Bitcoin prices are currently trading below the critical support level of $8005.0 following a price rally of about 123.46% from the breakout point of December 17 ’18.

Although we’re only just closing out the first week of June, there is still a lot more month to go as the RSI threatens to close below the level-70. In this post, we’ll be taking a look at technical patterns and events that may drive the Bitcoin price up and beyond the $10,000 mark.

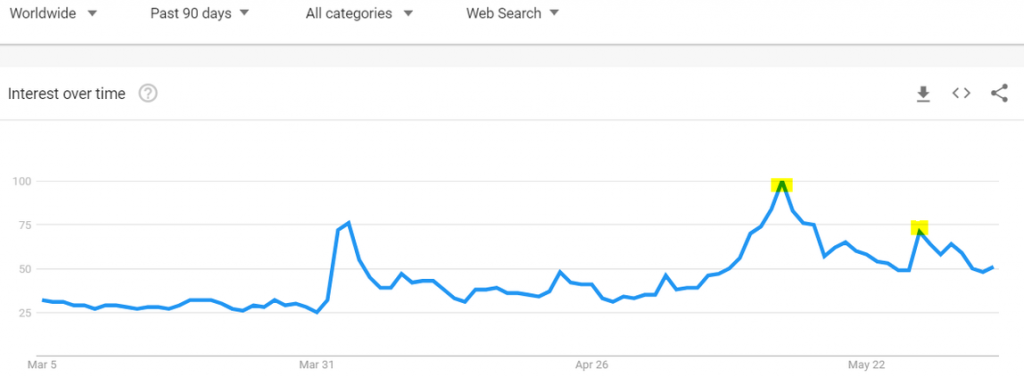

Google Trends

The levels highlighted in yellow is for May 14 and 27. Comparing this to the Bitcoin price, you’ll notice a similar regular bearish divergence setup. Following an increase in search for the term “Bitcoin,” the trend peaked at 100, after which a decline in interest was seen as prices continued to rally.

We look forward to seeing an increase in the price of Bitcoin as the search interest for the term increases.

[rml_read_more]

Speculative Demand

Basic economic theory views transactions, and supply of currency, as its main driving force.

According to a Bloomberg news report on May 31, Chainalysis, a blockchain intelligence firm, show that only 1.3% of economic transactions for Bitcoin (BTC) came from merchants in the early months of this year 2019.

Bitcoin’s top use case in the analysis continues to be speculative on exchange portals, making mainstream adoption for daily purchases still a distant fantasy.

With that being said, we expect speculators to force Bitcoin prices beyond the $10K mark, but not without first taking out some profits before entering at a lower retracement level, as our analysis suggests.

Technical Price Setup & Levels

Price is king when analyzing and gauging profitable entry points of a cryptocurrency pair. Below are the technical price patterns that can shoot the price of Bitcoin towards the $10K number.

BTCUSD WEEKLY

The weekly chart illustrated above highlights the technical price triggers in the introduction. After the pair entered the overbought zone on May 06 ’19, the price of Bitcoin still increased for another three weeks before signaling a bullish accumulation price pattern on May 27 ’19 with support levels at $8005.0, and $7436.4.

A price close below the $8005.0 support level will show a decline in demand and possible correction of the twenty-three weeks bullish trend, which will result in the RSI crossing below the level-70.

On the contrary, a price close above the support shows the bulls’ willingness to maintain buying pressure and take the pair to $10K.

BTCUSD DAILY

Here on the daily time frame, the pair signaled a regular bearish divergence setup in combination with a rejection of bullish accumulation support. A bearish accumulation pattern followed, along with a dark cloud cover candle pattern.

The Bitcoin price at press time trades above significant support of 7436.4, which is crucial for the formation of a hidden bullish divergence. If the price trades below this level, then the bullish divergence setup is nullified.

It is also worth noting that the RSI from the daily time frame is currently under level-50. A close above level-50 will confirm the bullish campaign towards the $10K mark.

Final Thoughts

As traders take profit from the early surge in Bitcoin price, the market may shake off traders with low stamina and conviction in order to hold their positions. This would allow long-term HODLERs a chance to accumulate more crypto and eventually send the pair beyond the $10K mark.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.

1 comment

[…] https://cryptotradernews.com/crypto-trader-pro/the-pathway-for-btc-to-reach-10k/ via /r/Bitcoin https://www.reddit.com/r/Bitcoin/comments/bxolfs/the_pathway_for_btc_to_reach_10k_read_more_here/?utm_source=ifttt […]

Comments are closed.