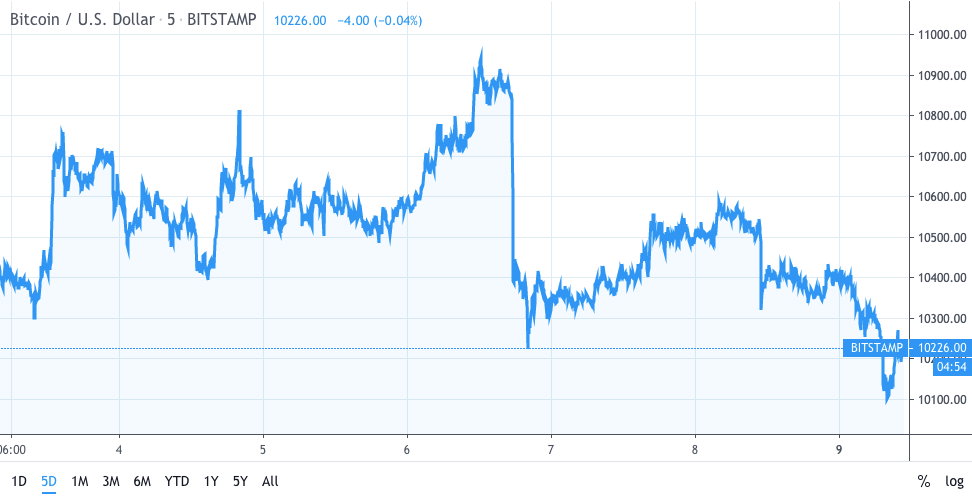

The top 5 cryptocurrencies recovered from the slump of the past week and gained momentum over the weekend. That being stated, Bitcoin is trading at $10,244, down 2.24% in 24 hours. The market movement will most likely be technical this week and the fundamental drivers are missing.

Central banks like People’s Bank of China (PBoC) and SNB are discussing the launch of their centralized digital currencies. Over the weekend Bitcoin’s price dropped from $10,500 to $10,200 level. This week the price could fall to the $10,100 support before rebounding. There are signs of a bullish bias above $10K and it a recommended level for buying as the cryptocurrency is most likely to rebound from this level to $11K within a week.

In the last weekly price prediction, we predicted that Bitcoin’s price may fluctuate between the range of $9,600 to $10,700 for the coming week. And the price was well within this range, it didn’t manage to surpass the resistance. A swing high was formed near $10,898 before the price started a downside correction. The price stayed above the $10,000 support and 100-day SMA. The price is well above the 50% Fibonacci retracement level and hasn’t hit lower than $9,272. This week there may be a bullish trend taking the price upwards of $10,300. There is initial resistance at the $10,700 level. If the price crosses this resistance it could move towards the $11,000 and $11,600 level.

Why you should consider shorting

Bitcoin’s price prediction for the week indicates that buyers are becoming less enthusiastic with every passing day. This may be the onset of another drop, to the $10,100 level. Though our position is bullish in the long term, the following week is particularly bearish for Bitcoin. However, we do not recommend shorting all your holdings and there is still a possibility that it the price could resolve upwards. As we discussed in our last prediction, Bitcoin has entered its fourth parabolic phase and this may be the best time to short the cryptocurrency before the upcoming bull run.

Disclaimer

Content provided by CryptoTraderNews is for informational purposes only, and should not be construed as legal, tax, investment, financial, or other advice. All information is of a general nature. As always, there is risk with any investment. In exchange for using our products and services, you agree not to hold CryptoTraderNews Pro, its affiliates, or any third party service provider liable for any possible claim for damages arising from decisions you make based on information made available to you through our services.