This week, the bears threaten to force Bitcoin prices below the critical support levels after the pair trades in the overbought region for about a week, offering both bearish and bullish swing trading setups on the intraday charts.

Let’s look at these technical price patterns and BTC news that traders are paying attention to.

In the news

Impact of institutional investors in the Bitcoin BTC market – J.P. Morgan Chase

Following an examination by asset management firm, Bitwise, a notable number of trade volume issued by exchanges may be false.

In a Bloomberg broadcast, J.P. Morgan Chase indicated the month of May to be the best performing month for the CME Group’s Bitcoin futures, as the implied volume achieved a high of $500 million USD.

J.P. Morgan affirmed that a variation in the volume from exchanges and Bitcoin futures shows an improvement in institutional investor trust towards the number one cryptocurrency.

[rml_read_more]

BTCUSD Daily Chart

The daily chart unveils a breakout of bearish accumulation on May 19 ’19 with support at 6999.9 USD, followed by a bear trap on May 23 ’19.

Subsequently, a hidden bullish divergence setup signaled on June 12 & 17 ’19, confirmed a continuation of the upbeat campaign for roughly 67.2% increase, before the price exited the overbought region on May 27 ’19, after setting resistance at 13764.0 USD.

So far, the support level at 10560.0 USD formed by the double bullish accumulation pattern on June 24 ’19 prevents the price from further decline.

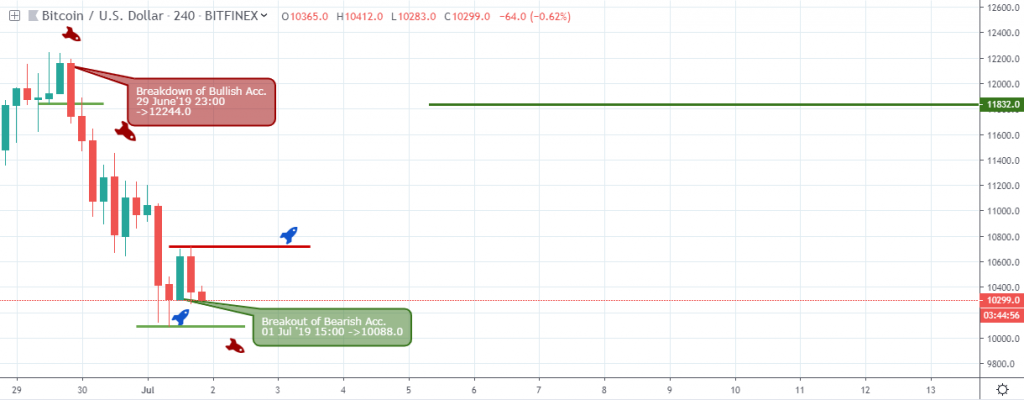

BTCUSD: 4-hour Chart

A view from the 4-hour chart, like the daily chart, reveals a breakout of hidden bearish accumulation on June 23 ’19 and a bullish accumulation on June 24 ’19.

The breakout pattern on this time scale coincides with the double bullish accumulation pattern on the daily chart, therefore reinforced the price increase.

The price spike triggered while the pair was in the overbought area, and was later countered by a dark cloud cover candle pattern and a bearish accumulation setup on June 26 ’19, resulting in a roughly 20% decline.

Upon hitting the previous breakout support level of 11232.0 USD on June 23, and signaling a hidden bullish divergence, Bitcoin prices bounced back in the bullish direction towards the new resistance level.

June 29 update on the 4-hour Chart

In the chart above, the price of BTC again broke below double bullish accumulation support on June 29 ’19 23:00, setting a sound resistance at 12244.0 USD. Further selling pressure has forced the price below new critical support formed from a breakout of bearish accumulation resistance for about 15.36% price decline.

BTCUSD: 1-hour Chart

From the 1-hour intraday perspective, the bulls forced price above a bearish accumulation resistance on June 27 ’19 17:00, and set support at 10388.0 USD.

A breakout of hidden bearish accumulation on June 28 ’19 01:00 maintained the bullish move was before a bull trap candle confirmation for the current bearish decline at press time.

Critical Resistance Levels of Bitcoin (BTC)

1-Hour

12417.0

4-Hour

13242.0

Critical Support Levels of Bitcoin (BTC)

1-Hour

10388.0, 10799.0, 11618.0

4-Hour

11232.0, 11000.0, 10388.0, 11832.0

Conclusion and Projections

The previous double bullish accumulation support of 10560.0 USD on June 24 ’19, from the daily time frame, now shows weakness. We look forward to a hidden bullish divergence formation, as long as recent BTC prices do not move below the 8985.9 USD support level.

Below indicates the daily chart of BTCUSD which still maintains a bullish outlook, however, the current bearish move should be considered a retracement for a bullish rally.

Update of Daily Chart

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.