As we get closer to the end of 2019, we see that the year was filled with failed institutional initiatives. We look hopefully towards 2020 and its promise of a state-of-the-art infrastructure to take crypto trading to the next level. For now, most altcoins are on a roller coaster ride of trading apprehension, which is pushing the price and support levels down. Is there hope for a bullish trend in our future?

According to the institutional data of the cryptocurrency market shared by Financial Magnates, more than 70 hedge funds have closed this year in the face of little interest from the institutional segment. This year will end with a substantial decline in institutional investment initiatives and retail customers will drive cryptocurrencies into 2020. Its worrisome that investment funds, family offices and similar projects have lowered the blind to the excess volatility and risk inherent in the crypto market.

On one hand, institutional interest has dipped, and on the other, news about the launch of new trading platforms with the capacity to manage 300K orders per second or more is doing the rounds. When we talk about 300K transactions per second and access to multiple exchanges without changing platforms, we are talking about high-frequency trading, arbitrage, market makers – not so much retail investors. This contrast makes me think that perhaps the institutions interested in crypto are yet to make their interests public. Then there is the regulations from governments where they may write new legislation, such as the European one, which allows traditional banks to offer products related to the crypto industry.

With this analysis of the industry, let’s dive into the movements for this week’s top 10 altcoins.

Rank 10. Stellar Lumens (XLM)

With a steep fall of 7.2% in the past week, XLM’s performance is far from stellar!

It has repeatedly broken below $0.056 in the past few days but the bears have not been able to sustain the price below $0.055. This is a positive sign as it shows that there is a new support being developed at $0.055 as we speak.

Source: tradingview.com

However, unless the price moves up sharply and sustains above $0.059, the bears will continue to hold the advantage over the bulls. If the XLM/USD pair plunges to a new yearly low, it may be one below $0.04. The next support to watch on the downside is $0.042. Conversely, if the price hits above $0.06, there will be mass buying. Until we see a clear movement forward, we suggest that traders should tread carefully.

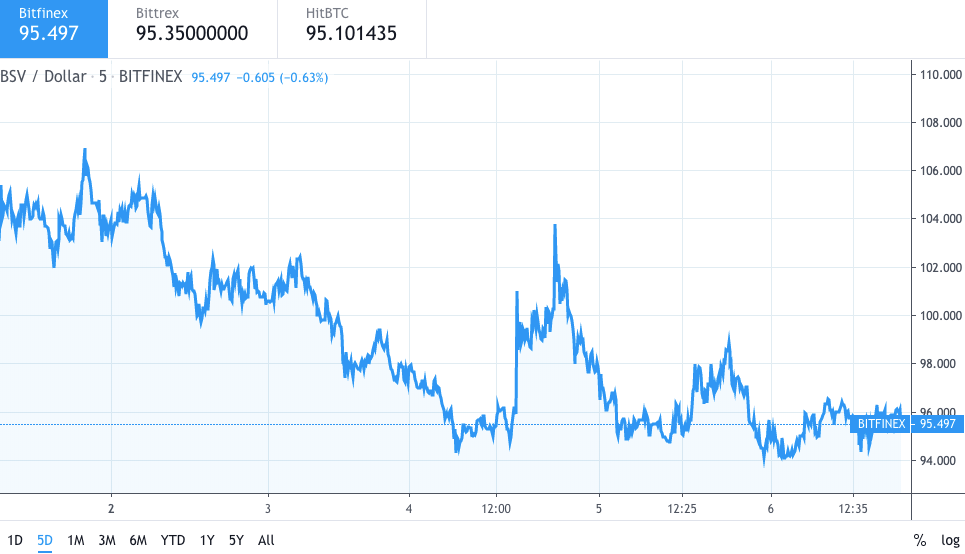

Rank 9. Bitcoin SV (BSV)

What was going down along with sale prices in Black Friday holiday promotions? BSV. With a whopping 12.7%, Bitcoin SV lost a considerable percentage of its market capitalization.

The bulls are attempting to keep Bitcoin SV (BSV) above the support at $95.3. However, the rebound off the support is not sustaining, and buying has been drying up at levels above $96.

Source: tradingview.com

This weekend, if the price drops below $93, the BSV/USD pair may fall to the next support at $80. This is an important level to watch out for because if it cracks, the decline can extend to the $70 level. The pair will turn bullish if the buyers can push the price above the overhead resistance at $100. Once the price crosses $100, a rally to $150 is possible.

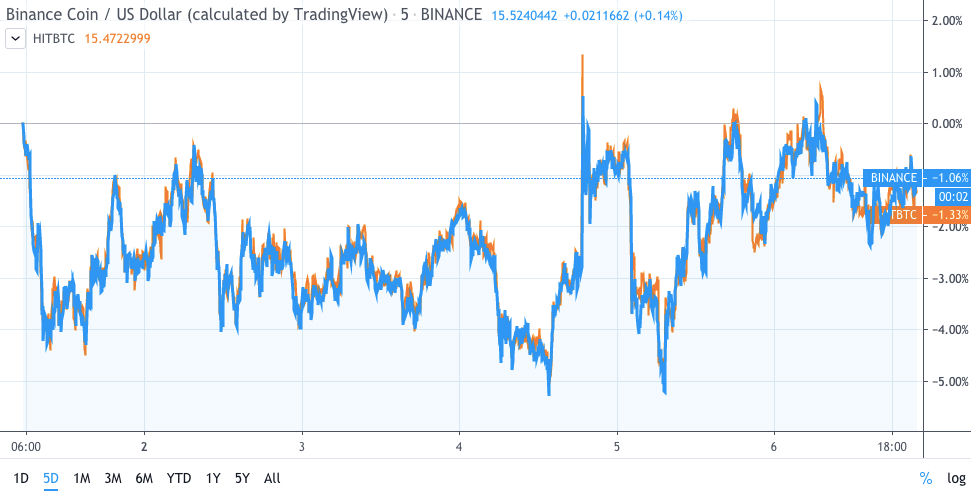

Rank 8. Binance Coin (BNB)

While CZ encourages Binancians to Ho Ho HODL, Binance Coin has dropped 3.4% in the past 7 days. HODLing may not really be the best thing to do if you have BNB in your portfolio.

Binance Coin continues to consolidate between $15.8 and $14.2555. This shows that buyers step in at $14.6 and the bears sell close to $15.5. The next trending move is likely to begin after the price escapes the the $15 level.

Source: tradingview.com

If you are planning to buy BNB at the moment, try to buy below $14 and sell above $16 for the next few weeks before we see the price move above the $16 level. If the bears sink the BNB/USD pair below $14.5, the downtrend will resume and the next stop is likely to be $12. On the other hand, if the bulls can propel the pair above $16, a move to $22 is likely.

Rank 7. EOS (EOS)

EOS has probably lost the least value among all other altcoins on the list. The cryptocurrency has dropped 2.5% in the last 7 days.

EOS is still within the 20-day EMA. Bears are active and buyers are guarding support at $2.5 and defending the 20-day EMA.

Source: tradingview.com

If the price drops below $2.5, the next support is at $1.57 and if it breaks resistance at $3, it may stay above that level.

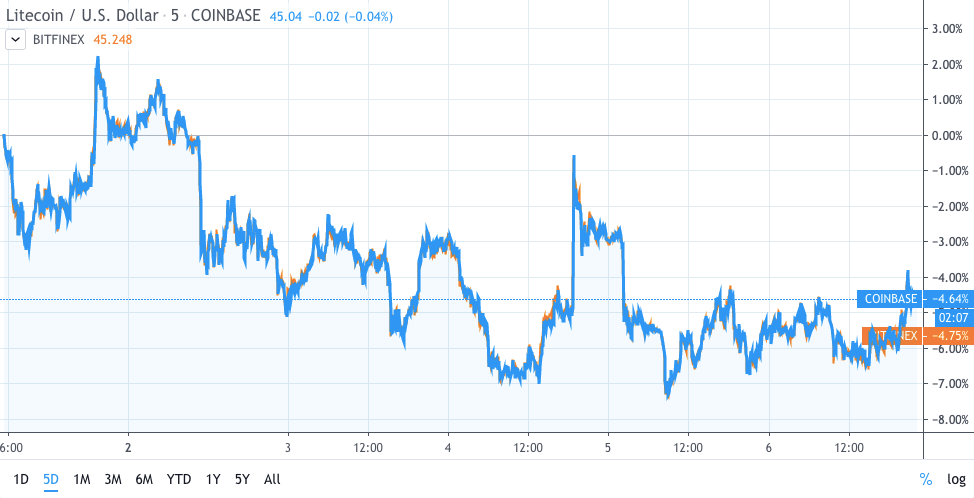

Rank 6. Litecoin (LTC)

1% drop a day, keeps the bulls away.

Litecoin’s price has dropped by 7% in the past 7 days. If it continues to drop at this rate it may drop by 15% in two weeks. It is attempting to bounce off its support at $44.89. This is an important level, hence, we expect the bulls to aggressively defend it. The altcoin is likely to consolidate between $46 and $50 this weekend.

Source: tradingview.com

A break out of the $46 range, indicates a buying opportunity. There is a minor resistance at 50-day SMA but it may get crossed this week. On the other hand, if the LTC/USD pair breaks below the critical support at $42, it will resume a downtrend.

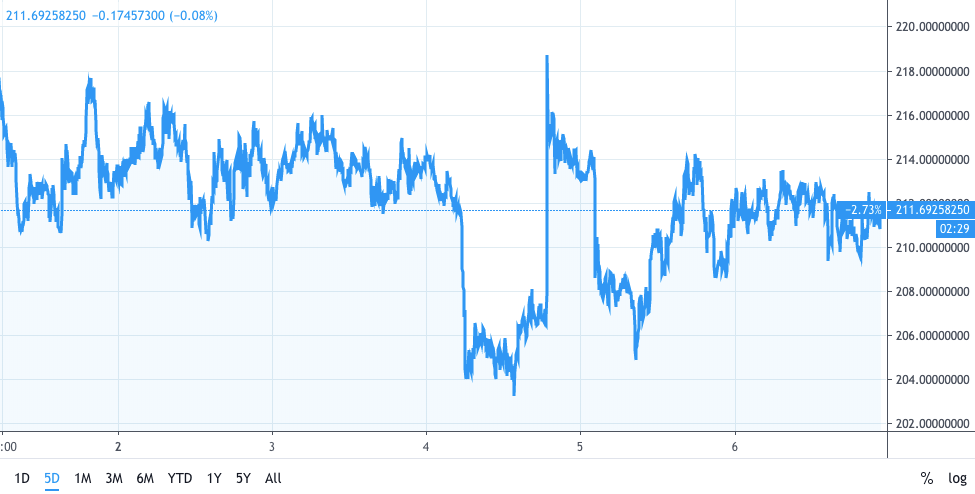

Rank 5. Bitcoin Cash ABC (BCHABC)

A low five ?

BCHABC has dropped by 5% in the past week.

Bitcoin Cash (BCH) has bounced off the first support at $209. This is a positive sign as it shows that there is demand at lower levels. If the price can continue to climb higher, it may break above $215, it will be the first sign that a new up move is likely.

Source: tradingview.com

However, if the bears sink the price below $209, the BCH/USD pair can slide to the next support at $190. A break below this support will resume the downtrend. We will wait for the price to break out of $225 before turning positive.

Rank 4. Tether (USDT)

The only gainer in the top 10

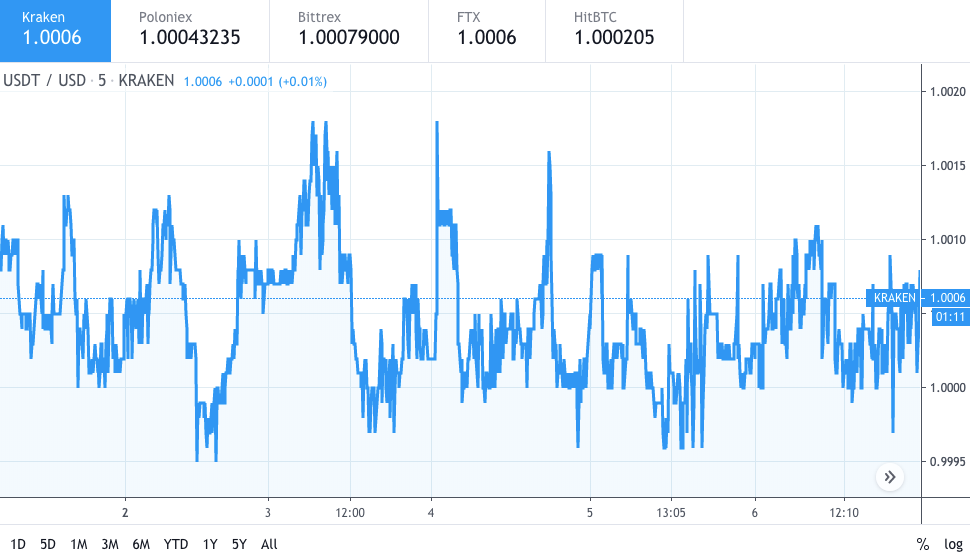

Tether gained 3% in the past week and is currently trading at $1. If you are looking for virtual currencies with good return, USDT can be a profitable investment option. Tether has been performing better than other cryptocurrencies during every bear market.

Source: tradingview.com

Though it’s a stablecoin with its value pegged to the USD, USDT has had its highs and lows. This week, its high. It’s a good time to sell USDT. We recommend buying below $0.99.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.