Blockchain technology. I’m sure you’ve heard of it by now. Whether it’s in the news when tech giants like IBM explore its application or when Bitcoin is observed going through startling ups and downs, let’s face it, blockchain is revolutionary; novel to some, controversial to others, but revolutionary none-the-less.

Regardless of subjectivity, the wheels have been set in motion and blockchain seems to be, at its core, fueling a digital and economic revolution. But what is blockchain and how is it revolutionary? At Crypto Trader News, we’ve given you the basics of crypto and blockchain, so if you’re already familiar with the concepts behind blockchain, feel free to skip ahead.

What is blockchain?

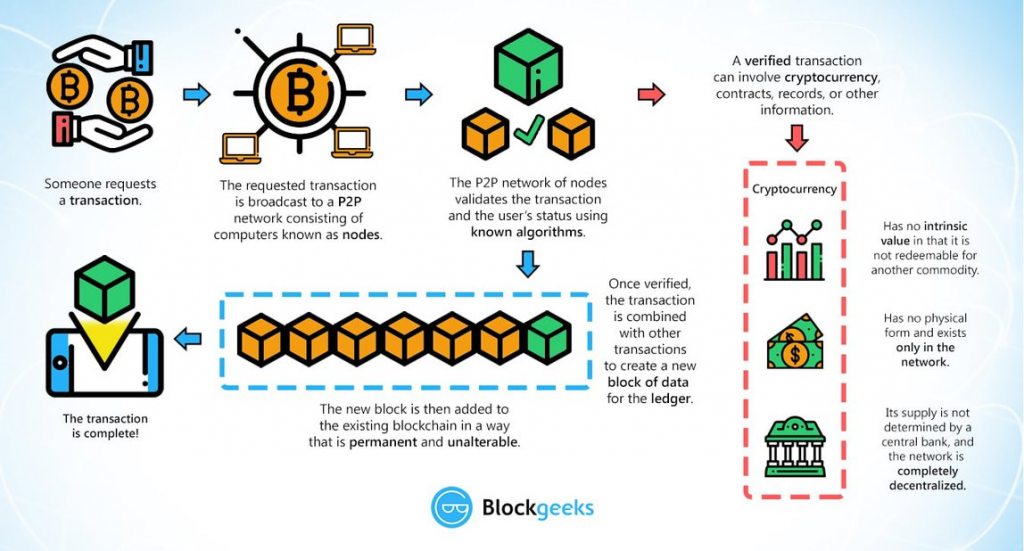

Invented over a decade ago as the underlying technology powering a global “peer-to-peer electronic cash system” – or what we know as Bitcoin, by an anonymous entity known simply as Satoshi Nakamoto, blockchain, in the simplest of terms, is similar to accounting software, but with a few perks.

It’s an immutable ledger that cannot be manipulated. The data may include digital records of economic transactions, anything that requires a time stamp, or data storage to track from creation to grave. It is decentralized, meaning this ledger of data is stored and maintained by a network of computers. No one system, server or computer failure will shut it down.

Data that involves economic transactions are especially sensitive so maintaining a record of all transactions on a public ledger might seem like a bad idea, but the beauty behind blockchain allows for cryptographic protocols to dissuade data manipulation or theft.

Here’s an infographic to make things easier to comprehend.

source

Why is blockchain so revolutionary?

It’s paperless, peer-to-peer, immutable, built on cryptographic principles, and cheaper.

Let’s take an example:

If you want to make a money transfer to a friend. Usually a bank or intermediary needs to facilitate the transaction, often with a hefty fee. In reality, physical money never leaves your account to get delivered to your friend, does it? With blockchain technology, this transaction subtracts the amount from your account and adds it to your friend’s account almost instantaneously. It’s not reversible unless the entire chain rejects the transaction. Why do you need the middle man?

Now, of course there needs to be some kind of intermediary to facilitate transactions between two parties, so pick a blockchain and its associated token. Bitcoin, Ethereum, EOS, are all individual blockchains that enable peer-to-peer transfers in a trustless environment.

Now, we have oversimplified the mechanics and technology because it’s important to have a basic understanding of the whats and whys of blockchain and digital asset adoption.

Decentralization is they key

Decentralization is a core component of a legitimate blockchain because it gives the responsibility and power back to the people instead of being concentrated in the hands of an elite few. When you have hundreds and sometimes thousands of servers operating and reaching consensus, it’s a relief to know that one failure will not bring down the whole network. It is virtually immune to attacks and hacks.

This begs the question: What happens when decisions and big changes need to be made? Who decides? How are changes implemented? This is where democracy comes into play. The people who use a specific blockchain vote for the block producers/miners who maintain the stability, speed, and security of the blockchain. Everyone should vote or proxy their vote.

The advent of cryptocurrency

Born from the financial crisis in 2008, Bitcoin emerged with a white paper presented by Satoshi Nakamoto, with the idea of using mathematical algorithms and cryptographic protocols for a peer-to-peer network and prevent double spending. Here we are, nearly ten years later with approximately 2,000+ alternate coins. Finally, mainstream is starting to pay attention to the next generation of record-keeping and money.

source

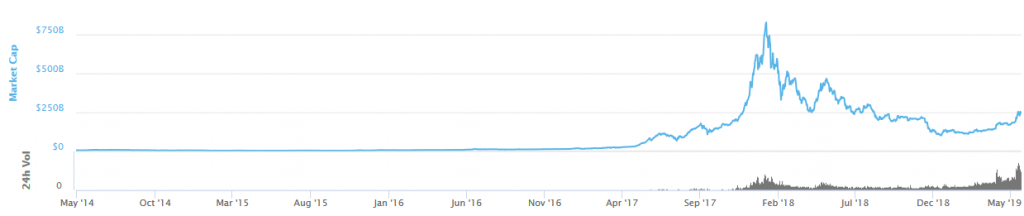

For a long time, the total market cap of the cryptocurrency market remained relatively low and stagnant, but in 2017, the cryptocurrency market really picked up the pace, observing a huge surge in market cap.

Part of the boom is attributed to ICOs, Initial Coin Offerings, which was a huge boon for crowdfunding projects in the crypto space. This, of course, was also abused by get-rich-quick schemes, but during its peak, the cryptocurrency market was worth a whopping $830 billion.

The ICO

An alternative to traditional IPOs and Venture Capital funding methods, which takes time, Initial Coin Offerings turned crowdfunding on its head. As mentioned earlier, the ICO was an alternative way for entrepreneurs to raise significant amounts of money for their projects.

Basically, in return for their investment, ICOs offered a utility token or stake. Think of this token as an IOU, a ticket, or a promise, that once the company finished building their platform or project, an investor can trade this utility token for the promoted products or services.

There are pitfalls to this. Several ICOs made a lot of money and never produced one thing. Many were Ponzi schemes and investors lost money and faith in ICOs. There is one project, however, that broke the mold based on technology and faith in a development team. EOS. They raised a record-breaking $4 billion in their ICO without having a platform or anything solid to prove their ideas or protocols.

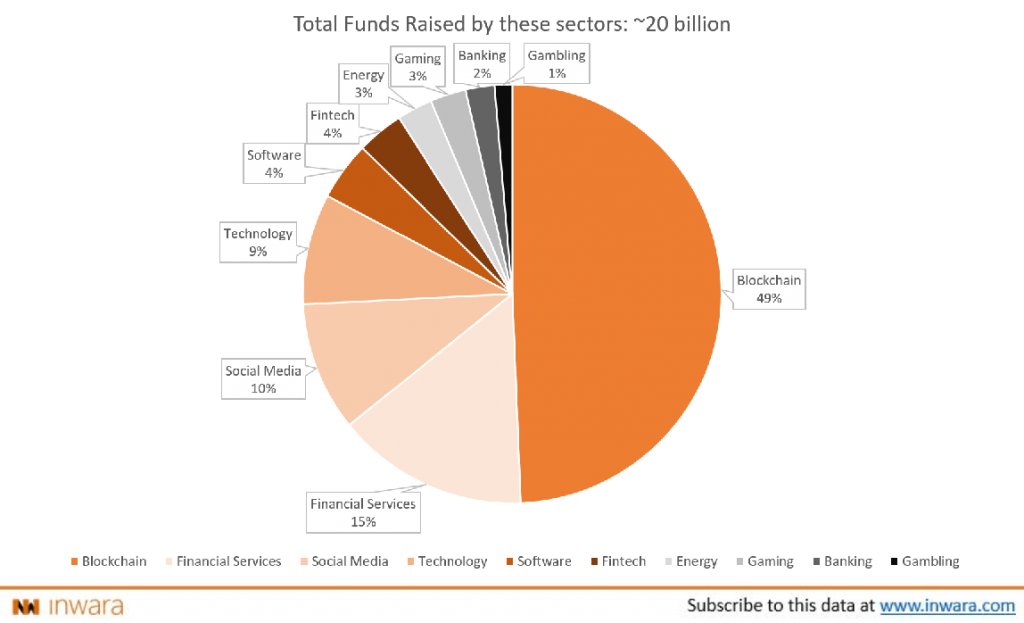

source

While ICOs accrued an eyebrow raising $24 billion, a significant portion of the funds was raised by startups aiming to augment blockchain technology by building new technologies. These startups alone raised $9.8 billion in funding through the ICO model. It’s kind of poetic that the promise of blockchain enabled decentralized crowdfunding to support the development of more blockchain initiatives.

Other sectors that were disrupted by the ICO model of fundraising include traditional financial services, FinTech, trading and investing among many other industry sectors. The ICO model of fundraising enabled entrepreneurs to gain access to enormous amounts of capital which would have traditionally been out of their reach.

The STO

The successor to the ICO model is the Security Token Offering, better known as the STO. STO’s came into the limelight once entrepreneurs ran into trouble with the Securities and Exchanges Commission. According to the SEC, most ICO projects are functioning similar to how an unregulated security would operate and hence is in violation of securities laws.

An STO is essentially a utility token, but the key difference is these token are often backed by underlying traditional security. In simple terms, they are the next generation of securities.

Being the latest trend in the crypto space, STO’s are compliant with security norms of their respective jurisdiction. This means a few things. Firstly, as STO’s are regulatory compliant, investors are protected by law and founders are punishable by law for any fraudulent activity. Secondly, since traditional securities can now be transformed into a new, digital form, they are more accessible and can be easily traded.

This is revolutionary because securities, in the past, were incredibly hard to trade, but thanks to the new technology, these assets can be easily traded with an increase in liquidity that was once considered low-liquidity assets. This also means these securities can now be accessed by global investor pools and even traded on the secondary market.

Thirdly, STO’s are really security offerings and many jurisdictions, countries, or states are barred from participating in security offerings because of the securities exchange laws. Unfortunately, this bastardizes the initial ethos of blockchain technology and being a true peer-to-peer, global opportunity, but governments will make this difficult for mainstream adoption until they find a way to get their cut of the economic windfall.

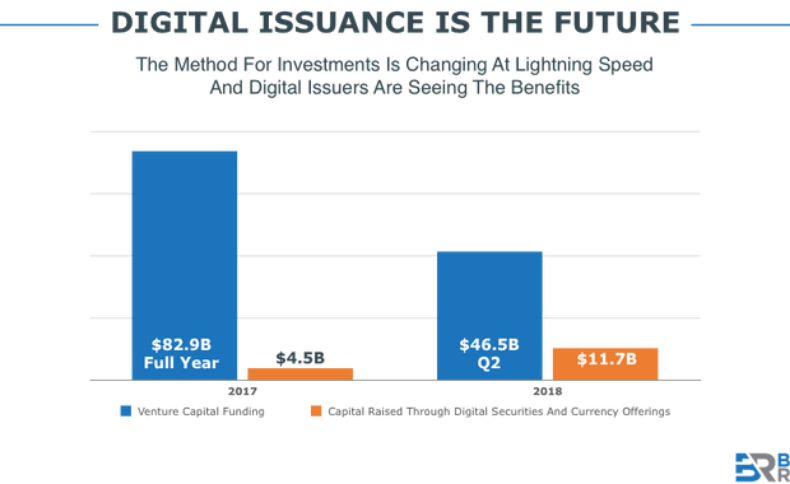

source

Blockchain technology has changed the face of venture funding so much that there’s a good chance capital raised through digital securities will outgrow traditional venture funding in the near future. According to Blockrake’s data, as much as $11.7 billion was raised through the sale of digital securities during 2018. Just a year earlier it was $4.5 billion which means funds raised increased by 160% YOY from 2017 to 2018.

Blockchain and Web3.0

On top of the various ways blockchain applications like IOCs, STOs are already impacting our current global economy, there is an even more profound impact that we’re on the leading edge of.

Remember, Web 1.0 launched back in 1995 when the National Science commission in the US decommissioned its backbone service, the NSFET. The current version of the internet, or Web 2.0 made a breakthrough in 2007 when the first smartphone was released.

Blockchain technology can help create the next generation of the internet; one that is not controlled by large conglomerates. Imagine Web 3.0! But before we get into the profound impact of the new internet and how it could impact our everyday lives, it’s important to understand some human psychology and the market effects of technology.

The Fat-tail effect

The initial ethos of Blockchain and cryptocurrencies was about democratizing power to the hands of the people. This is going to be a key feature of Web 3.0; redistributing technology and innovation power back into the hands of small enterprises.

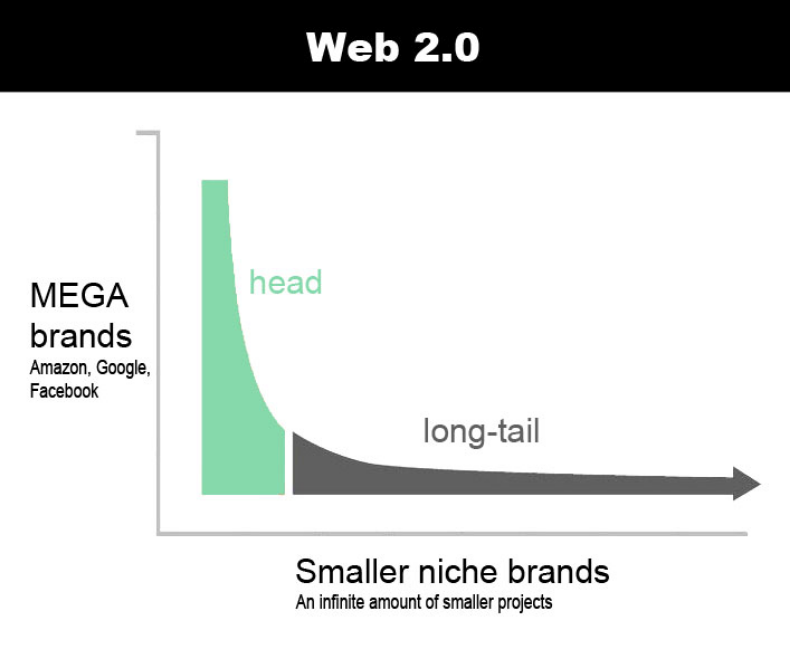

Remember, the advent of Web 2.0 saw the rise of tech companies like Google, Amazon and Facebook. These companies perfectly illustrate how tech companies can grow to such unfathomable lengths that they virtually have a monopoly over the profit pools of their industry. This shut out competitors from vital cash and tech resources.

This is where the fat-tail effect comes into play.

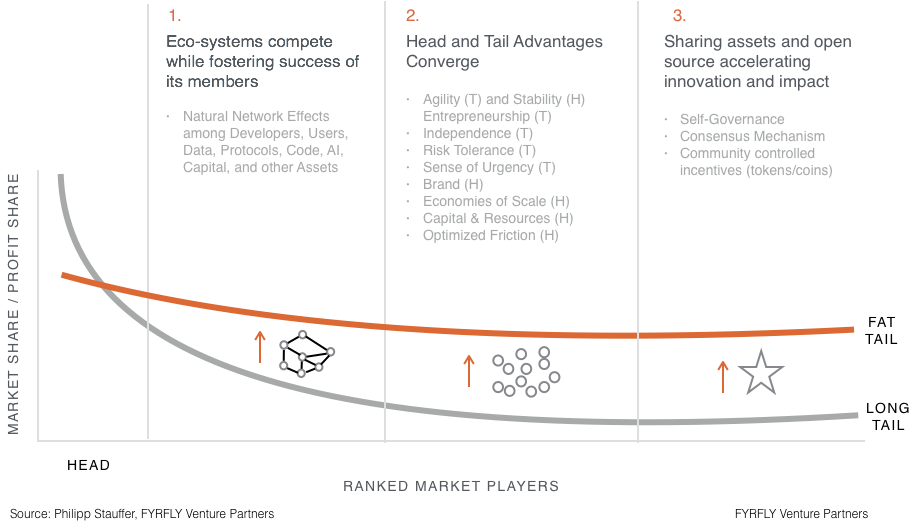

The fat-tail effect is akin to a hybrid of head-tail and long-tail effects. So what does tech companies have to with this? Let me explain.

The head-tail or the green portion of the above graph is where the more established tech companies with entrenched powers lie. While the head companies fuel innovation in their respective industries it is often restricted to innovation that doesn’t challenge the status quo. This obviously leads to stifled growth.

Startups and small business are at the long-tail. Startups often have to make do with the limited resources available to them and this is a driving factor for innovation. But companies in the long-tail end of the spectrum often suffer from scalability issues which often leads to higher prices, and slower production rates among other problems.

Now imagine fat-tail to be a mixture of both head-tail and long-tail trends. A rare mix that brings together the benefits of both trends while at the same time reducing the inefficiencies of both.

This is what, at least in theory, Web 3.0 should be able to do, and what blockchain technology can help achieve. The current version of the internet and most digital business is based on the centralization of data. In light of the data scandals and leaks that have recently surfaced, and possibly been long practiced, most startling and recently even to claim that the U.S. presidential election was rigged, is a compelling case why the centralization and lack of transparency is a bad idea.

Blockchain technology is inherently decentralized, meaning there are no central authorities. It is governed by mathematical protocols and algorithms. Users can have privacy and know that their data cannot be edited or deleted. Additionally, the cryptographic techniques being employed in blockchain means that it is incredibly difficult for hackers to gain access.

But more importantly, similar to how blockchain technology enabled startups to circumvent traditional fundraising mechanisms to raise funds through direct crowd sourcing, Web 3.0 will likely bring in more accountability, privacy and ownership over our data. The same cannot be said with the status quo, especially when the status quo promotes the centralization of power, wealth, and resources.

But now, with big established enterprises like Facebook entering the crypto space, mainstreaming crypto looks like it might be right on the horizon. The social media giant aims to leverage its cryptocurrency to target the Indian remittances market. Certainly the development of Facebook’s Libra could help the adoption rate of cryptocurrencies rocket by 100-200%, but there is a down side and begs the question, will industry giants like Facebook enable the Fat tail effect to take its course in the crypto space or will they buy up the competition?

Do not think for one moment that the global economy is safe from entities who will try to manipulate and monopolize the market, but a new generation of internet and money is here. Do your due diligence and get yourself a reliable hard-wallet.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.