks in the Top 20 cryptocurrencies by market cap and is one of the most popular one among stakers.

Staking can be done by HODLing NEO in almost any top cryptocurrency exchange.

When NEO was launched, due to its revolutionary features and use of smart contracts, it was referred to as Chinese Ethereum. The best part about staking NEO is that there is another cryptocurrency associated with it – GAS.

GAS can also be stored in NEO wallets and staked for handsome returns. To earn GAS, users stake NEO in a wallet like their Binance or KuCoin exchange wallet, and then GAS is distributed as a dividend among NEO holders.

At press time, GAS is worth $1.05.

If you’re curious about how much GAS you can earn on staking NEO, checkout the NEOtoGAS calculator. You can sign up on Binance, if you haven’t already and get started by buying NEO and HODLing it in the exchange wallet. Get started now.

Cosmos (ATOM)

Cosmos is an exciting project that has created an ecosystem of connected blockchains.

The market cap is currently hovering around $902 million. Cosmos (ATOM) suggests two ways of earning through its tokens:

- You can delegate Cosmos

- You can run a validator node

Binance has estimated the annual yield from staking ATOM to be between 12 to 14%.

More details about staking token on Binance can be found here, but if you’re curious as to how much ATOM you can earn through staking, this calculator can help you out.

Like NEO, you can sign up on Binance and very quickly begin to HODL Cosmos in your exchange wallet.

Pundi X (NPXS)

Pundi X is not a very popular coin, but it’s gaining popularity due to its good staking design. It helps transform retail businesses with its blockchain-based point of sale solution. It is an open-source system.

You can stake PundiX in two ways:

- Through the XWallet directly.

- By linking your ERC20 or NEM wallet address to the XWallet.

Caution: Exchange wallets do not support NPXS staking.

Token holders who participate in the staking process will receive the 11.063% of NPXS and NPXSXEM unlocked tokens until the completion of the accelerated three-month monthly unlock program. This and many more details are shared on their Medium blog.

Komodo (KMD)

Komodo is a privacy focused coin that was introduced as a result of a fork in the ZCash blockchain.

Komodo blockchain consensus is achieved via Adaptive Proof of Work and the opportunity to earn passive income requires you to stake KMD in a KMD wallet. Currently the reward is fixed at 5% annually, which may not be very exciting compared to other projects, but is a good place to start from.

While the returns on most projects are humble, it is breaking down the barrier to enter the cryptocurrency ecosystem, and this allows users to adopt crypto at a faster pace.

What is Mining?

In the context of cryptocurrencies, mining is the process of validating transactions and then appending them to a long, public list of all transactions known as a blockchain. In exchange, miners get rewarded with cryptocurrency.

What does it take to become a miner?

A computer, cheap electricity, some graphic cards and an active internet connection.

While this excites many, an important fact to remember is that mining is not always profitable and is dependent on several factors such as which cryptocurrency you’re mining, your internet speed, the cost of electricity in your area, and possibly special equipment or upgrades to your CPU or GPU.

If you do not take these factors into account, you may end up spending more on mining than what you earn back.

How you can get started with mining

After some preliminary research, we found that the first step to get started is – to purchase mining hardware. Most of it is available on Amazon, so you can get it delivered to your doorstep. Let’s discuss Bitcoin mining in detail.

While earlier it was possible to mine with your computer’s CPU or high speed video processor card, that’s no longer the case for Bitcoin. There are custom Bitcoin ASIC chips that offer performance up to 100x, and these are the most popularly used ones.

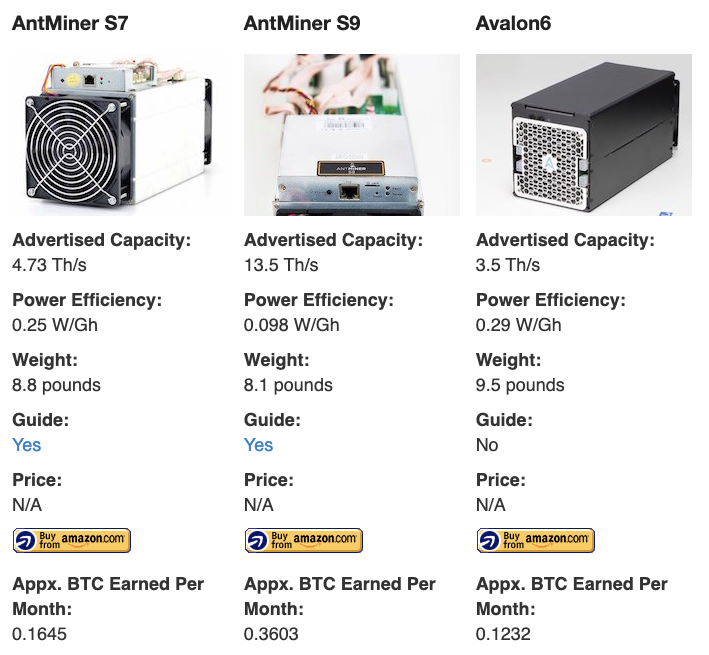

If you try mining with cheaper chips, you may end up paying more in electricity costs. Understand that small Bitcoin miners are disappearing because of the resources and difficulty level but it’s not impossible. If you want to invest, it’s essential to mine Bitcoin with the best Bitcoin mining hardware; built to consume less electricity and deliver more results. Here’s a comparison between different hardware used for mining.

Source: https://www.bitcoinmining.com/

Another popular way to mine is by buying cloud mining contracts. This simplifies the process a lot, however there is no way for you to control the hardware used in mining. As expected, cloud mining generates low returns compared to traditional mining and the process is simple, register with a cloud mining service, buy mining contracts and get started.

There are many popular cloud mining services but we’ve been hard-pressed to find in-depth information or legitimate reviews. One recommendation from us – stay away from what you don’t know about, since scams are rampant in the industry. Cloud mining contracts are sold on the basis of Hash Rate, ie. your processing power. If you purchase a higher hash rate, you will receive more coins, however, that also needs a higher investment.

Depending on the company you choose, you might pay a monthly fee, or you might pay according to the hash rate. Almost all companies charge a maintenance fee and in general the cost of Bitcoin Cloud Mining is high. Depending on the cloud mining service, you can sign a 3-month, 6-month, or year-long contract and this locks you in even if the price of Bitcoin crashes. It may take several months before you recover your initial investment, even with a profit every month.

When we compare it with traditional mining, at least you don’t have to worry about the cost of electricity and other direct costs related to doing all of the mining with your own equipment.

On comparing staking and mining

I’d conclude that staking involves less preparation and investment and offers better returns. When you invest in mining, your profitability depends on the price of the cryptocurrency that you are mining, the cost of electricity, and several other factors. In case of staking there are more factors in your control and a steady passive income is generated.

To put this into perspective, let’s consider investing $1000 in staking and mining.

On staking $1000 in an ATOM wallet, you’ll earn a profit of 1% at the end of 30 days. On mining using HashFlare, you’ll lose $200 and get only $800 back at the end of 30 days. (Information based on HashFlare’s mining calculator.)

Hope this helps you decide how to create a passive income stream for yourself using staking/ mining. Do share your experience with us in the comments below.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.

1 comment

[…] Altcoins […]

Comments are closed.