Cameron and Tyler Winklevoss founded Gemini exchange in 2015. The twins sued Mark Zuckerberg over Facebook, asserting he stole their idea. They were awarded $65million USD in damages in court, of which most was invested into Bitcoin. This investment placed them as one of the largest holders of Bitcoins with a current valuation of over a billion dollars.

The trading company is located in New York and has the status of being a New York State limited liability Trust. Gemini is a registered venture that dutifully obeys the rules and regulations of the U.S. banking industry. Due to their popularity, it handles clients of all categories both institutional and individual.

Being a force to reckon with, Gemini is one of the sector’s most well-respected exchanges and serves as the connection between the traditional financial market and the cryptocurrency ecosystem. The company offers a high standard in their work and provides a top-class service that is praised by many of its customers.

[rml_read_more]

Functionality – The company’s platform is designed to make it easy for the user. The interface is simplified and offers a smooth and effective user experience. Important data on prices, orders, and balances update promptly, which keeps the platform remarkably active and allows users to stay on top of their trades.

Features

Security – Gemini remains fully obedient of all digital asset rules and customer assurance laws and as a result, functions at a high level of safety and professionalism. US Dollar Accounts are protected by the FDIC, with funds secured in a New York-chartered bank. All digital assets are put into cold storeage, while online assets are managed on Amazon Web Services, which also uses several additional security measures.

Customer Support – Gemini provides an in-depth FAQ that attempts to answer the most common questions, as well as a blog that gives its users instructions on how to buy and sell Bitcoin. Specific user inquiries are managed through email and Gemini endeavours to reply to customer’s questions within a few hours.

International Availability – The clearinghouse is currently available to roughly 45 U.S. states, Canada, Hong Kong, Puerto Rico, Singapore, South Korea, and the United Kingdom.

Gemini Signup & Login

Gemini Registration

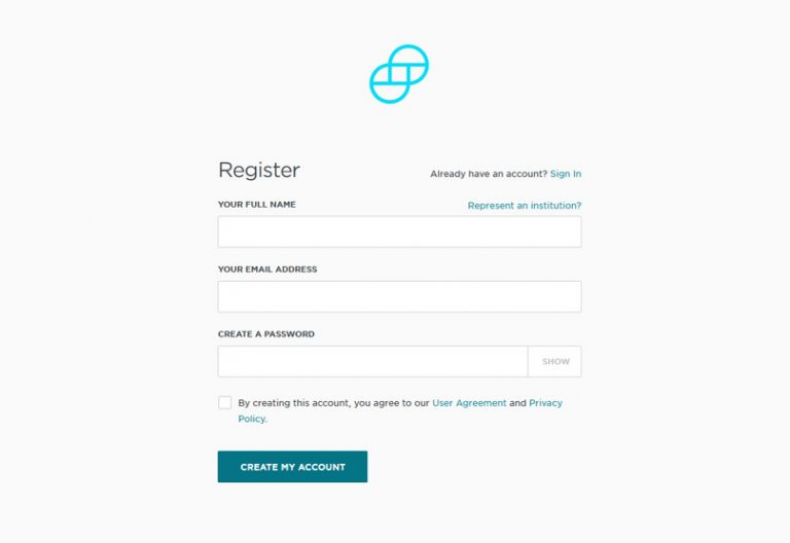

1) Register

Proceed to the site and begin the signup process. You can simply open an account by entering your name, email address, and password.

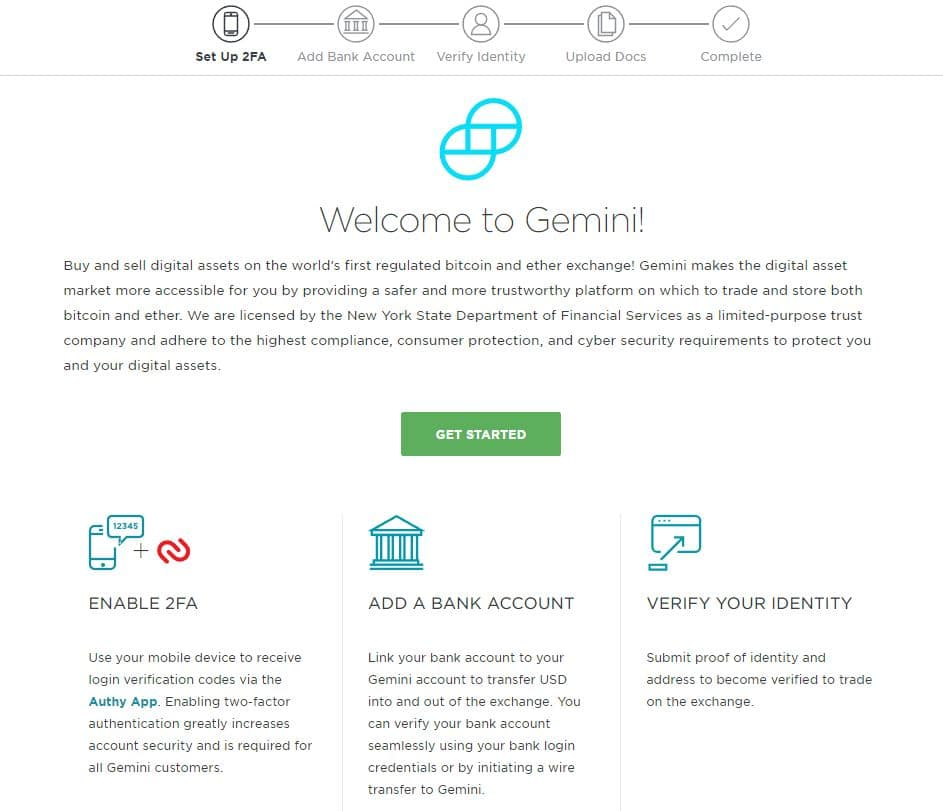

After confirming your email address, it’s essential to:

Enter both your location and phone number, after this, you can set up Two Factor Authentication (2FA) which adds an added layer of security to your account.

Attach the bank account that you will make transfers to and from. Gemini currently only allows bank transfers and wires as the processes for storing funds.

Upload your ID. To verify your account you are expected to upload government-issued modes of identification. This allows Gemini to comply with the Bank Secrecy Act (BSA) and Anti Money Laundering (AML) commands. This also authorizes its users to deposit, make a withdrawal, and trade in US Dollars. The confirmation time depends on the number of applications being prepared and can take anywhere from a few to several days.

Once this step is done, the process is complete and you can move onto funding your account.

2) Make a Deposit

From the menu, go to click on Transfer Funds, then click on Deposit into Exchange and Bank Transfer. From here you can enter the amount you want to deposit. Bank transfers are initially restricted to a maximum of $500 a day.

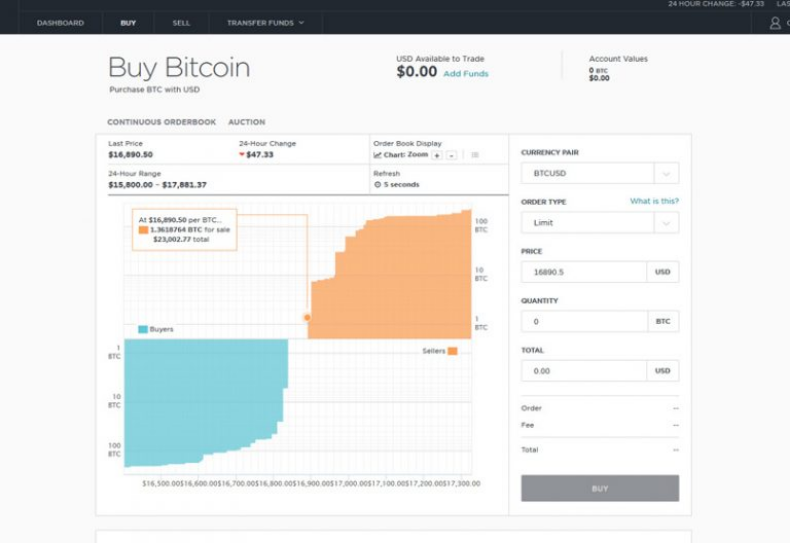

3) Buying Bitcoin and Ethereum

Deposits performed through bank transfer are instantly available for dealing and you can purchase by navigating through the Menu and choosing your preferred buying pair. For example, BTC/USD for Bitcoin, and ETH/USD for Ethereum.

You simply enter the price and volume and prepare your order. There is also the choice to obtain trades via the marketplace which houses market orders provided by other users.

After you initiate your investment, your account will be credited with your cryptocurrency purchases. You can sell your Bitcoin and Ethereum on the market but you cannot make a withdrawal until your bank transfer has been thoroughly processed.

Gemini Market place

Gemini runs a 24/7 marketplace where users can choose from different trading options.

Instant Market Orders: This order type is initiated at the current available price.

Limit Orders: These pending orders of type buy limit and sell limit. With a buy limit order, the pending order is placed below the current ask or bid price.

Sell limit orders are placed above the current bid or ask price.

Gemini operates as a complete reserve exchange and all orders made on the platform are completely financed.

Margined trading is not offered on Gemini and any outstanding interest on their orders books cannot exceed a user’s account balance at any time.

Gemini Fees

Users on the Gemini exchange can make deposits using Bitcoin, Ether, as well as zero charges on bank wire transfers. Please note that depositor bank may charge their customers while making transfers to their Gemini account.

Customers on the Gemini platform also enjoy 30 zero fee withdrawal every month.

Trading Limits

At Gemini, there are currently no boundaries on withdrawals and deposits.

Automated clearinghouses on the hand have a maximum deposit limit of $500 day and $15000 per month for individual account holders and $10,000 per day or $30000 per month for institutional investors.

Is Gemini Safe?

Gemini is an FDIC insured exchange, with their funds held in a New York-charted Bank. All digital assets on Gemini are stored in cold storage. With that said we believe that Gemini is a safe haven for trading cryptocurrencies.

Conclusion

Gemini maintains a reputable public presence as a cryptocurrency exchange. The advantage of transferring and withdrawal of funds to and from the exchange makes it a favorite exchange for U.S residents.